Traders Brief - Extended Consolidation Ahead of the Long Holidays and FOMC Meeting Next Week

HLInvest

Publish date: Thu, 28 Apr 2022, 09:40 AM

MARKET REVIEW

Global. Tracking overnight slump in Wall St, Asia markets ended mostly lower amid multiple risks, including the prospects for aggressive Fed rate hikes, China’s Covid-19 lockdowns, surging inflation, and the protracted Russia-Ukraine conflict. Meanwhile, SHCOMP staged a 2.5% relief rally after recent slide following strong industrial production data and market talks that Beijing would step up infrastructure spending to boost a flagging economy. Whilst awaiting key results from Apple, Amazon and Twitter tonight, the Dow surrendered early 457 pts gains to end +62 pts at 33,302, as investors weighed on the looming Fed’s decision on 3-4 May, Europe’s energy crisis (after Russia halted gas supplies to Poland and Bulgaria), China’s extended lockdowns, and a deluge of earnin gs. After trading hours, Meta Platforms surged 18% on upbeat earnings.

Malaysia. In tandem with sluggish regional markets, KLCI slid 10.7 pts at 1,586, led by selling spree in selected heavyweights i.e. PCHEM, IHH, PMETAL, IOICORP, CIMB, HARTA and TOPGLOV. Market breadth returned to negative as 645 losers overwhelmed 300 gainers. Foreigners (+RM31m, YTD: +RM7.2bn) and retailers (+RM42m, YTD: +RM573m) were major net buyers whilst local institutions (-RM73m, YTD:-RM7.79bn) stayed as net sellers.

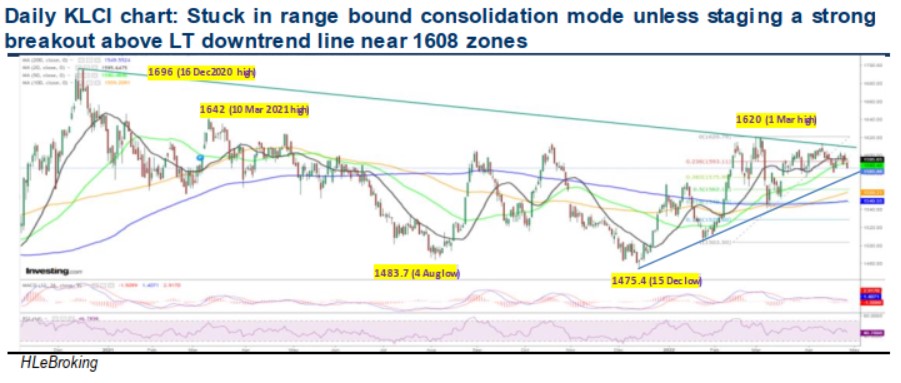

TECHNICAL OUTLOOK: KLCI

In the near term, KLCI is likely to stuck in an extended range bound consolidation mode unless it can break the LT downtrend line near 1608 (from a 2Y high 1,696) successfully. The next barriers situated at 1,620 (YTD high) and 1,642 (14M high). On the downside, any decisive fall below the immediate support of 1,580 (uptrend line from 1,475) could trigger another round of selldown towards 1,550-1,560 levels.

MARKET OUTLOOK

Ahead of the long Workers’ day and Hari Raya holidays next week (2-4 May) investors are expected to adopt a risk-off mode (supports: 1,550-1,560; resistances: 1,600-1,620), grappled by (i) ongoing 1Q22 results season (US and Malaysia); (ii) protracted Russia Ukraine war; (iii) FOMC meeting on 3-4 May; and (iv) China Covid-19 lockdowns. That said, a sharp selloff may be cushioned by (i) Malaysia’s relative safe-haven appeal in wake of the geopolitical conflict; (ii) transition to endemicity; and (iii) possible pre-election rally.

Source: Hong Leong Investment Bank Research - 28 Apr 2022

.png)