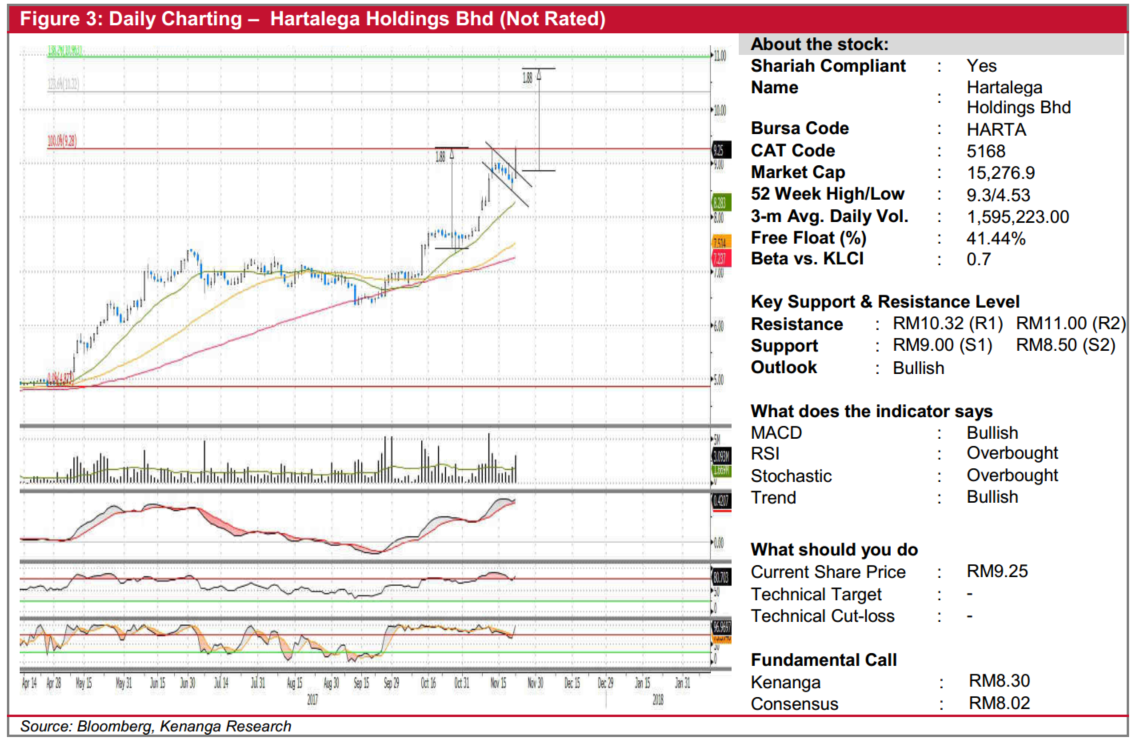

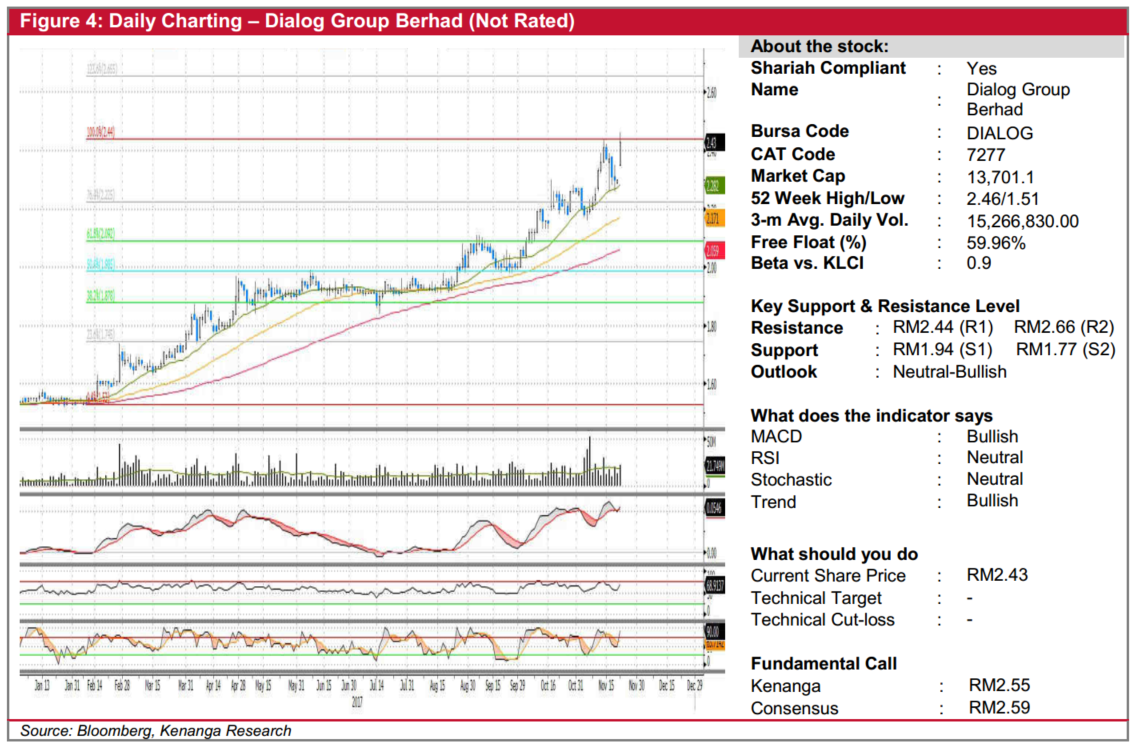

Daily Technical Highlights - (HARTA, DIALOG)

kiasutrader

Publish date: Thu, 23 Nov 2017, 10:41 AM

HARTA (Not Rated). Earlier this month, we highlighted HARTA after its share price broke out of its consolidation phase at RM8.00 (report dated 8th Nov). Since then the share price had rallied to as high as RM9.28 before staging a mild downward consolidation this past week. Nevertheless, the share price is now poised to kick off the next leg of its rally following yesterday’s strong 61.0 sen (7.1%) surge to RM9.25. In particular, the share price has now confirmed a “Bullish Flag” pattern on increased trading volume of 3.1m shares, while the upticks on the key momentum indicators reflect the pick-up in buying momentum. Hence, we expect further gains over the coming weeks towards RM10.32 (R1) and RM11.00 (R2). Any near-term pullback towards the RM9.00 (S1) support may be viewed as a buying opportunity, although a further break below RM8.50 (S2) would trigger stopping loss action.

DIALOG (Not Rated). Yesterday, DIALOG gapped up and closed higher by 13.0 sen (5.7%) at RM2.43 on increased trading volume. This comes after the company announced its 1Q18 quarterly results earlier, with core net profit figures improving +41% on a YoY basis. Chart-wise, the share has been moving in a relative uptrend since the start of the year. Key SMAs continue to be in a bullish “golden-cross” state, while upticks in key indicators are also further positive signs. From here, we suspect the share could be in the midst of re-testing its immediate resistance of RM2.44 (R1). With sustained follow-through momentum, expect a decisive breakout for the share to trend towards next resistance at RM2.66 (R2). Conversely, downside supports can be found at RM1.94 (S1) and RM1.77 (S2).

Source: Kenanga Research - 23 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

DIALOG2024-11-26

DIALOG2024-11-26

HARTA2024-11-26

HARTA2024-11-22

DIALOG2024-11-22

DIALOG2024-11-22

HARTA2024-11-21

DIALOG2024-11-21

DIALOG2024-11-21

HARTA2024-11-21

HARTA2024-11-21

HARTA2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-19

DIALOG2024-11-18

DIALOG