Daily Technical Highlights - (SEM, MMODE)

kiasutrader

Publish date: Fri, 27 Oct 2017, 09:59 AM

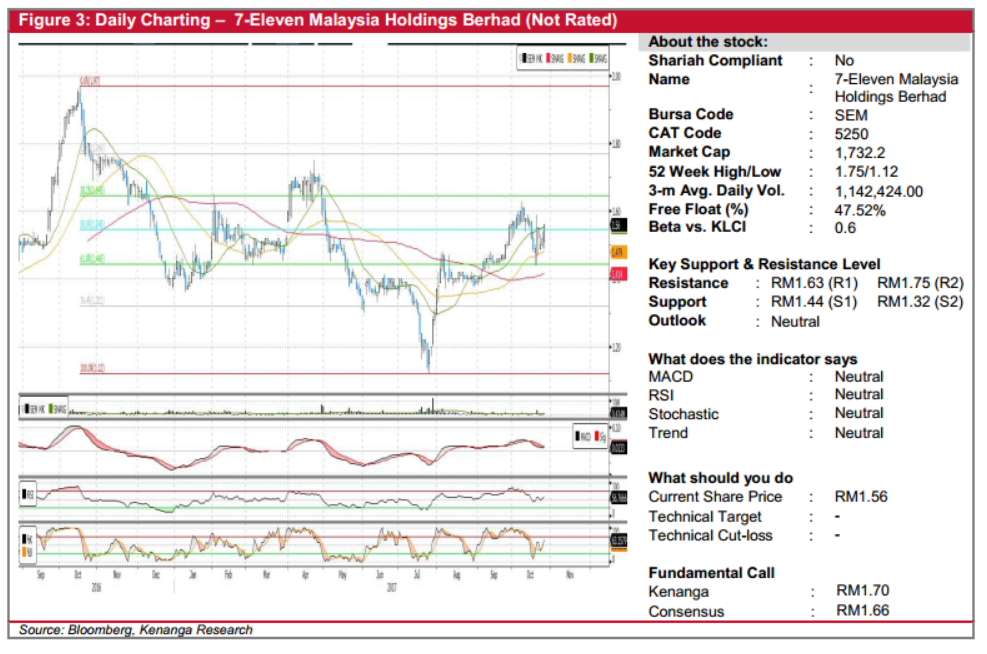

SEM (Not Rated). Yesterday, SEM rose 4.0 sen (2.6%) to close at its intraday high of RM1.56. Chart-wise, the share may look to rebound to retest recent highs after bottoming out in late July. Yesterday’s candlestick, coupled with key SMAs currently in a “golden-cross” state could be encouraging signs of a potential recovery play, but the tapering volumes could also raise some caution. Likewise, key indicators also seem to point towards directionless trading. From here, key resistances to look out for are RM1.63 (R1), RM1.75 (R2), and RM1.92 (R3). Conversely, supports can be identified at RM1.44 (S1), RM1.32 (S2) and RM1.12 (S3).

MMODE (Not Rated). MMODE’s share price climbed 3.0 sen (7.9%) yesterday to close at its 18-month high of RM0.41. This was accompanied by increased trading volumes, which climbed to 10.7m shares traded, versus its 20-day average of 2.1m shares. We believe yesterday’s breakout provides further affirmation that the share has now broken out of its prior downtrend. With key SMAs completing a “Golden Crossover”, coupled with positive showings from key indicators, the balance of evidence could be tipped in favour for a move higher. As the share is now in the midst of testing its immediate resistance at RM0.41 (R1), a decisive punch-through would see a subsequent resistance higher up at RM0.46 (R2). Conversely, downside support levels can be found at RM0.34 (S1) and RM0.30 (S2).

Source: Kenanga Research - 27 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|