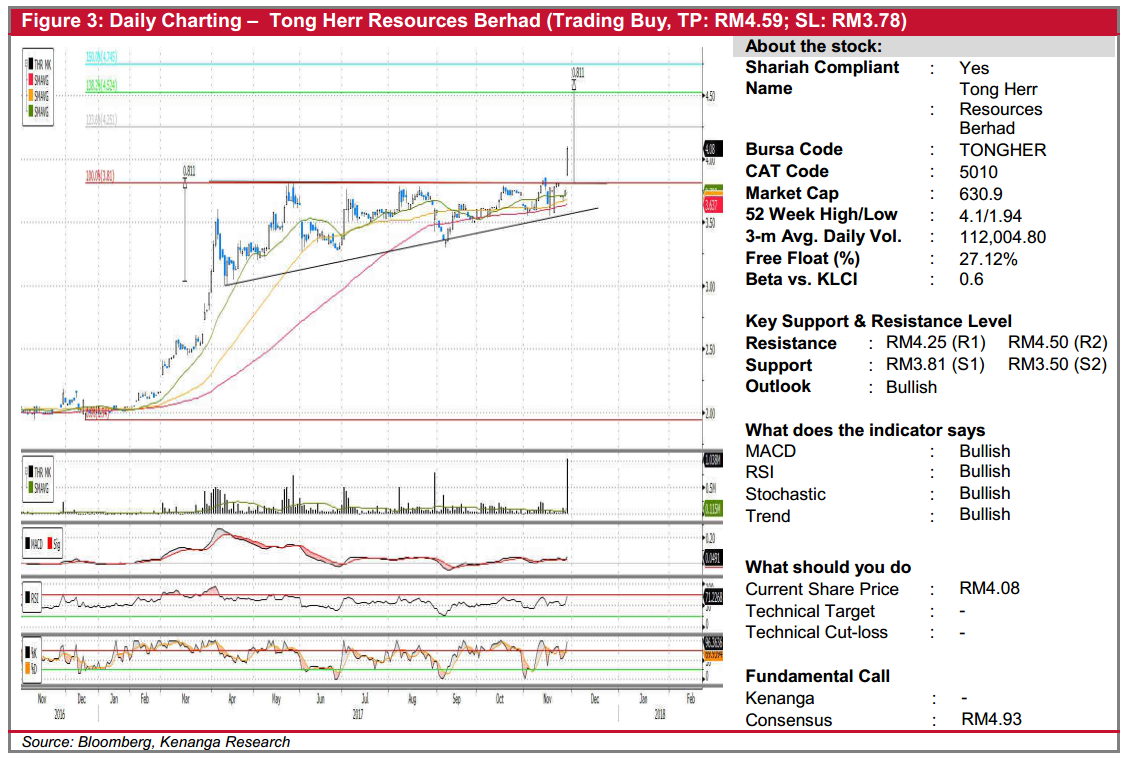

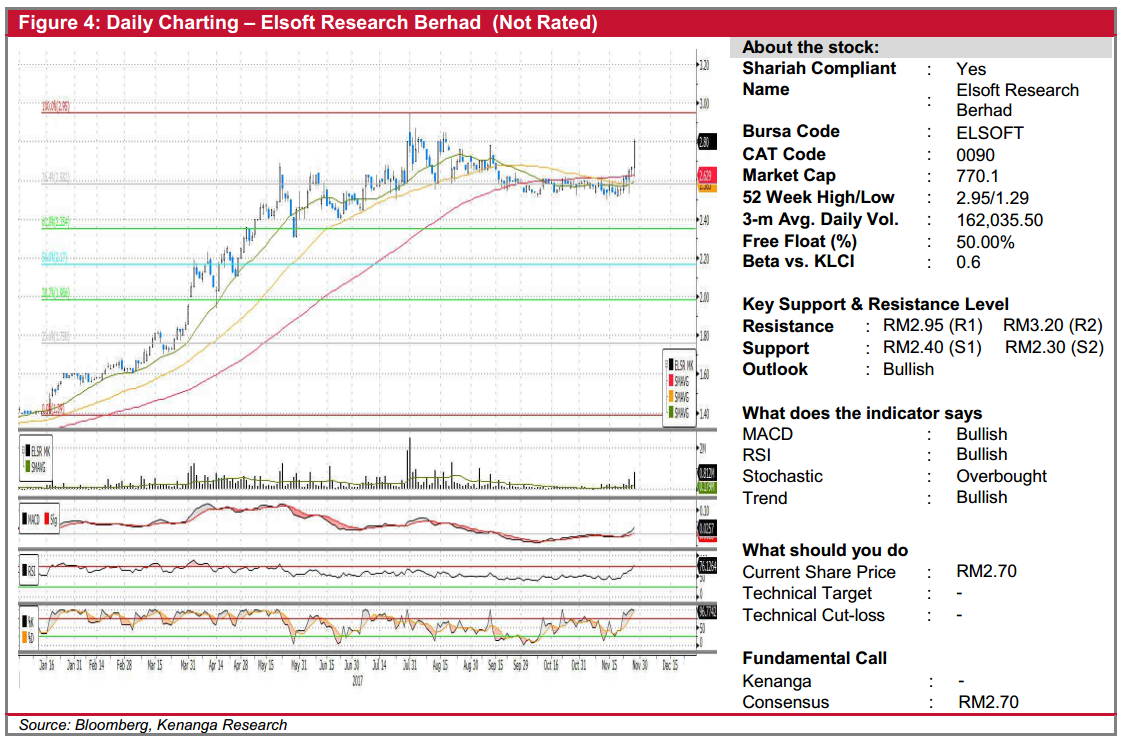

Daily Technical Highlights - (TONGHER, ELSOFT)

kiasutrader

Publish date: Wed, 29 Nov 2017, 09:54 AM

TONGHER (Trading Buy, TP: RM4.59; SL: RM3.78). TONGHER’s share price rallied 33.0 sen (8.8%) yesterday to finish at RM4.08 after the company announced its 9M17 earnings that showed a 54% jump. As a result of yesterday’s bullish move, TONGHER has now broken out of an “Ascending Triangle” pattern, potentially signalling that the share price is poised to kick-off the next leg of its rally after an extended 7-month pause. Similarly, upticks on the key momentum indicators are supportive of a move higher. From here, we expect a climb towards next resistance levels at RM4.25 (R1) and RM4.50 (R2) before reaching the “Ascending Triangle” measurement objective of RM4.62. Look to take profit 3 bids below that level, while a stop-loss should be placed just below the RM3.81 (S1) trigger-line.

ELSOFT (Not Rated). Yesterday, ELSOFT rose a spectacular 13.0 sen (4.9%) to close at RM2.70, on the back of increasing trading volume which hit 812k shares, above its 20-day average of 179k. From a technical perspective, yesterday’s move marks as a breakout from a 7-month long sideways consolidation and potentially signals a continuation of its earlier uptrend. Likewise, positive showings from key-indicators may also seem to suggest that increasing trading momentum may be at play, with the MACD continuing its trend above the Signal and zero lines. From here, expect some immediate overhead resistance at recent high of RM2.95 (R1), with another resistance higher up at psychological level of RM3.20 (R2). Conversely, downside support can be found at RM2.14 (S1), and at RM2.05 (S2) further down.

Source: Kenanga Research - 29 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|