Daily Technical Highlights - (MESB, TRIVE)

kiasutrader

Publish date: Thu, 12 Oct 2017, 11:47 AM

MESB (Not Rated). MESB rallied 14.5 sen (15.0%) to finish at the day’s high of RM1.11.Trading volume was high for the day, at 1.2m shares vs. the daily average of 0.4m. From a charting perspective, yesterday’s bullish move resulted in the formation of a “Marubozu” candlestick which indicates that the buyers were in firm control throughout the day. Meanwhile, the MACD has just crossed above its Signal line to reflect this transition to bullish momentum. From here, expect a retest of last month’s high of RM1.12 (R1). Once taken out, the next resistance is RM1.22 (R2) further up. Downside support levels are RM1.00 (S1), and RM0.90 (S2) further down.

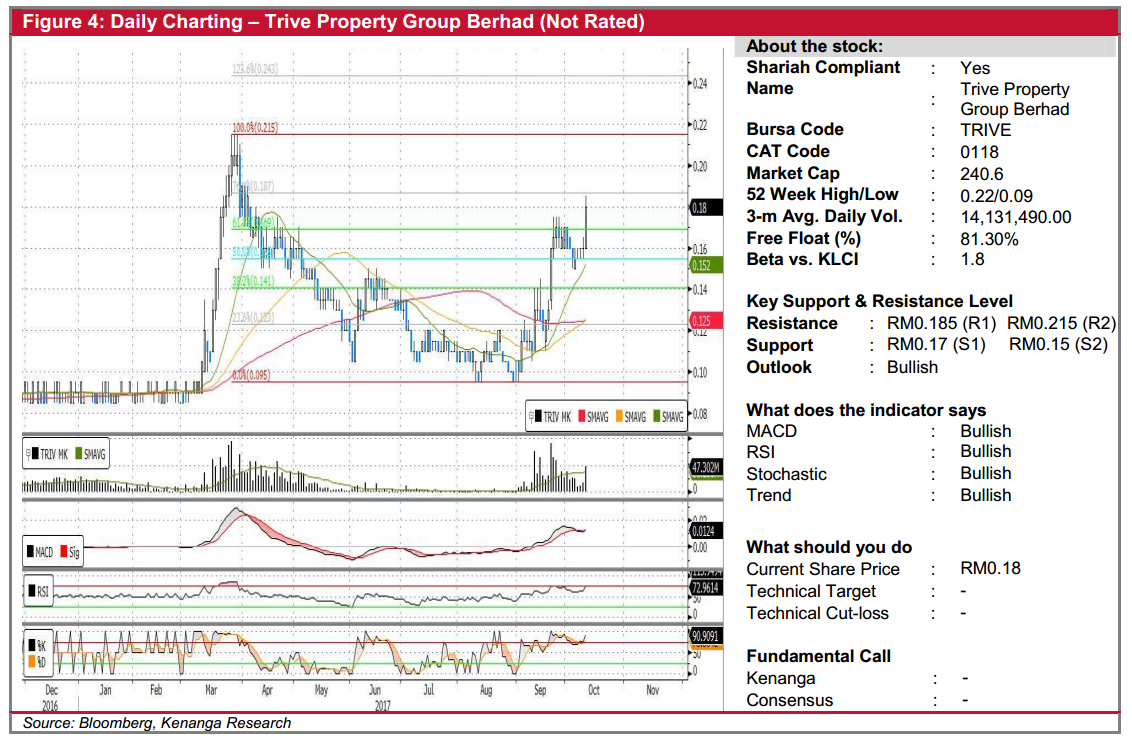

TRIVE (Not Rated). TRIVE rallied to the highest level in six months yesterday after the share price climbed 2.0 sen (12.5%) to RM0.18. From a charting perspective, the share price had bottomed in August, and has since been on a uptrend. In fact, a “Rounding Bottom” pattern appears to have taken shape, with this gradual shift in sentiment being reflected by the “Golden Crossovers” on the key SMAs. Similarly, volume indicators have been healthy. Combined, the balance of evidence strongly favours the upside from here. TRIVE’s share price is now in the midst of testing the RM0.185 (R1) resistance. However, should this level be taken out next, further gains would then be expected towards RM0.215 (R2). Downside support levels are likely to be present at RM0.17 (S1) and RM0.15 (S2) below.

Source: Kenanga Research - 12 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|