Daily Technical Highlights - (HARTA, MHB)

kiasutrader

Publish date: Wed, 08 Nov 2017, 09:29 AM

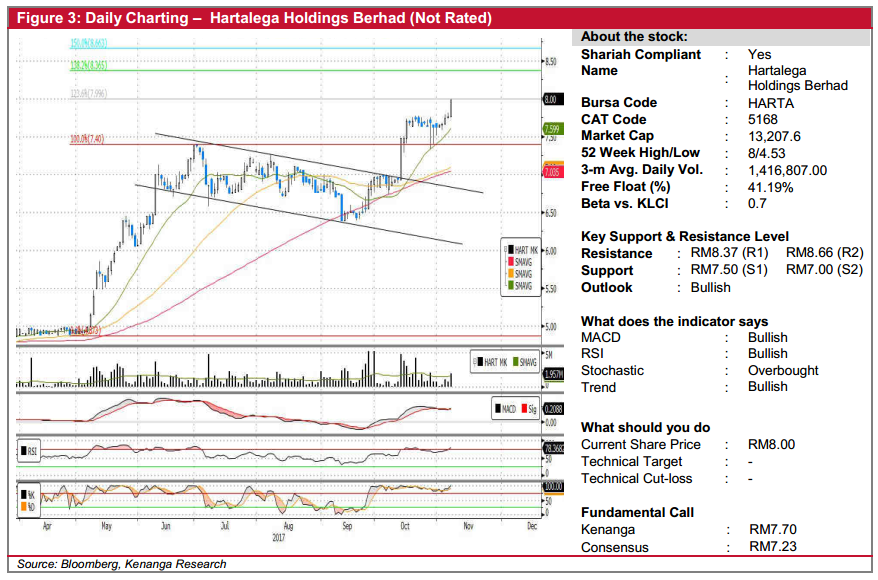

HARTA (Not Rated). Glove-maker HARTA’s share price rallied 24.0 sen (3.1%) yesterday to finish at the day’s high of RM8.00 amid the release of its 1H18 headlines earnings that showed a 64.6% YoY jump. Overall, HARTA’s short-to-longer term technical outlook is bullish with the share price firmly above the key SMAs. Notably, yesterday’s move triggered a consolidation breakout following a 3-week pause. The MACD has also crossed above its Signal-line and as a result this reflects the pick-up in bullish momentum. HARTA’s share price is now in the midst of testing its RM8.00 resistance. However, we expect follow-through buying to continue and expect a climb to the next resistance levels of RM8.37 (R1) and RM8.66 (R2) next. Downside support levels are RM7.50 (S1) and RM7.00 (S2) below.

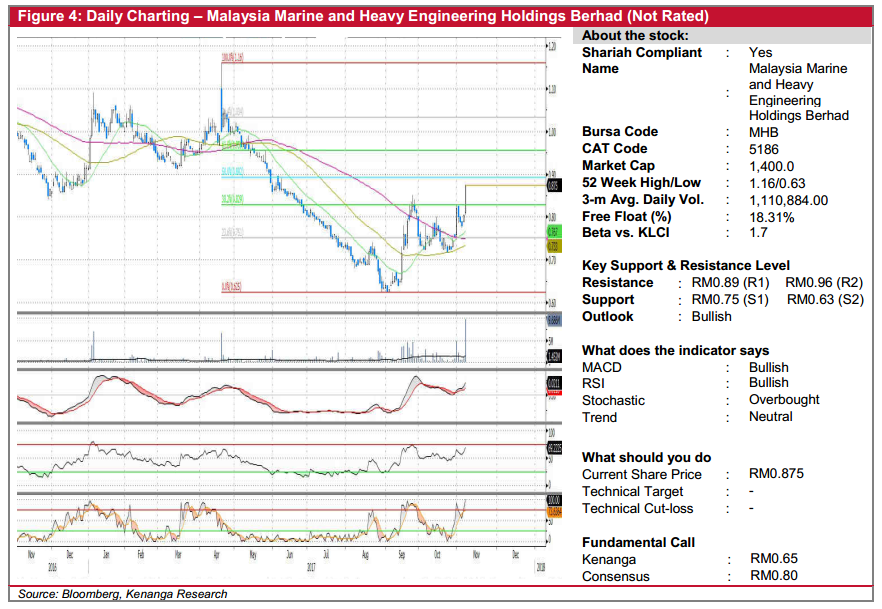

MHB (Not Rated). MHB rallied an impressive 7.0 sen (8.7%) yesterday, closing at intra-day high of RM0.875. This was accompanied by exceptional trading volume, with 9.7m shares exchanging hands – representing 6.5x its 20-day average. Chart-wise, the share underwent a 6-month downtrend until September before transitioning into a period of sideways consolidation. More importantly, yesterday’s move marks as a first decisive breakout from this consolidation. Key SMAs had just traced out a “golden-crossover” which coupled with positive displays from key indicators could be signals of the share bottoming-out for a move higher. From here, immediate resistances can be identified at RM0.89 (R1) and RM0.96 (R2), while support levels are found at RM0.75 (S1) and RM0.63 (S2).

Source: Kenanga Research - 8 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|