Daily Technical Highlights - (GENETEC, YGL)

kiasutrader

Publish date: Wed, 11 Oct 2017, 10:47 AM

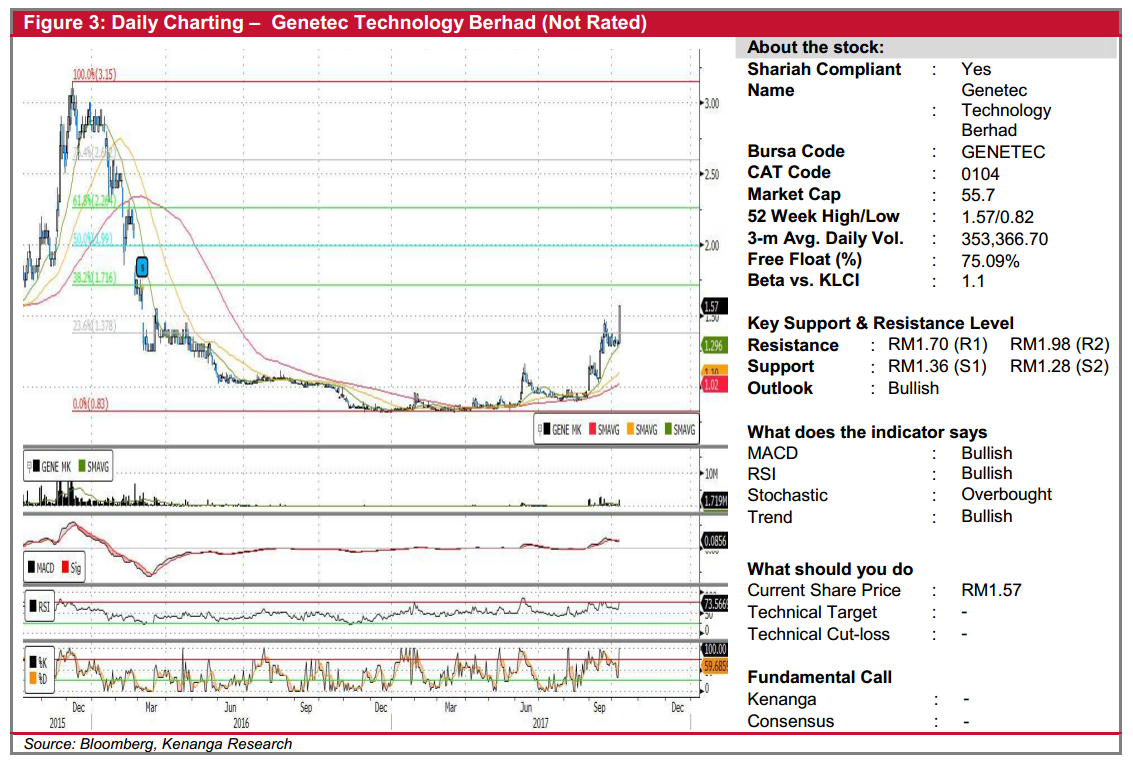

GENETEC (Not Rated). GENETEC’s share price shot up 26.0 sen (19.8%) to close at an 18-month high of RM1.57. From a technical perspective, the share price has formed a “Marubozu” candlestick with a marked increase in trading volume, indicating that the bulls dominated the entire trading day. Similarly, the key momentum indicators have all hooked upwards to reflect this sudden increase in buying interest. From here, we expect further gains, towards resistance levels RM1.70 (R1) and RM1.98 (R2) next. Any near-term pullback towards the RM1.36 (S1) support may be viewed as a buying opportunity, although a further break below RM1.28 (S2) would be highly negative.

YGL (Not Rated). YGL climbed as much as 3.5 sen in the morning session before finishing the day up by 2.5 sen (11.9%) at RM0.235. Trading volume was explosive, with 13.7m share changing hands. From a charting perspective, YGL’s share price has been on a healthy uptrend since the start of the year. In fact, the share price had been trading within a broadening formation or “Megaphone” pattern and now appears poised to rally in the months ahead. Similarly, yesterday’s uptick on the MACD signalled a shift to bullish momentum. Hence, investors may look forward to a retest of the July's high of RM0.275 (R1), and possibly RM0.30 (R2) where the uptrend resistance is located. Downside appears limited with RM0.20 (S1) likely to have strong buying interest, although this could trigger a capitulation towards RM0.18 (S2).

Source: Kenanga Research - 11 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|