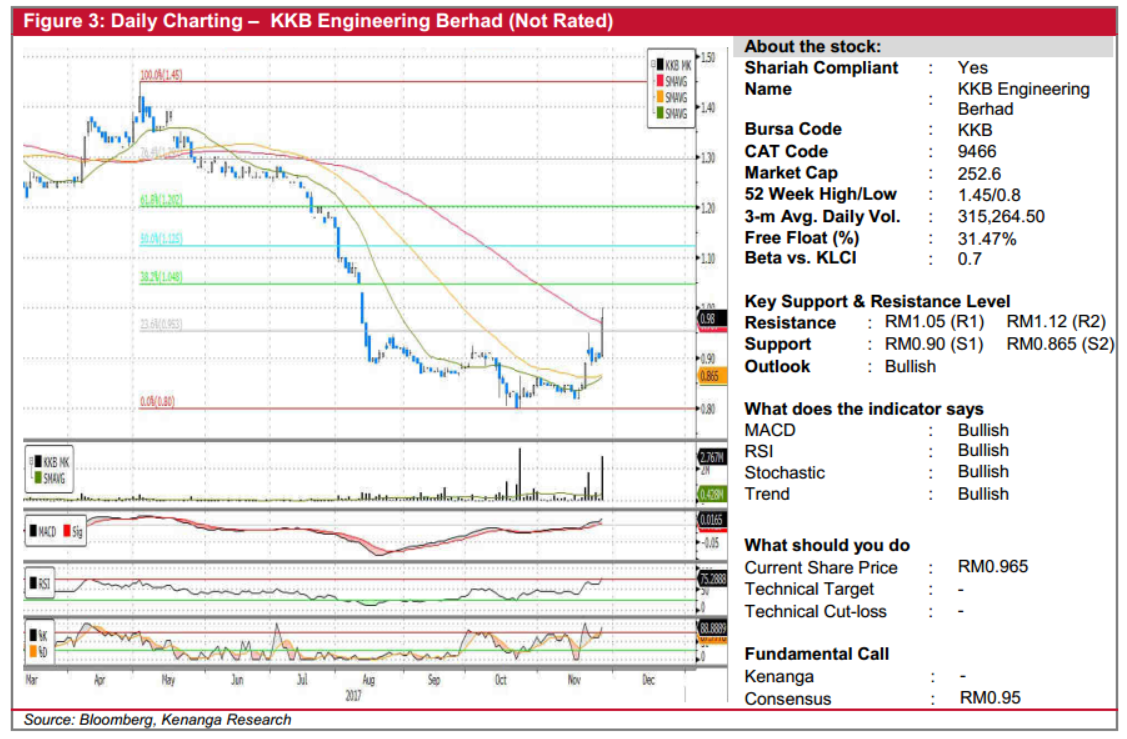

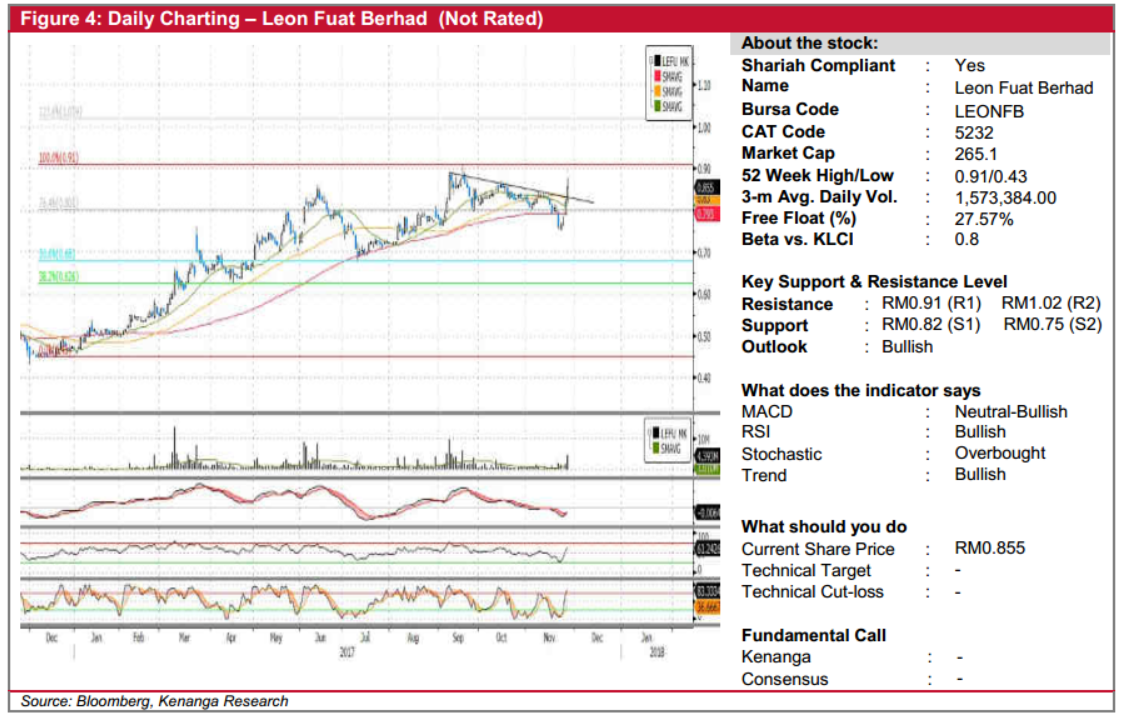

Daily Technical Highlights - (KKB, LEONFB)

kiasutrader

Publish date: Tue, 28 Nov 2017, 09:04 AM

KKB (Not Rated). KKB’s share price rose 8.0 sen (8.9%) yesterday to finish at a three month high of RM0.980. Historically a quiet stock, KKB saw 2.8m shares changing hands. From a charting perspective, the share price had been on a declining trend since May, but now appears to have bottomed out. In fact, KKB is beginning to show early signs of a strong recovery in its share price. Note that the 20- and 50-day SMAs are in the midst of converging, while the MACD is now in a bullish convergent state. Combined, these indicate that sentiment towards the stock has transitioned from bearish to bullish. Now with the RM0.96 resistance taken out, we see the potential for a further move towards the next resistances at RM1.05 (R1) and RM1.12 (R2). Downside support levels should be present between the RM0.90-RM0.96 (S1) range, failing which another confluence of support levels can be found at RM0.865 (S2).

LEONFB (Not Rated). LEONFB’s share price advanced 3.5 sen (4.3%) yesterday, to finish at RM0.855. The move was accompanied by immense trading volume of 4.4m, more than 4-fold its 20-day average volume of 1.0m. Chart-wise, LEONFB kicked off the year with a strong uptrend where its share price climbed from RM0.46 to a high of RM0.91 in midSeptember. Thereafter, it entered into a 2-month consolidation phase with price ranging between RM0.755 to RM0.91. Of note, yesterday’s move marked a breakout from its 2-month consolidation period, possibly signalling a continuation of its prior uptrend. Likewise, positive upticks from key oscillators along with MACD-Signal Line crossover are indicative of a move higher. From here, sustained momentum should see the counter moving towards RM0.91 (R1), and sequentially trend toward RM1.02 (R2). Conversely, downside supports can be identified at RM0.82 (S1) and RM0.75 (S2).

Source: Kenanga Research - 28 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|