Daily Technical Highlights - (CCK, ORNA)

kiasutrader

Publish date: Fri, 03 Nov 2017, 10:40 AM

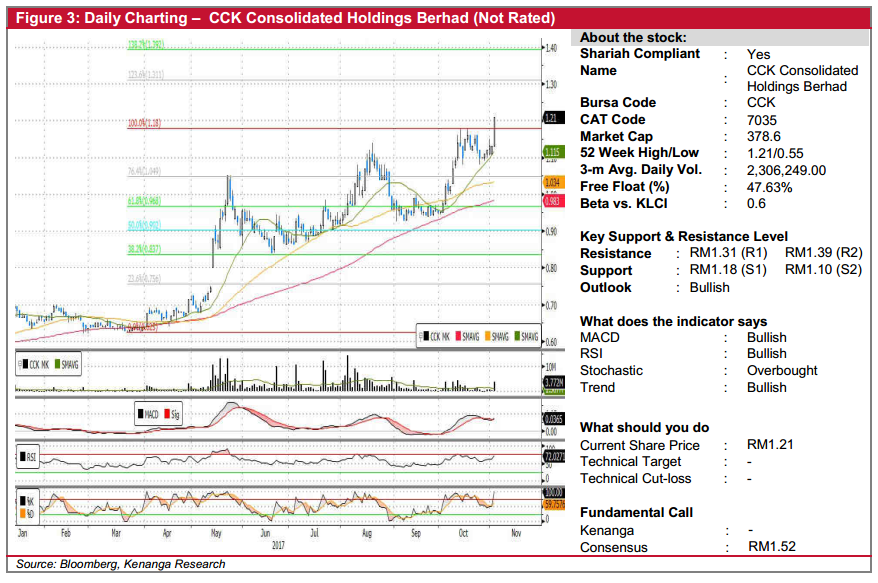

CCK (Not Rated). CCK’s share price rallied 8.0 sen (7.1%) yesterday to finish at the day’s high of RM1.21. Trading volume was elevated, with 3.8m shares changing hands. From a charting perspective, CCk’s overall uptrend is bullish over the short-longer term, with the SMAs in “Golden Crossover”, More importantly, yesterday’s share price has resulted in the MACD crossing above the Signal-line to reflect a sudden shift to bullish momentum. We reckon that the share price is biased to the upside, and expect the share price to move higher towards the resistance level at RM1.31 (R1) and possibly RM1.39 (R2) further up. Immediate support levels are RM1.18 (S1) and RM1.10 (S2) below.

ORNA (Not Rated). ORNA rallied an impressive 17.0 sen (11.9%) yesterday, closing at all-time high of RM1.60 and forming a white “Marubozu” candlestick. This was accompanied by exceptional trading volume, with 2.5m shares exchanging hands – nearly 10x its 20-day average of 256k shares. More notably, yesterday’s bullish move marks a very decisive breakout from its two-and-a-half month consolidation period, as well as its previous high of RM1.51. Likewise, positive upticks seen in key indicators could also be indicative of a possible continued move higher. From here, key resistances to look out for include its immediate resistance at RM1.63 (R1) and RM1.70 (R2). Conversely, downside supports can be identified at RM1.39 (S1) and RM1.32 (S2).

Source: Kenanga Research - 3 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|