TENAGA - Is it time to sell?

DividendGuy67

Publish date: Sat, 31 Aug 2024, 12:54 AM

Background

TENAGA closed strongly today at RM14.64, or +5.02% after an excellent QR the night before.

At RM14.64, the price gains compared to the recent swing low a year ago at RM7.90 is nearly doubled (+85%!). As a result, its Market Cap has grown from RM45 billion to over RM85 billion, or nearly RM40 billion gain!

Is the price gain too much + too fast + too soon?

Long Term Price Chart

A quick glance on the above chart tells me that the answer is a resounding NO! It is still too early to sell. Why?

Technical Analysis is an art, and my gut tells me that what I am seeing is fairly reliable from a TA perspective. Why?

I pretty much ignored the RSI indicators and all other indicators and just trust my instincts on the long term uptrend channel.

What makes me think that this channel is "reliable"?

Here's a few summary TA reasons:

- This is a TA chart that stretches back to nearly 3 decades. The longer the time period, the greater the reliability.

- This channel connects many points. A channel can basically be broken down into 3 parts - the top line, the middle line and the bottom line.

- Most channel technicians tend to focus only on the bottom line and the top line, and here, there are many connecting points. At the bottom lines, there are many circles drawn. At the top line, there are many circles drawn too.

- But the art of channel drawing is to not forget the middle line too, which most textbook ignores.

- The middle line shows many supports and resistance over this period too.

- In short, it looks to me, that as it connect the greatest number of bottom, middle and top line, this is probably what the majority of the market is seeing.

And most important of all, it looks to me that we are just breaking out from the middle line, and now moving toward the top line.

I appreciate this is very, very hard to accept. After all, TENAGA has been showing consecutive green monthly candles for 12 consecutive months!!! How can a big cap keeps growing and growing and growing non-stop for 12 consecutive months?

As technicians, it is good to ask questions outside of technicals. However, it is not our job to override our non-technical views against the price charts. Unless we have really important insider information (which is illegal by the way), we have to trust the charts and perhaps ask deeper fundamental questions to understand if there is divergence or confluences.

What are the fundamental claims that TENAGA is over-valued?

Dividend Yield

The claim is that with 85% price rise, TENAGA's dividend yield is halved. But is this true?

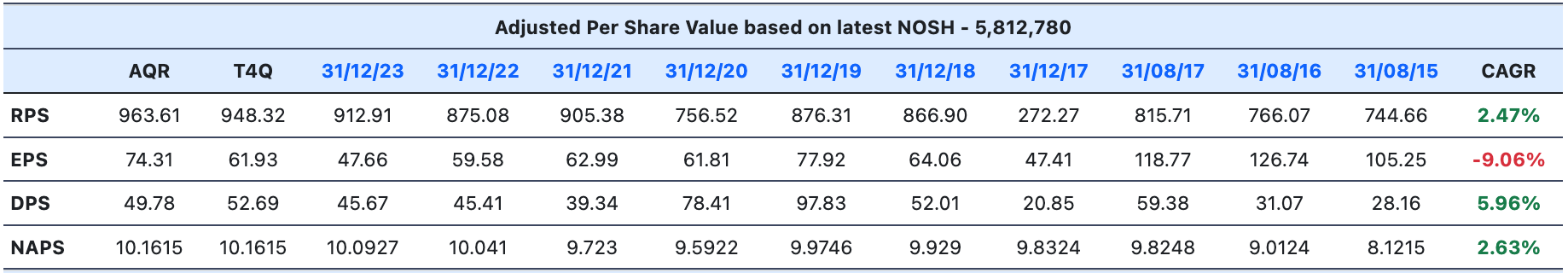

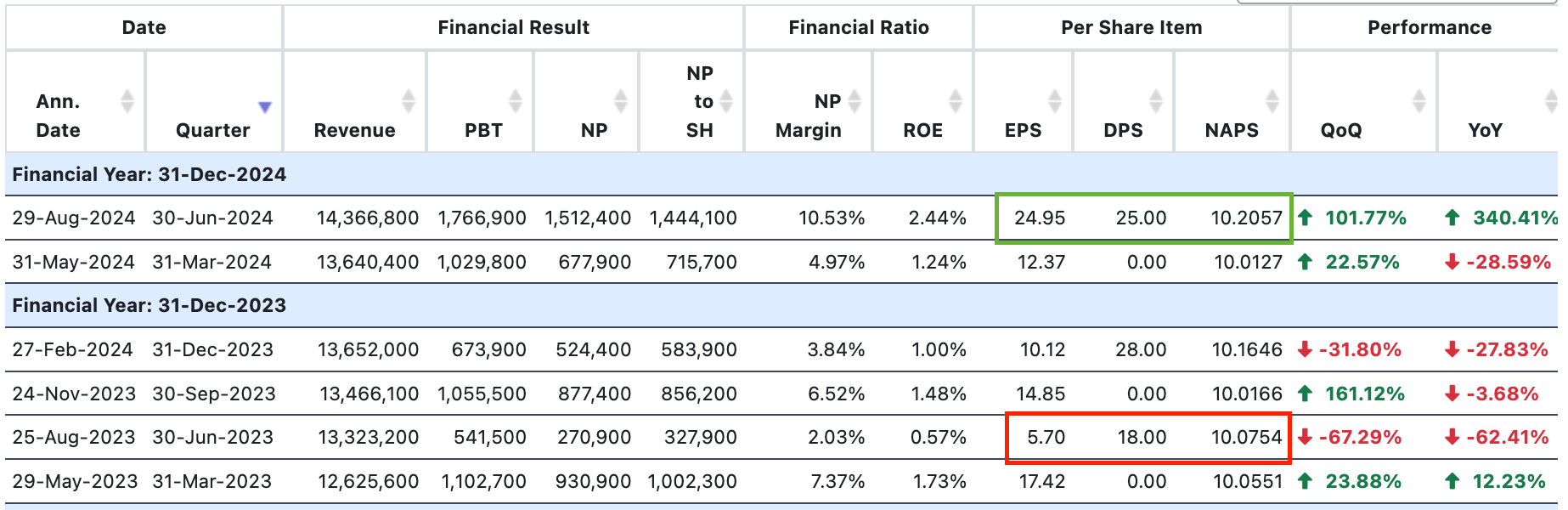

Investors know that the real life is more complex than that. Let's take a look at the 10 Year Fundamentals.

Key observations:

- YoY DPS has increased from 18 sen to 25 sen, an increase of 39%!

- YoY EPS has increased from 5.7 sen to nearly 25 sen, an increase of 338%!

- The mid year 25 sen dividend is easily supported by total H1 earnings of 37.32 sen.

- In 2019, the total Adjusted DPS was 97.83 sen.

- TENAGA's revenue on TTM basis is the highest it has ever had over the past 10 years!

- The rise in the last quarter EPS is promising - annualizing this gives nearly 100 sen, suggesting that it could retest the 2015-2017 highs where EPS exceeded RM1. From the 10 year chart, the 2015-2017 highs saw TENAGA trading at the top of the channel drawn, where the circles were drawn.

- There are many other observations, but just these alone is enough to suggest that TENAGA is not yet near saturation or near its historical maximum in terms of what it is capable of doing fundamentally from business perspective.

- If TENAGA is able to repeat or approach (and does not need to exceed) its past fundamental achievements, there is no reason why it could not trade above its all time high of RM16.92 or even near the upper channel line above that.

- As for DPS, my expectation is an increase in total year's DPS from 46 sen to around 60 sen +/- 4 sen. If price stays constant at today's close of RM14.64, the Dividend Yield ~ 60 sen / 14.64 = 4.1%, still higher than FD rates.

Lazy fundamental investors looks at last year's DPS of 46 sen, divide by 14.64 and see the Dividend Yield as only 3.1%. Still 3.1% beats headline FD rates by the top 3 banks! That laziness simply missed the fact that TENAGA's last quarterly report earnings is fantastic. As such, it is important to adopt a balanced view, considering its future prospects. If market only considers the past, then, the historians and the librarians would be the richest investors in the world, but we all know this is not the case.

It's not stretching for TENAGA to pay 60 sen in dividends for 2024 Financial Year, considering historically, it has paid as high as 100 sen in 2019.

Additionally, the % of foreign ownership of TENAGA's stock is nowhere near its all time highs yet. With the continued strengthening of the Ringgit, overseas investors will find Malaysia stock market appealing, and will find TENAGA attractive.

Summary and Conclusion

As you know, I am constantly inspired by the world's greatest investor Mr Warren Buffett.

One thing I learnt from him is not to do day trading or swing trading on your core investing positions.

Buffett's own examples showed what he does with stocks like PetroChina or Apple. He buys them at attractive / fair prices and he holds them for many years until the bull market approaches the peak of the rally. And when he feels the stocks are over-valued, then, he finally disposed them and typically, his sell timings tend to be near the peak of the bull market.

In this manner, I intend to emulate Buffett one-time buy, one-time sell, within a single bull market cycle with TENAGA stock.

The long term price chart may not be identical, but I hope is a decent proxy to Buffett's approach, to supplement my fundamental readings.

At least, it objectively indicates to me where are the Accumulation Zones and where are the Selling Zones.

On this basis, it suggests to me that I could start to plan my disposal gradually, starting from around RM17 to the top of the channel (assuming next few QRs continues to grow strongly on YoY basis. If so, I expect TENAGA price will gradually climb that "wall of worry").

My base case is to expect its fundamentals to continue to improve over time.

Additionally, with the continued strength in the Ringgit, and the continued rise in foreign shareholding %, I expect TENAGA to still have significant room for its price to rise further.

In short, so far, I have not seen major divergences yet. My expectation is to still continue to see confluences of fundamentals, technicals, business, forex, foreign shareholder behaviour i.e. nothing major out of the expectation.

Hence, I don't really care what others say, because my system tells me to hold and to continue to do nothing. Do nothing when there's nothing to do!

Of course, in the short term, TENAGA is clearly over-bought and nothing goes up forever.

However, TENAGA is not a trading stock to me (I have other stocks for short term trading, swing trading, where the price movements are 2, 3, 5 times higher).

Hence, I am happy to not do anything with my TENAGA investing position.

If you are a like-minded investor, I wish you all the best to hold your TENAGA position!!

Cheers!

PS. My average price after dividends is now only half of today's price. This helps to stay on course, because even if TENAGA were to crash tomorrow by 50%, I would still not lose monies. This is the power of holding on the stock for year, to collect dividends over the years.

Disclaimer: As usual, you are fully responsible for your own investing and trading decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-22

TENAGA2025-01-21

TENAGA2025-01-21

TENAGA2025-01-21

TENAGA2025-01-21

TENAGA2025-01-21

TENAGA2025-01-21

TENAGA2025-01-21

TENAGA2025-01-21

TENAGA2025-01-20

TENAGA2025-01-20

TENAGA2025-01-20

TENAGA2025-01-20

TENAGA2025-01-20

TENAGA2025-01-20

TENAGA2025-01-17

TENAGA2025-01-17

TENAGA2025-01-17

TENAGA2025-01-17

TENAGA2025-01-17

TENAGA2025-01-17

TENAGA2025-01-17

TENAGA2025-01-16

TENAGA2025-01-16

TENAGA2025-01-16

TENAGA2025-01-16

TENAGA2025-01-16

TENAGA2025-01-16

TENAGA2025-01-15

TENAGA2025-01-15

TENAGA2025-01-15

TENAGA2025-01-15

TENAGA2025-01-15

TENAGA2025-01-15

TENAGA2025-01-14

TENAGA2025-01-14

TENAGA2025-01-14

TENAGA2025-01-14

TENAGA2025-01-13

TENAGA2025-01-13

TENAGA2025-01-13

TENAGA2025-01-13

TENAGAMore articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Jan 22, 2025