Superlon Holdings - Extended Technical Rebound to be Anticipated

HLInvest

Publish date: Fri, 24 Apr 2020, 09:18 AM

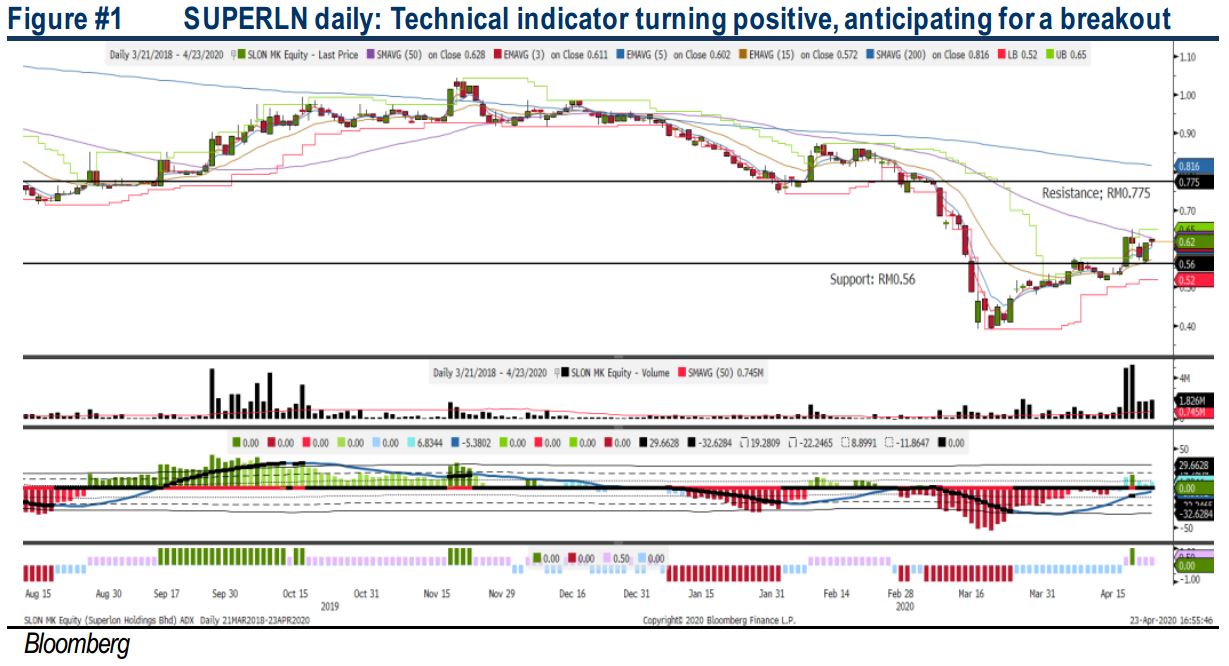

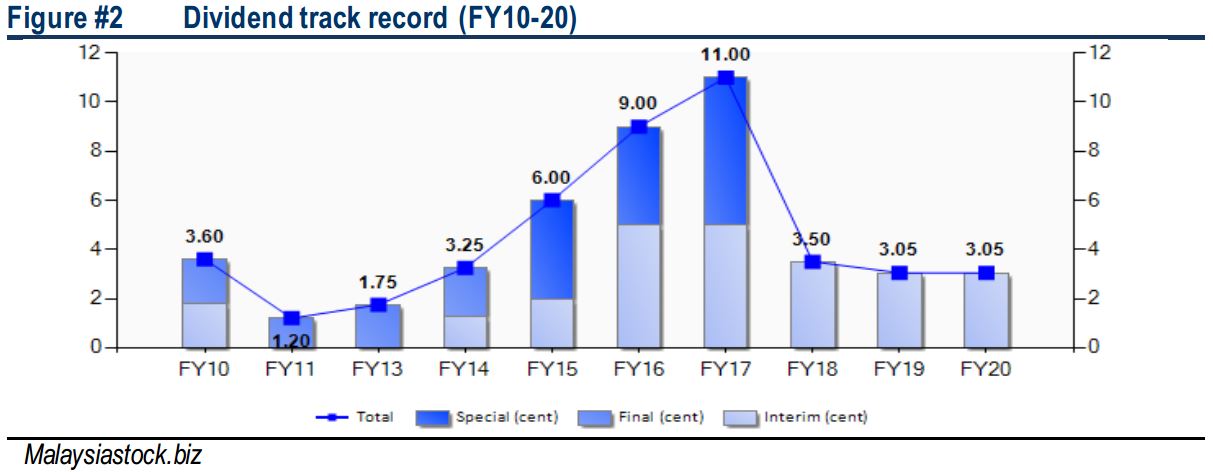

SUPERLN has declined significantly by 63% amid the Covid-19 outbreak and we believe this is overdone. Since mid-March, it has recovered c.57% in tandem with recovery of the broader market. We like SUPERLN on the back of its (i) healthy balance sheet with a net cash per share of 3.5 sen, (ii) steady dividend paymaster over the years (in FY20, they paid 3.05 sen, translating to 5% DY, (iii) better operating results from its Vietnam operations and (iv) significant YTD drop of more than 50% in butadiene price. Technically, it has formed a flag formation breakout, targeting RM0.665-0.715-0.775. Support is located around RM0.585-0.595, with a cut loss set around RM0.56.

Vietnam expansion plans should be on track after Covid-19 episode. SUPERLN expanded to Vietnam in FY18 and noticed some positive impact in its latest quarterly results. Although management is expecting near term outlook to be clouded by the Covid-19 outbreak, we believe the recovery would be seen moving forward.

Healthy net cash of RM5.6m and decent DY. It has net cash of 3.5 sen (5.7% of share price) and has been a steady dividend paymaster throughout the years. In FY20, SUPERLN declared dividend of 3.05 sen, translating to c.5% dividend yield.

Flag formation breakout. SUPERLN has formed a flag formation breakout two days ago, while we saw some buying support yesterday. With the indicator suggesting a potential recovery in the near term, buying interest could sustain towards RM0.665- 0.715, with a LT target set around RM0.775. Support is pegged around RM0.585- 0.595 and cut loss is anchored around RM0.56.

Source: Hong Leong Investment Bank Research - 24 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|