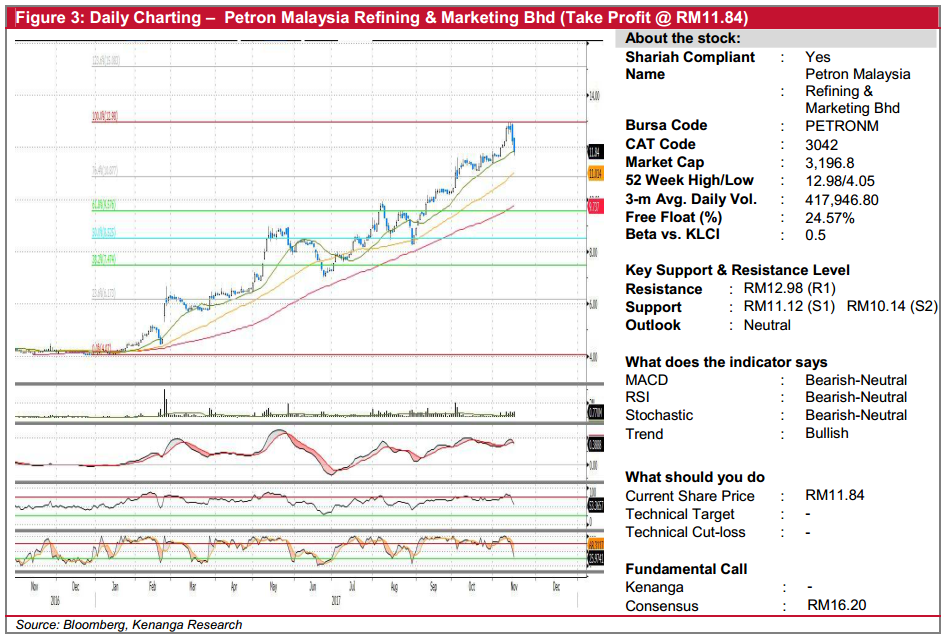

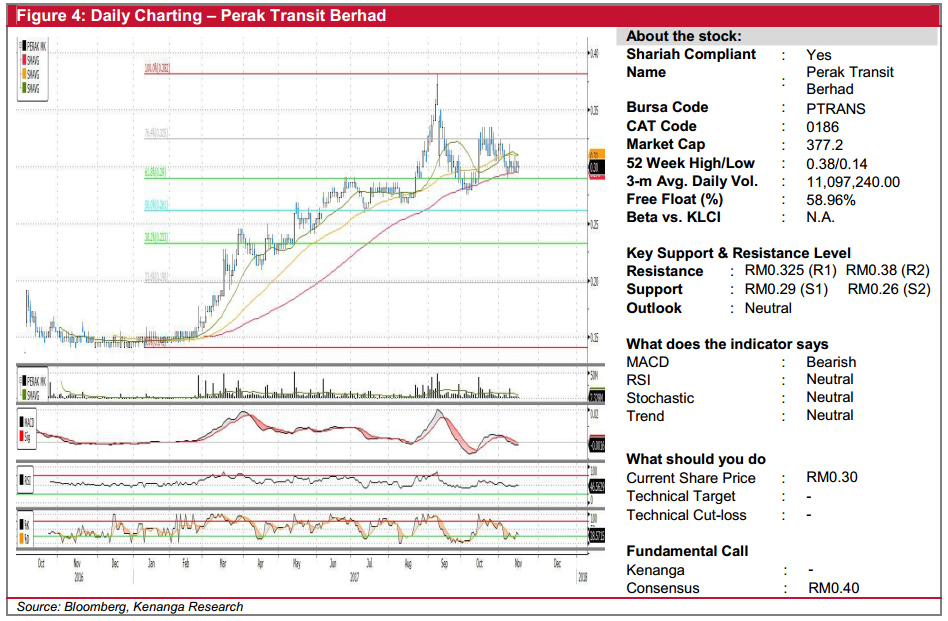

Daily Technical Highlights - (PETRONM, PTRANS)

kiasutrader

Publish date: Thu, 16 Nov 2017, 09:33 AM

PETRONM (Take Profit @ RM11.84). Recall that we recommended a technical “Trading Buy” on PETRONM in our report dated 19-Sep-2017. Since then, the share price has performed remarkably, continuing its uptrend rally. However, the last two days of consecutive bearish performance has now prompted us to take profit on the counter, with the technical picture turning more negative. Taking profit at current levels would imply bagging total gains of 15% in a span of just less than two month. And while its uptrend is still somewhat intact at this juncture, negative showing from key indicators, coupled with multiple retests of its RM12.98 (R1) resistance could be some early signs of a near-term consolidation. From here, keen investors could look to a possible re-entry at more attractive levels near supports at RM11.12 (S1) and RM10.14 (S2).

PTRANS (Take Profit @ RM0.30). Amidst weaker market breadth in recent days, we seek to slice down our technical portfolio to better weather through this period. As such, we are also taking profit on PTRANS, thus bagging total gains of 46% since our initial “Trading Buy” recommendation on 16-May-2017. Note that this includes the free warrants received, on the basis of 1 warrant for every 2 shares (ex-date: 12-Sep-2017, last price: RM0.165). Chart-wise, PTRANS has been hovering in a sideways consolidation of late, with its earlier uptrend and “golden crossover” between key SMAs deemed no longer intact. Similarly, its MACD is also showing negative signs with a bearish cross below its Signal-line, while trading volumes continued to be subdued. As such, we reckon the balance of evidence points towards a possible continuation of directionless trade. From here, resistances can be found at RM0.325 (R1) and RM0.38 (R2) while immediate supports can be identified at RM0.29 (S1) and RM0.26 (S2).

Source: Kenanga Research - 16 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|