Daily Technical Highlights - (JAKS, DATAPRP)

kiasutrader

Publish date: Wed, 01 Nov 2017, 11:28 AM

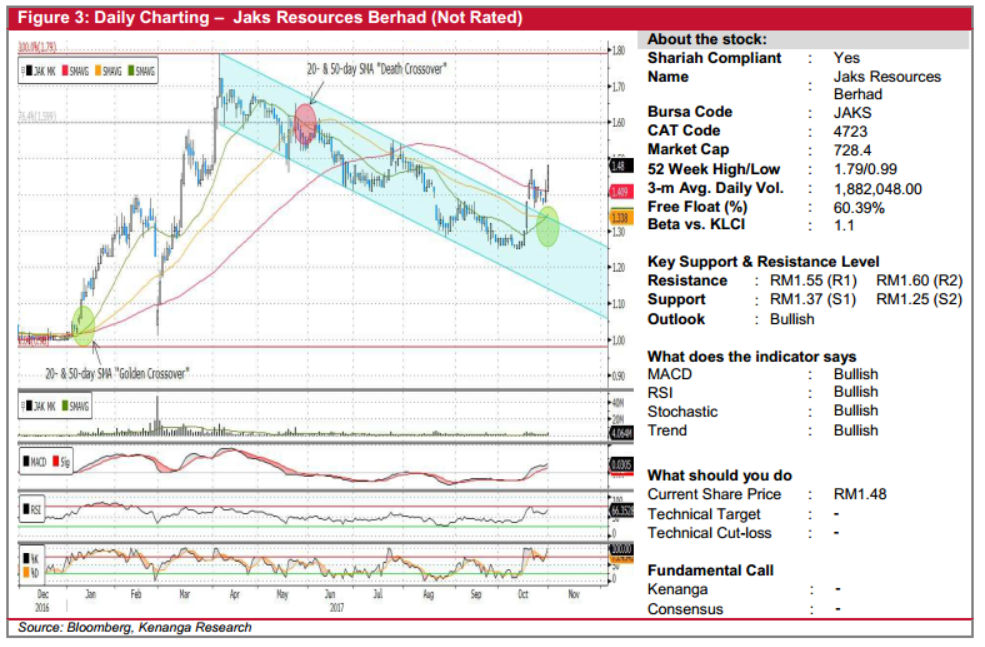

JAKS (Not Rated). JAKS saw its share price climbing 7.0 sen (5.0%) to finish at a three-month high of RM1.48. From a charting perspective, the share price had broken out of its downtrend resistance stretching two months back and its overall technical picture has shown a marked improvement since. Notably, the momentum indicators are now in a bullish state, while the 20-day SMA has just completed a “Golden Crossover” with the 50-day SMA. As such, we believe the share price has bottomed out after a six-month long downtrend, and expect a strong recovery to be on the cards. From here, we expect a move to retest the July high of RM1.55 (R1). Should this level be taken out next, further resistance levels to target are RM1.60 (R2) and RM1.79 (R3) beyond. Downside support levels are RM1.34/1.37 (S1) and RM1.25 (S2).

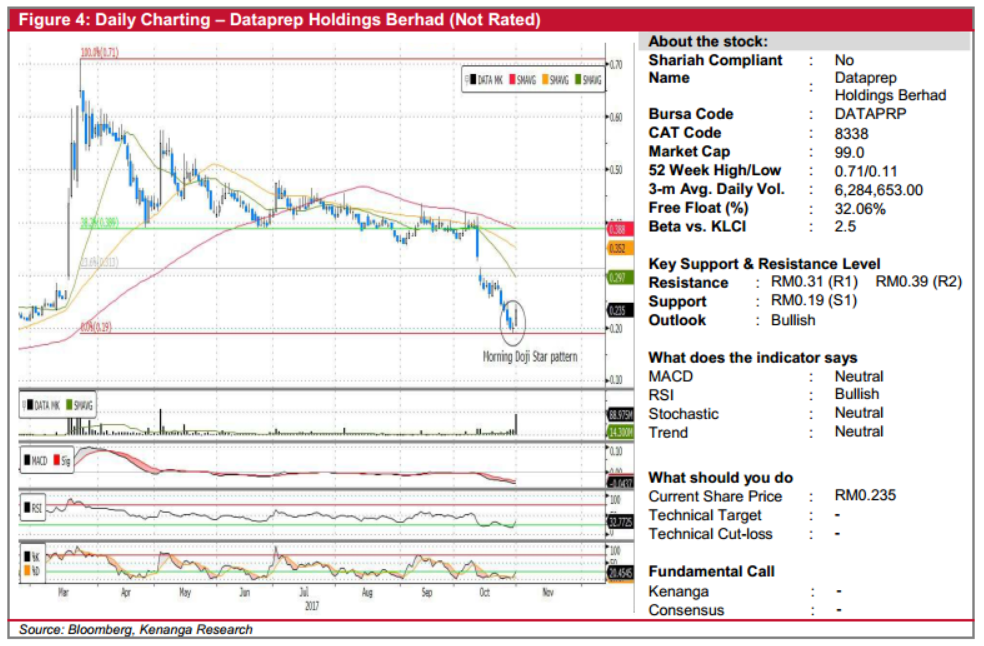

DATAPRP (Not Rated). Yesterday, DATAPRP gained an impressive 3.5 sen (17.5%), closing at RM0.235. This was accompanied by exceptional trading volume, with 89m shares exchanging hands – more than 6x its 20-day average. Chart wise, DATAPRP has been on a downtrend since mid-October, with its share price plunging from RM0.41 to a low of RM0.19 after a 6-month long sideways consolidation phase. Notably, yesterday’s bullish move completes a “Morning Doji Star” candlestick pattern, marking a possible early indication of a downtrend reversal. Likewise, key indicators such as the RSI and Stochastic had also hooked up from their respective oversold position, possibly signalling a turn of sentiment favouring the bulls. From here, we expect the share to trend towards resistances placed at RM0.31 (R1) and RM0.39 (R2), with a crucial support level at RM0.19 (S1).

Source: Kenanga Research - 1 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|