Technical Tracker - ITMAX: Accumulate for the Next Wave

HLInvest

Publish date: Wed, 04 Jan 2023, 06:53 PM

Provider of networked systems in the public space. ITMAX operates in two business activities namely (i) supply and installation of networked systems; and (ii) provision of networked facility, with the former accounting for 52% of FY21 revenue while the latter accounting for the remainder. Under the supply and installation of networked systems segment, ITMAX provides end-to-end services from supply, installation, testing, and commissioning of the networked systems, as well as connection to a designated control centre. The revenue from this segment is project based on lump sum contracts. The provision of networked facility segment, on the other hand, provides a recurring revenue stream to the group by charging fees for the use of its facilities such as video surveillance systems, control centre facilities, and others. ITMAX’s unbilled sales currently stands at RM598.2m with a tender book amounting to RM600-800m.

Multi-growth pillars to accelerate growth. Leveraging on its proven track record and its ability to provide total system integration to design and develop customised and localised public space networked systems, ITMAX envisages foraying outside the central region. We see significant opportunities in this development for ITMAX to replicate its success story and expand its exposure outside the central region, which accounted for only 3.1% of the group's FY21 revenue. Meanwhile, revenue from the central region of Peninsular (96.9% of its total revenue) is expected to grow steadily in anticipation of more video cameras installations. Based on IHS Markit’s report, the number of CCTV cameras per capita in Kuala Lumpur still lagging behind compared to other SEA cities (see Figure #1). Other than that, the group is also planning to reach into other enterprise markets including shopping malls, buildings, expressways, and hospitals. All in, we project ITMAX’s core net profit to grow at a strong FY21 -24 CAGR of 31%. HLIB initiated coverage on ITMAX last month with a BUY call and a TP of RM1.70.

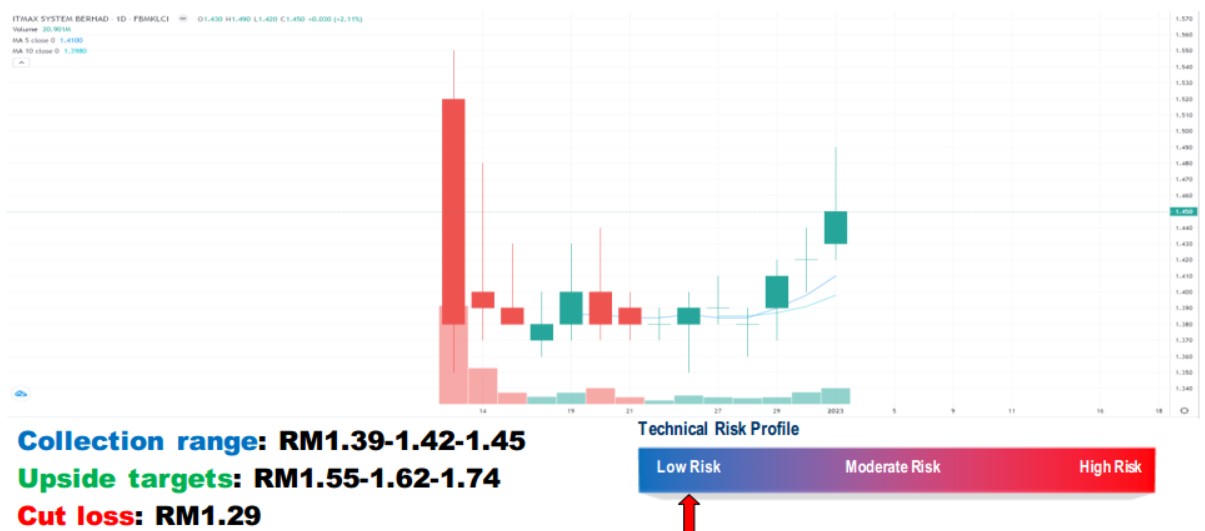

Another wave on the card? After hitting a high of RM1.55 on its first-day listing, ITMAX has corrected 6.4% to RM1.45, oscillating at RM 1.35-1.45 levels. Interestingly, we see some similar patterns in ITMAX’s share price performance with other IPOs – 79% of 2022 IPOs’ stock price start to consolidate for 2–46 days (with low volume) after the first-day rally and stage for another wave thereafter. A successful breakout above the RM1.45 resistance will spur the share price toward RM1.55–1.62-1.74 levels. Cut lost at RM1.29.

Source: Hong Leong Investment Bank Research - 4 Jan 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|