NAGA Warrants 2017 Ninth Issuance - Opportunity to Position Ahead for Seasonally Stronger Quarters

kiasutrader

Publish date: Thu, 28 Sep 2017, 11:14 AM

After three consecutive weeks of inflows, foreign funds offloaded a massive RM477.7m in Malaysian equities last week amid geopolitical tensions and as the US Federal Reserve announced plans for quantitative tightening as early as October 2017 which investors fear may trigger a sell-off in emerging markets due to further outflows. Furthermore, the recently concluded 2QCY17 earnings season has offered little consolation and even showing signs of weakness compared to the previous two quarters.

Nevertheless, the FBMKLCI has already retreated almost 30 points from its recent high and is now nearing the crucial 1,754/1,760 support levels where we expect some degree of bargain hunting to emerge. With market volatility still on the low side (14-day volatility at 3.8%) and candlestick chart beginning to show signs of nibbling, we believe that the current landscape provides investors the opportunity to position ahead for a seasonally stronger 4Q and 1Q.

In today’s batch of Naga Warrants, Equity Derivatives will be listing 11 Structured Warrants comprising LBS-CB (strike: RM2.40), DRBHCOMC44 (strike: RM2.00), KERJAYA-CF (strike: RM4.30), VITROX-CE (strike: RM5.00), PETRONM-CF (strike: RM11.00), ECONBHD-CH (strike: RM3.40), YTL-C13 (strike: RM1.50), SENERGYC51 (strike: RM1.90), HAIO-CC (strike: RM5.10), EWINT-CI (RM1.20) and PBBANK-C18 (RM21.50).

Structured Warrants Commentary

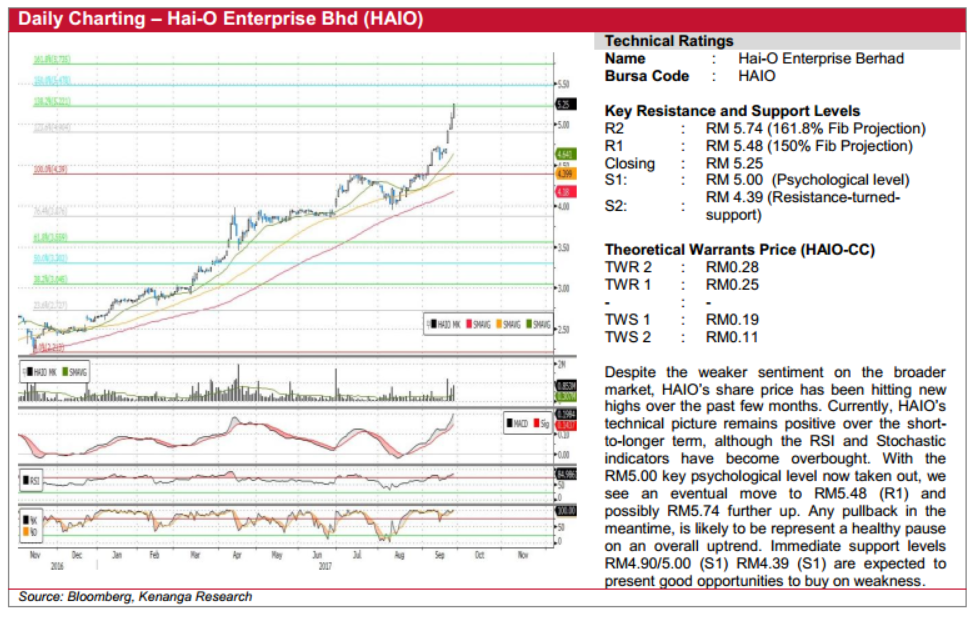

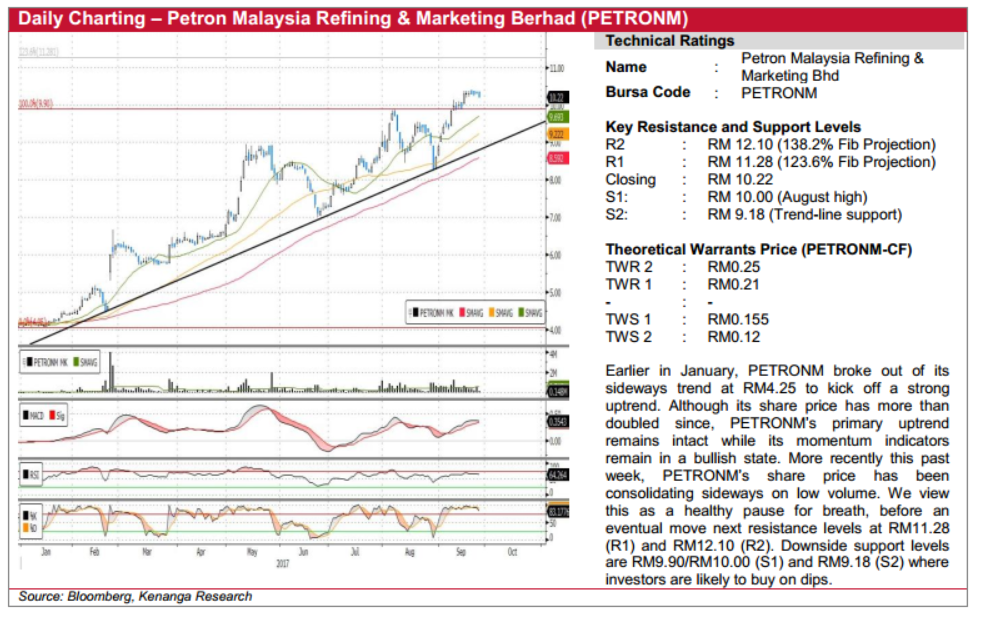

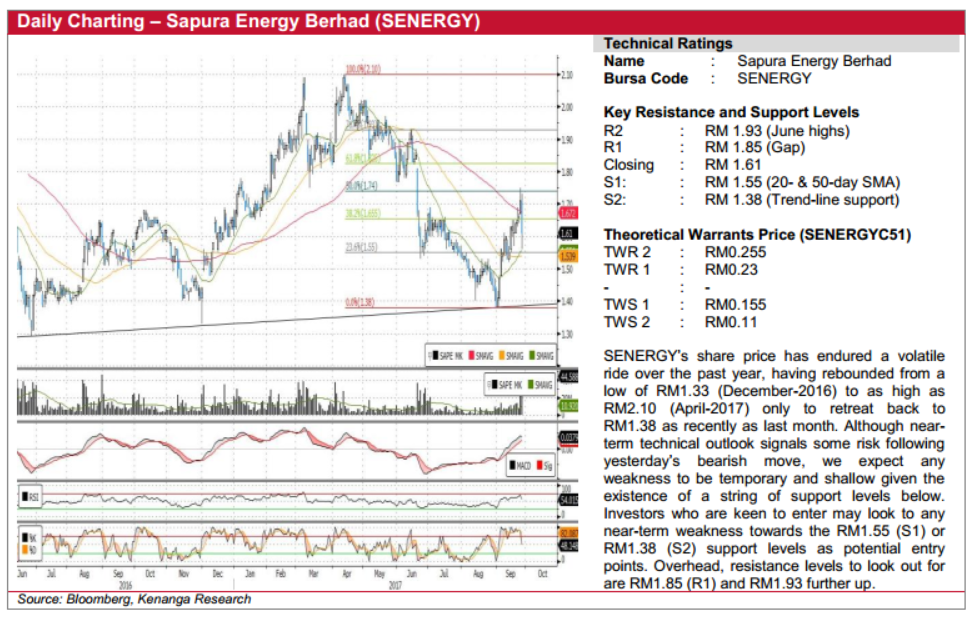

A number of the Naga Warrants being listed by Equity Derivatives today are being issued to replace expiring structured warrants from previous listings, with an additional few being provided as added tools for investors who wish to trade on the more active news-driven counters. Although we do not have active coverage on any of these stocks, we note that EWINT-CI, ECONBHD-CH, LBS-CB and VITROX-CE have consensus BUY calls on their underlying stocks. Meanwhile, we also see the potential for HAIO-CC, PETRONM-CF and SENERGYC51 to attract some trading interest from both news-flow and charting perspective.

For HAIO (MP; TP: RM4.40), we recently upgraded our target price on the stock from RM4.00 last week after the company announced its 1Q18 earnings. Notably, 1Q18 revenue surged 58%, driven by impressive growth in its MLM division (+81%) as additional sales were generated from newly recruited distributors and higher sales volume from newly launched big-ticket items in its fashion and beauty range of products and recurring sales from its consumer products. Higher margins from the MLM division and a lower effective tax rate also helped boost net profits by 81% YoY, necessitating an upwards revision on our forecasts and target price.

Meanwhile, PETRONM’s (Not Rated) share price has been on strong run since the start of the year, aided by strong earnings delivery and an abundance of market chatter by retail investors. More recently, with the string of hurricanes affecting oil refining supply, the impact is seen as a temporary boon for Asian refiners and petrochemical players. Gross refining margin remains elevated pre-Hurricane Harvey, even as US-based refiners restarted their operations after a twoweek shutdown.

As for SENERGY (OP; TP: RM1.55), the company announced its 2Q18 earnings which came below expectations yesterday, dragged by the stubbornly high fixed cost amidst weak drilling utilisation. Uncertain timing of contract award remained a concern to SENERGY even though tender enquiries were active. We are guided that job bidding market remains competitive but has improved over the past few months. However, the timing of contract award is still uncertain pending approval from the oil majors. The market has already reacted negatively to the earnings announcement. Although yesterday’s market reaction signals some risk to SENERGY’s technical picture, we see downside support levels of RM1.55 (R1) and the RM1.38/1.40 (R2) technical floor as potential entry points for bargain hunters.

These 11 structured warrants are priced with a range of +/-28% moneyness. All the warrants issued are European Styled Non-Collateralised Cash Settled Warrants with a tenure of 6 months. The gearing ranges from as low as 3.6x to as high as 15.3x and the conversion premium ranges from 11% to 44%. Call-warrants are leveraged instruments. For instance, by participating in PETRONM-CF, an investor is exposed to a gearing of 5.5x. To be more precise, this call warrant offers up to 3.0x effective gearing for traders. Based on our target price of RM11.28 (implying a potential upside objective of 13.9% based on the EOD price of RM9.90. Theoretically speaking, a 13.9% increase in the underlying price should translate to ~42% gain in PETRON-CF. This general estimate is applicable to other Naga Warrants as well.

Source: Kenanga Research - 28 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)