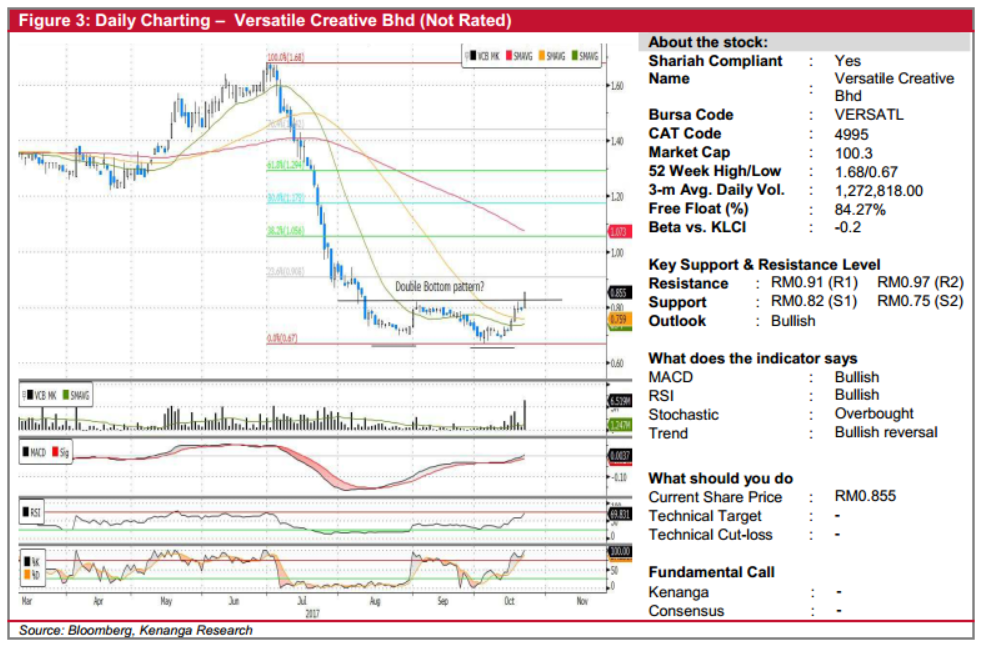

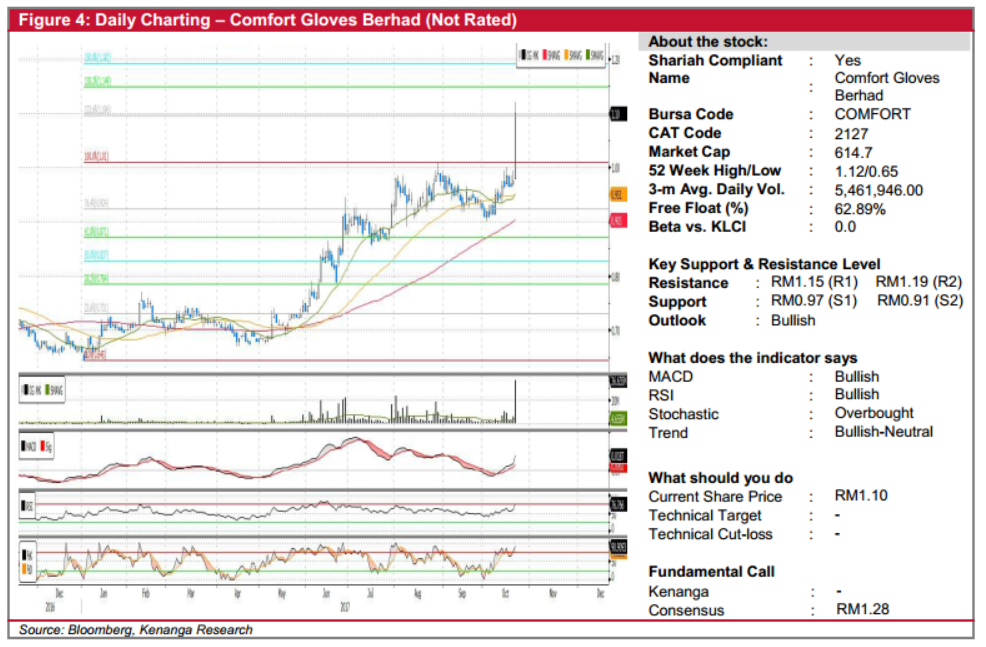

Daily Technical Highlights - (VERSATL, COMFORT)

kiasutrader

Publish date: Tue, 24 Oct 2017, 10:28 AM

VERSATL (Not Rated). VERSATL saw its share price surging 6.0 sen (7.5%) yesterday to finish at the day’s high of RM0.855. Trading volume rose to 6.5m shares, five-fold the daily average. Of note, VERSATL has now broken out of a “Double Bottom” chart pattern, which signalled that the share price is poised for a major reversal having endured a steep downtrend earlier in July-August. Furthermore, the MACD is also showing signs of bullish convergence to reflect this shift in sentiment. From here, we see the potential for a swift move to RM0.91 (R1) and the measurement objective of RM0.97 (R2) further up. Any return to the RM0.82 (S1) neckline can be viewed as a buying opportunity, although a move below the 20- and 50-day SMAs at RM0.75 (S2) would be highly negative.

COMFORT (Not Rated). COMFORT rallied an astonishing 12.5 sen (12.8%) yesterday, closing at RM1.10. This was accompanied by exceptionally high trading volumes of 36.6m shares – more than 7x its 20-day average of 4.7m shares. More importantly, yesterday’s move could potentially signal a continuation of a prior uptrend, which lasted from May to Aug, after a 2-month long period of sideways consolidation. Likewise, with key SMAs forming a “golden-cross”, coupled with upticks in key SMAs, we reckon that the balance of evidence favours a continued move upwards at this juncture. From here, expect some overhead resistances at RM1.15 (R1) and RM1.19 (R2), while downside supports can be identified at RM0.97 (S1) and RM0.91 (S2).

Source: Kenanga Research - 24 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)