Daily Technical Highlights - (EMETALL, JAKS)

kiasutrader

Publish date: Tue, 21 Nov 2017, 04:09 PM

EMETALL (Not Rated). EMETALL’s share price climbed 4.0 sen (5.1%) to finish at RM0.825 on increased trading volume of 3.9m shares. From a charting perspective, EMETALL kicked off a strong uptrend earlier in the year, having climbed from RM0.54 to as high as RM0.87 in September before consolidating sideways over the subsequent two months. Nevertheless, consequent to yesterday’s bullish move, upticks on the momentum oscillators are now signalling that bullish momentum is returning after a brief hiatus. As such, we expect the share price to retest its RM0.87 (R1) level next. Should this resistance be taken out next, further gains would then be expected towards RM0.96 (R2) further up. Downside support levels from here are RM0.79 (S1) and RM0.75 (S2) below.

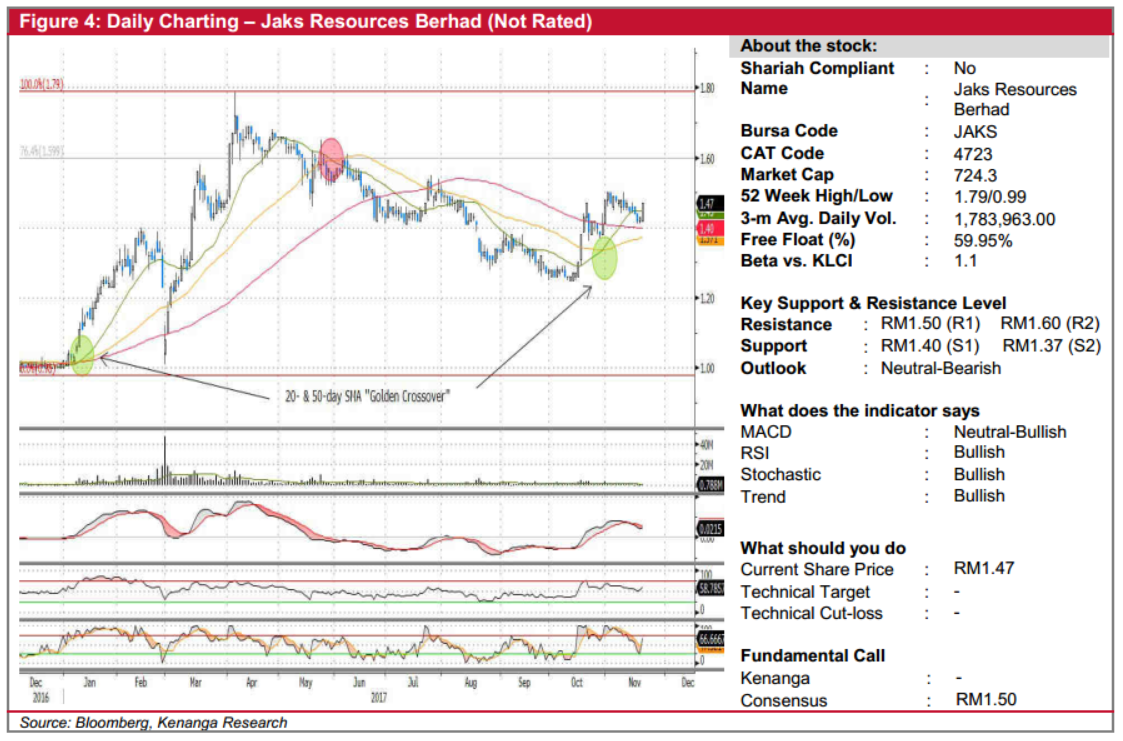

JAKS (Not Rated). JAKS saw its share price climbing 4.0 sen (2.8%) to RM1.47. Although trading volume for the day was lower than what we would like to see, the bullish move still signals a consolidation breakout – potentially indicating that the share price is poised to kick off the next leg up. Note that earlier this month, the share price had broken out of its 8-month downtrend, while the 20-day SMA had also completed a “Golden Crossover” with the 50- and 100-day SMA. With these signals, the overall technical picture has improved significantly from as recent as a month back, and we now believe the share price is in the midst of a strong recovery. From here, expect a move to retest this month’s high of RM1.50 (R1) before a further climb towards RM1.60 (R2) next. Any weakness towards the 50-day SMA at RM1.40 (S1) may be viewed as a buying opportunity, although a further break below RM1.37 (S2) would be highly negative.

Source: Kenanga Research - 21 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|