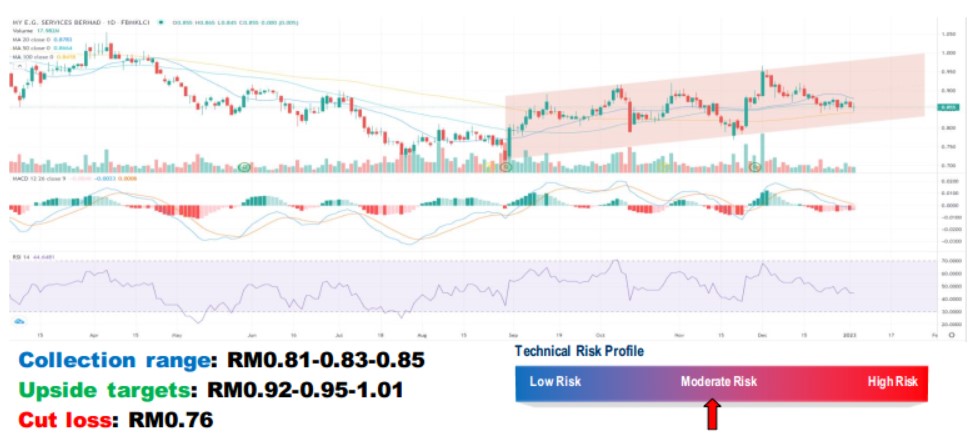

Technical Tracker - MYEG: A Higher High?

HLInvest

Publish date: Fri, 06 Jan 2023, 09:38 AM

Big upside for Zetrix. Recall that MYEG launched the Zetrix blockchain via an exclusive three-year JV with Xinghuo BIF’s core protocol developer Bubi. MYEG was then appointed to own and operate Xinghuo BIF’s (the Chinese national blockchain infrastructure under the Ministry of Industry and Information Technology) international supernode, which will enable Zetrix network’s on-chain assets and transactions to cross seamlessly into Xinghuo BIF. With Zetrix being the international extension of Xinghuo BIF, this international gateway will provide connectivity to China’s national blockchain infrastructure to enable frictionless cross-border trade and facilitate global collaboration for digital economy development. It enables trade and payment flow in the Regional Comprehensive Economic Partnership (RCEP) such as product traceability, tariff computation, and supply chain financing.

MYEG will monetize Zetrix via an ICO (Initial Coin Offering) and the provision of its blockchain services, where the issued token can be used as a gas fee for various applications provided on the Zetrix platform, such as the Blockchain-based Identifiers (BID)/Verifiable Credentials (VC), Blockchain-based E-signing services, and others. Note that, Xinghup BIF resolves approximately 100m blockchain identifiers daily, placing it as the most actively used blockchain platform globally. We see sizeable earnings accretion if Zetrix’s China-Asean trades gain traction. Notably, the street is projecting a conservative RM50-127m PBT contribution from Zetrix for FY2022-2023.

Still growing strong. Although the contribution from MYEG's healthcare segment is expected to taper off following the gradual removal of Covid-19 SOPs, we believe this will be cushioned by MYEG's immigration segment as well as the road transport segments, which are deemed to be a prime beneficiary of border reopening. In particular, MYEG Immigration segment's matching and permit renewal services will likely to get a strong boost following the return of foreign workers amid acute labour shortages across most sectors.

Trading near its uptrend support. Technically, MYEG is trading near its uptrend channel support of RM0.81. In the wake of the higher lows pattern, a decisive breakout above RM0.87 will spur prices higher towards RM0.92-0.95-1.01 territory. Cut loss at RM0.76

Source: Hong Leong Investment Bank Research - 6 Jan 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jan 22, 2025

Blue Tulip

Gambateh, MyEG! Add oil. Come on.

2023-01-06 09:45