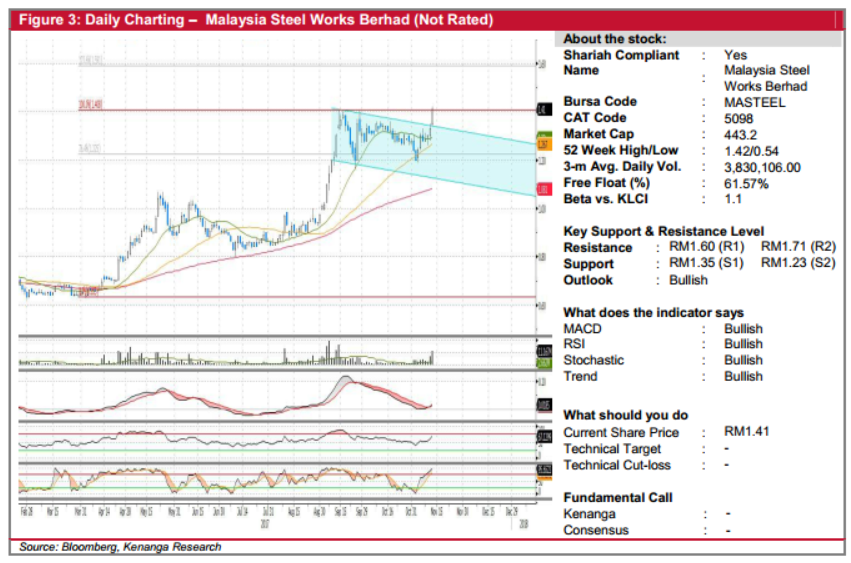

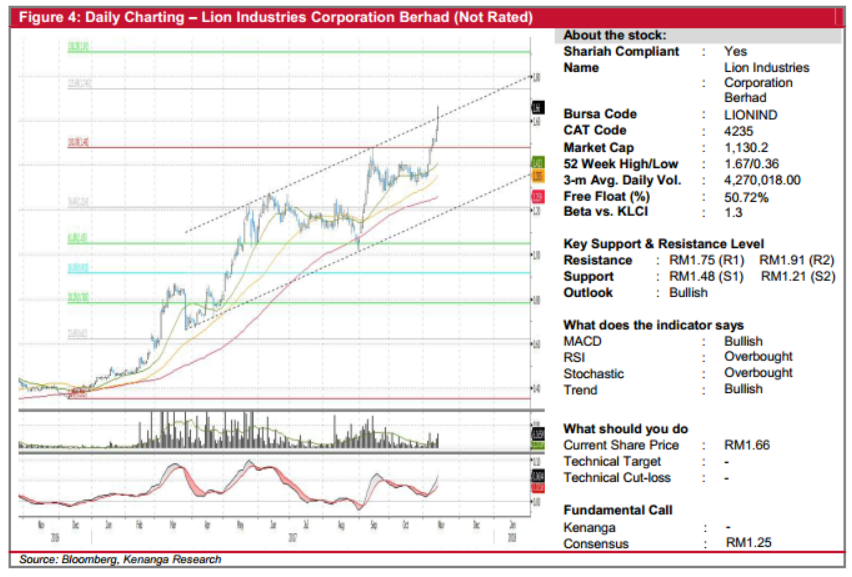

Daily Technical Highlights - (MASTEEL, LIONIND)

kiasutrader

Publish date: Tue, 14 Nov 2017, 09:11 AM

MASTEEL (Not Rated). MASTEEL climbed 8.0 sen (6.0%) yesterday to finish at RM1.41 on high trading volume of 11.2m shares. Chart-wise, MASTEEL’s share price has been experiencing sporadic rallies and subsequent consolidation phases over the past year. More recently in early September, the share price broke out of the RM1.00 consolidation resistance, and kicked off a strong rally to as high as RM1.41 before pausing for breath. Now with the share price staging yet another breakout, we believe that MASTEEL is poised to commence the next leg higher. Indicator-wise, the MACD has also crossed above the Signal-line and as such, we expect momentum to carry the share price towards the next resistance levels of RM1.60 (R1) and possibly RM1.71 (R2) beyond. Downside support levels are RM1.35 (S1) and RM1.23 (S2) further down.

LIONIND (Not Rated). LIONIND saw an impressive rally yesterday, gaining 10.0 sen (6.4%) to close at RM1.66. Chartwise, LIONIND traded within an uptrend channel since the start of the year. Convincingly, volumes were healthy whenever the counter rallied during this period, signalling a build-up in investors’ interests. With that said, yesterday‘s session was also accompanied by healthy volume, with 6.2m shares exchanging hands – more than double its daily average. Moreover, yesterday’s move can be interpreted as bullish breakout from its uptrend channel. Coupled with a positive display from the MACD, we believe the balance of evidence points towards a possible move higher at this juncture. From here, overhead resistances to watch out for are RM1.75 (R1) and RM1.91 (R2). Conversely, downside support can be found at RM1.48 (S1) and RM1.21 (S2).

Source: Kenanga Research - 14 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|