Daily Technical Highlights - (DGB, BSLCORP)

kiasutrader

Publish date: Thu, 09 Nov 2017, 11:07 AM

DGB (Not Rated). DGB’s share price rose 0.5 sen (5.6%) yesterday to its RM0.095 close. Until recently last month, DGB had been in a sideways grind. Nevertheless, DGB finally broke out of its prolonged slumber on 12 Oct and kicked off a strong run-up which saw its share price nearly doubling to RM0.10 (from RM0.055 a few days earlier). Although the share price subsequently entered into a sideways consolidation, early signs are beginning to signal a resumption of its prior rally. Most notably being yesterday’s climb, which was accompanied by high trading volume of 25.3m shares, or double the daily average over the past 30 days. Meanwhile, the momentum indicators remain in a bullish stance. The share price is now in the midst of retesting its RM0.10 resistance. Should this level be taken out, we see the potential for a run-up towards RM0.115 (R1) and possibly RM0.125 (R2) in fairly short order. Downside support levels are RM0.085 (S1), and RM0.075 (S2) below.

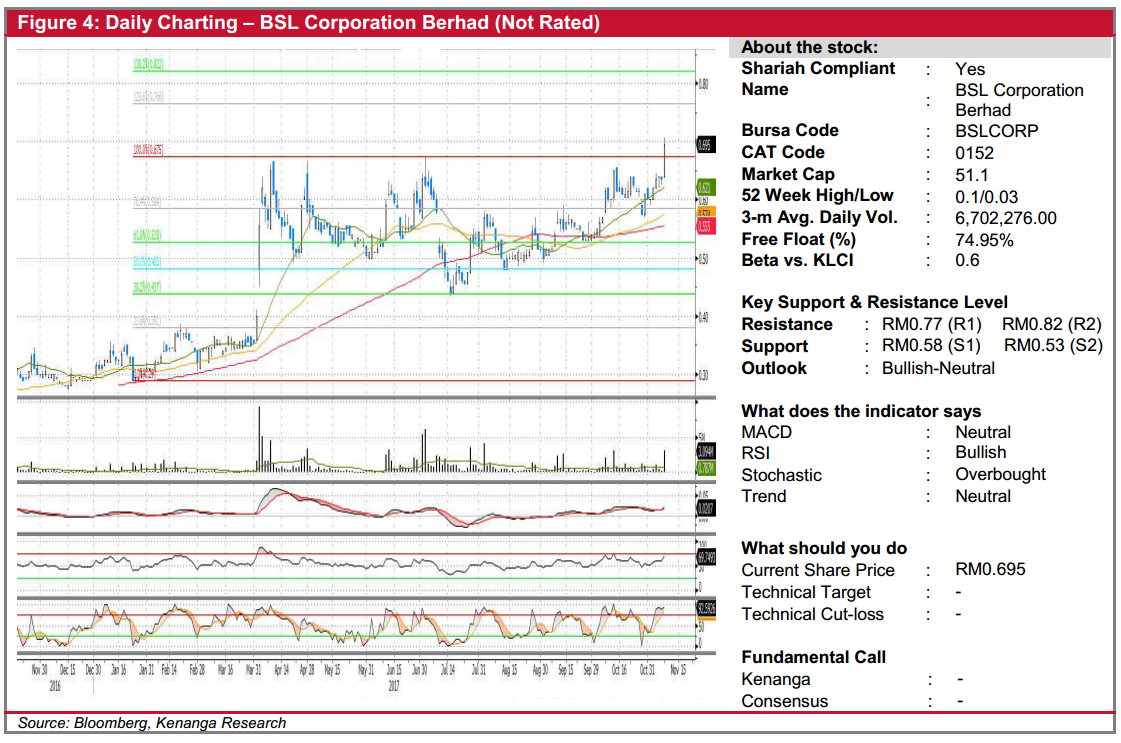

BSLCORP (Not Rated). Yesterday, BSL staged a good run, rallying 6.0 sen (9.5%) to close at record high of RM0.695. This was accompanied by healthy trading volume, with 3.1m shares exchanging hands – representing almost 4-fold its 20- day average. More importantly, yesterday’s move marks as a first breakout from its 7-month long consolidation period, as well as its previous resistance at RM0.675. Likewise, other bullish signs include the share trading beyond key SMAs, which in turn are currently in a “golden-crossover” state, and positive upticks in key indicators. From here, sustained momentum could see the share trends towards resistances at RM0.77 (R1) and RM0.82 (R2), while key supports can be identified at RM0.58 (S1) and RM0.53 (S2).

Source: Kenanga Research - 9 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|