Daily Technical Highlights - (MAYBULK, AEMULUS)

kiasutrader

Publish date: Fri, 10 Nov 2017, 10:05 AM

MAYBULK (Not Rated). MAYBULK’s share price rose 4.5 sen yesterday (5.1%) to RM0.92 on increased trading volume of 3.9m shares. Earlier in August, MAYBULK’s share price bottomed out at RM0.67 after a five-month downtrend, and had since recovered to the highest level since April. With yesterday’s bullish move, the share price has now taken out its RM0.88/RM0.90 resistance and appears poised to retest its April high of RM0.955 next. Indications from the momentum oscillators are positive which support a move beyond this crucial RM0.955 (R1) resistance. Beyond, the next resistance level to target is RM1.00/RM1.02 (R2). Downside support levels include the aforementioned RM0.88/RM0.90 (S1) and RM0.84 (S2) below.

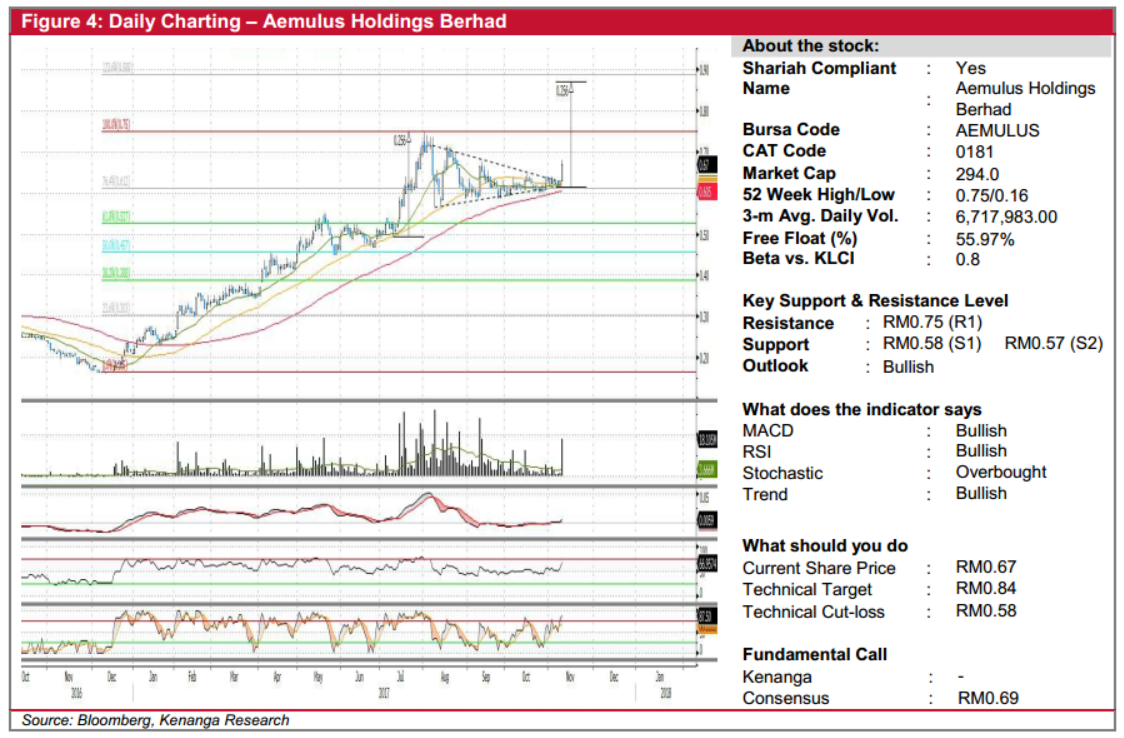

AEMULUS (Trading Buy, TP: RM0.84; SL: RM0.58). AEMULUS gained 4.0 sen (6.4%) yesterday to close at RM0.67. This was accompanied by a sudden spike in volume, with 18.1m shares exchanging hands – representing almost 5-fold its daily average. Yesterday’s move marks as a breakout from its 3-month sideways consolidation, and could potentially signal a continuation of a prior uptrend which lasted from the start of the year until end-July. Notably, yesterday’s bullish run also confirms a “Penant” continuation chart pattern, characterised by its converging trend lines during its consolidation phase, followed by yesterday’s breakout. Likewise, positive showings from key indicators could be suggestive of a move higher from here. By projecting the pennant’s flagpole, we set our eventual technical target at RM0.84, with an intermediate resistance at RM0.75 (R1). Conversely, our stop-loss level is placed at the RM0.58 (S1) support, with a lower support identified at RM0.57 (S2).

Source: Kenanga Research - 10 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

AEMULUS2024-11-26

MAYBULK2024-11-25

AEMULUS2024-11-25

AEMULUS2024-11-25

AEMULUS2024-11-25

AEMULUS2024-11-22

MAYBULK2024-11-22

MAYBULK2024-11-21

MAYBULK2024-11-20

AEMULUS2024-11-20

AEMULUS2024-11-20

AEMULUS2024-11-20

AEMULUS2024-11-20

AEMULUS2024-11-20

MAYBULK2024-11-19

MAYBULK2024-11-18

AEMULUS