Daily Technical Highlights - (WELLCAL, PMETAL)

kiasutrader

Publish date: Wed, 25 Oct 2017, 09:19 AM

WELLCAL (Cut loss @ RM1.40). Earlier in May, we recommended a Trading Buy on WELLCAL when the share price broke out of a “Falling Wedge" pattern. Although initial gains were encouraging, it proved short-lived as the share price subsequently topped out and entered into a downtrend. Yesterday, the share price was down 2.0 sen (1.4%) to RM1.40. Notably, the share price is in the midst of negotiating the downtrend resistance line at RM1.45 (R1). However, with momentum indicators remaining bearish, we believe that the overall technical picture favours the downside. As such, we opt to square off our position for now. Downside support levels are likely to be present at RM1.37 (S1) and RM1.24 (S2) while overhead resistances are RM1.45 (R1) and RM1.58 (R2).

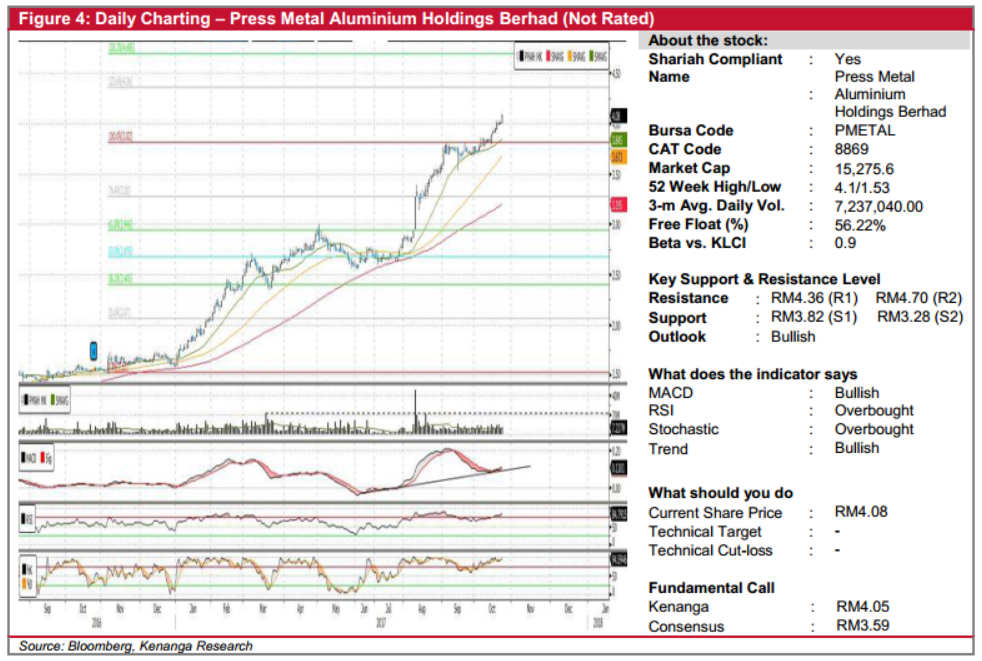

PMETAL (Not Rated). Yesterday, PMETAL saw its share price inching up another 7.0 sen (+1.7%) to finish at record high of RM4.09. From a technical perspective, this move further reaffirms the positive underlying uptrend which has remained actively intact since its emergence back in Aug 2015. Likewise, with key SMAs still in its “golden-cross” state, coupled with the MACD also just staging a bullish crossover against its Signal line to remain healthy above its zero-line, we believe the balance of evidence is favouring the upside at this juncture. From here, we expect the share to continue trending towards overhead resistances of RM4.36 (R1) and RM4.70 (R2). Conversely, downside supports can be identified at RM3.82 (S1) and RM3.28 (S2).

Source: Kenanga Research - 25 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|