Daily Technical Highlights - (MULPHA, VIS)

kiasutrader

Publish date: Thu, 02 Nov 2017, 10:08 AM

MULPHA (Not Rated). MULPHA’s share price rose 7.0 sen (2.8%) to finish at the highest level since April at RM2.57. Chart-wise, the share price has broken out of the crucial RM2.50 resistance, which it had previously tested on multiple occasions over the past six months. Similarly, the momentum indicators reflect the shift to bullish sentiment, particularly with the MACD crossover above its Signal line and uptick on the RSI. With the RM2.50 resistance taken out, MULPHA now has a fairly clear path towards RM2.68 (S1) and possibly RM2.82 (S2) further up. Any near-term weakness towards the RM2.50 (S1) resistance-turned-support may be viewed as a buying opportunity, although a further break below RM2.40 (S2) would be a huge negative.

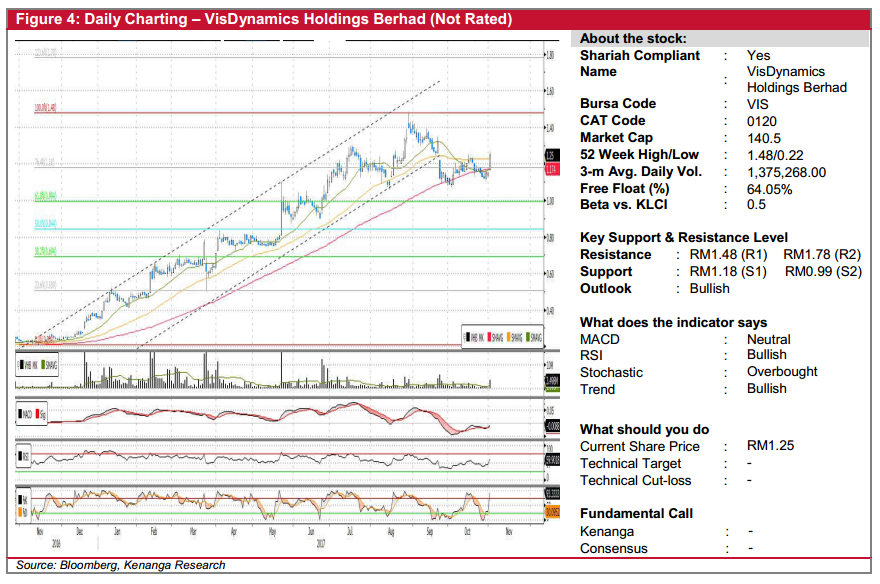

VIS (Not Rated). Yesterday, VIS marked an impressive rally, gaining 10.0 sen (8.7%) to close at RM1.25. This comes after the company announced bonus issues the prior day, and was accompanied by healthy trading volume, with 3.5m shares exchanging hands – nearly 4-fold its 20-day average. Chart-wise, VIS has entered into a phase of sideways consolidation since late-Sep, effectively ending its prior uptrend which lasted since the beginning of the year. However, yesterday’s move marks the first bullish breakout throughout this consolidation phase, potentially signalling a continuation of its prior uptrend. Likewise, encouraging signs from key indicators – i.e. bullish crossover of its MACD against its Signal-line, and positive upticks in the RSI and Stochastic indicators, could also be indicative of a continued move higher. From here, sustained momentum could see the share continue trending upwards to retest its all-time high at RM1.48 (R1), with a higher resistance at RM1.78 (R2). Conversely, an immediate support can be identified at RM1.18 (S1), with a lower support placed at RM0.99 (S2).

Source: Kenanga Research - 2 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|