Daily Technical Highlights - (BREM, CCMDBIO)

kiasutrader

Publish date: Wed, 22 Nov 2017, 11:43 AM

BREM (Not Rated). BREM’s share price gapped at the opening bell yesterday, and continued to climb towards its RM1.12 close (up 6.0 sen or 5.7% for the day). This follows its 1H18 earnings announcement, which jumped 432.1% to RM17.4m. From a charting perspective, the share price has been on an overall uptrend since the start of the year. However, with yesterday’s bullish move, the share price has now punched through its RM1.11 resistance to signal a continuation of its prior uptrend after the past month’s pullback. Similarly, the MACD has now crossed above its Signal-line, while upticks on the RSI and Stochastic indicate a pick-up in bullish momentum. Hence, investors may expect bias to be on the upside from here. Immediate resistance levels to watch are RM1.17 (R1) and RM1.21 (R2) while downside support levels are RM1.05 (S1) and RM1.00 (S2).

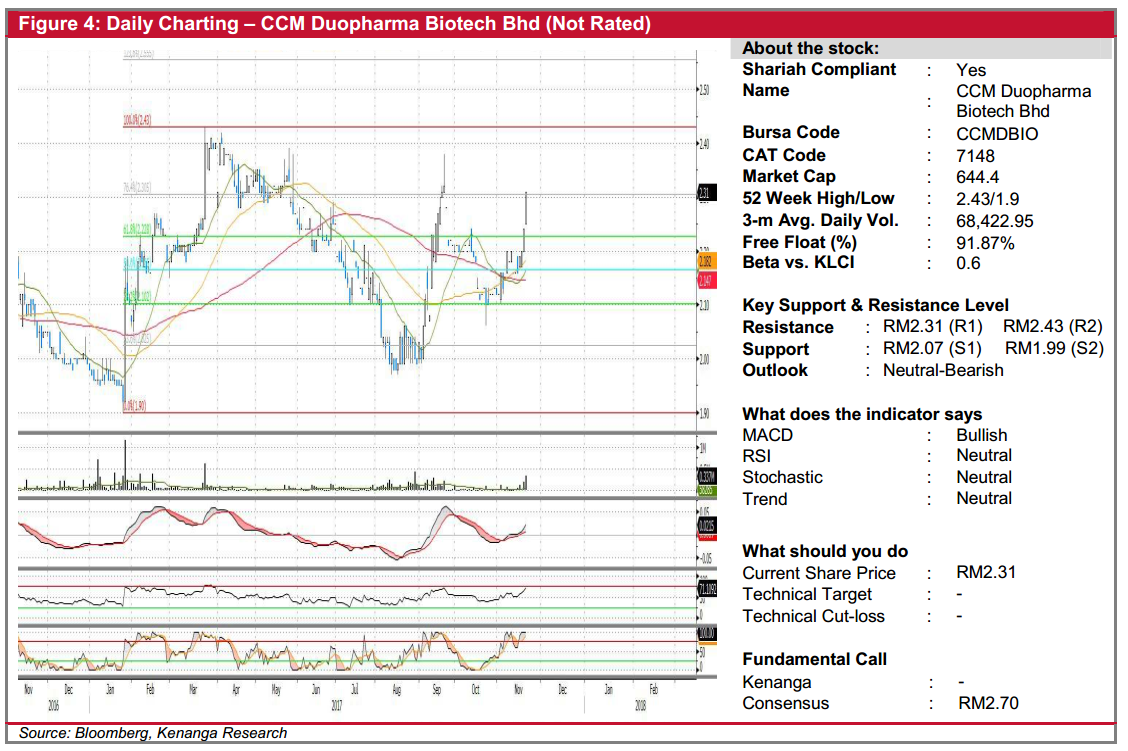

CCMDBIO (Not Rated). Yesterday saw CCMDBIO rallying up for a fourth consecutive day, gaining 7.0 sen (3.1%) to close at RM2.31. This comes after the company announced its 3Q17 quarterly results, which saw its headline net profit figure jumping 80% on a YoY-basis. From a charting perspective, this recent rally brought key SMAs to a “golden crossover”, with key indicators following with positive upticks. Notable is the MACD which crossed over its Signal-line while in an upward motion. Increased trading volumes of late also indicate a possible gain in investors’ interest. Currently, we believe the share is in the midst of retesting its RM2.31 (R1) resistance. With sustained follow-through momentum, we expect the share to decisively break out and trend towards the higher resistance at RM2.43 (R2). Conversely, downside support levels can be identified at RM2.07 (R1) and RM1.99 (R2).

Source: Kenanga Research - 22 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|