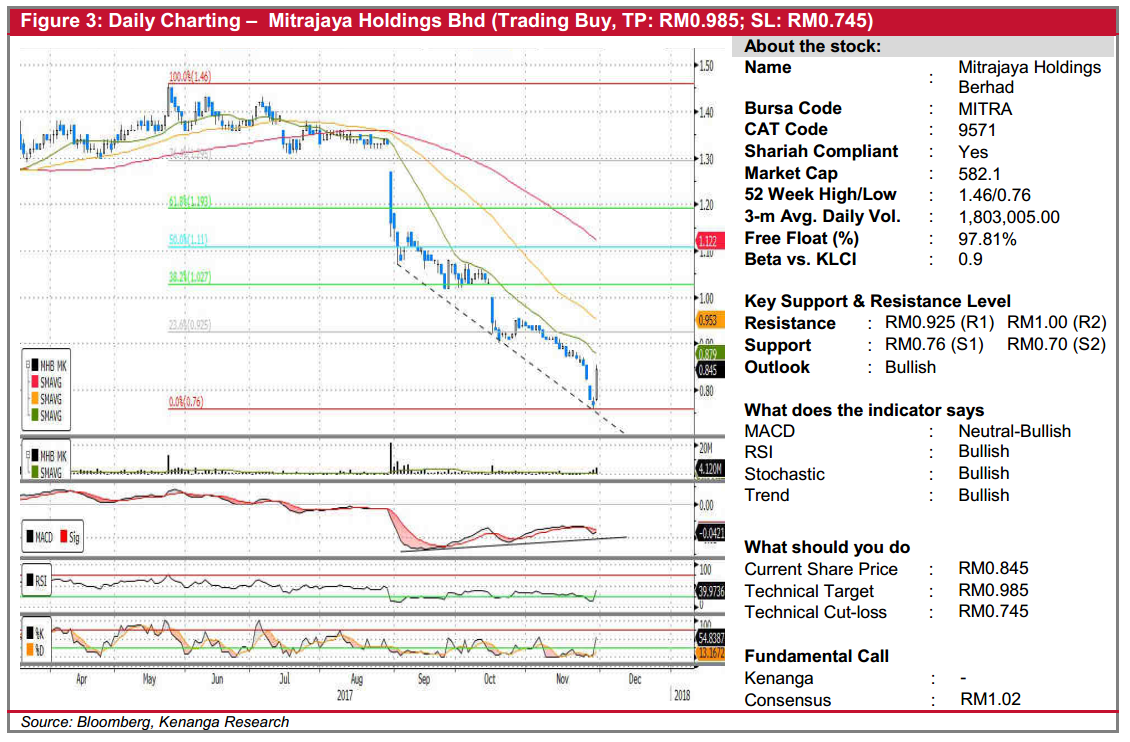

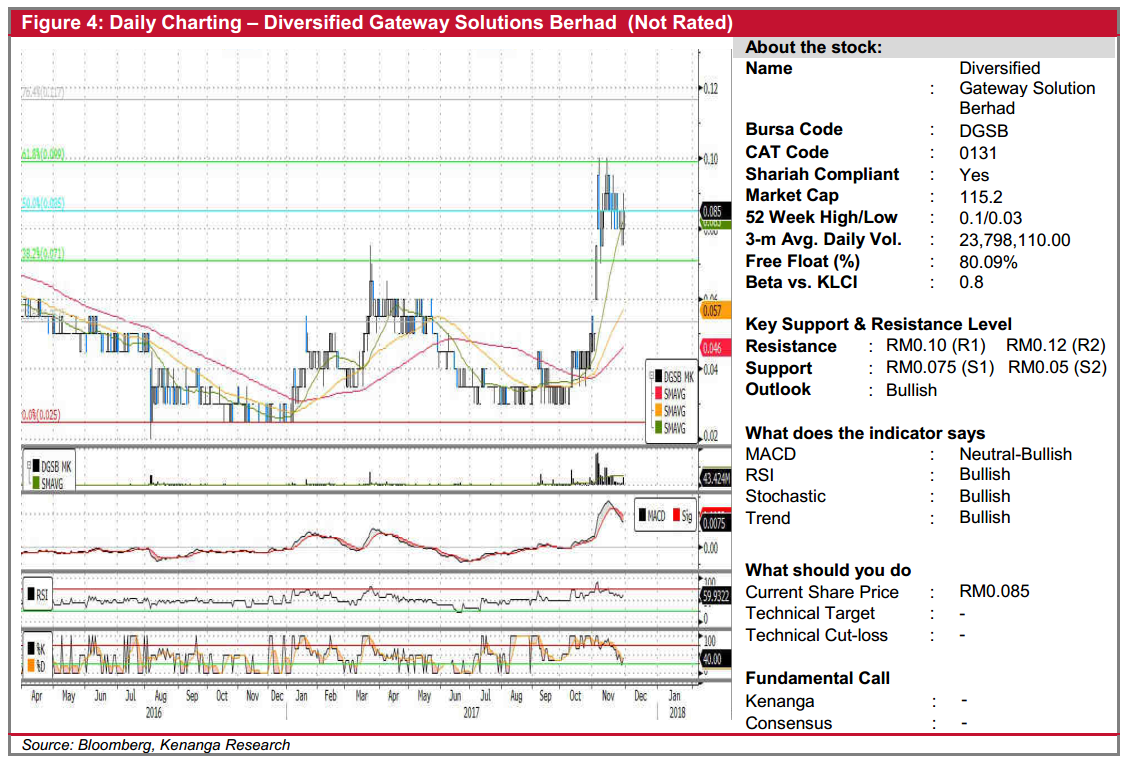

Daily Technical Highlights - (MITRA, DGSB)

kiasutrader

Publish date: Thu, 30 Nov 2017, 09:26 AM

MITRA (Trading Buy, TP: RM0.985; SL: RM0.745). MITRA’s share price surged 7.5 sen (9.7%) yesterday to a closing price of RM0.845 after the company announced its 3Q17 core net profit that jumped 61% YoY. From a charting perspective, the share price has shown signs of bottoming out, having endured a steep three-month correction. Notably, the MACD had been bullishly divergent since September, while more recently this week, MITRA formed a “Morning Doji Star” candlestick formation to signal a short-term reversal from bearish to bullish. From here, we see the potential for a gradual recovery towards RM0.925 (R1) and RM1.00/RM1.04 (R2) further up. Any near-term weakness is likely to be limited to RM0.76 (S1) although a break below would be highly negative with next support only present at RM0.70 (S2).

DGSB (Not Rated). DGSB’s share price rallied 0.5 sen (6.3%) yesterday to finish at the day’s high of RM0.085. Previously on a sideways trend for more than a year, the share price finally kicked-off an uptrend earlier this month after its share price broke out at RM0.075 on explosive trading volumes. The share price subsequently reached a recent high of RM0.10 before experiencing profit-taking activities over the recent two weeks. Nevertheless, DGSB now appears poised to resume its uptrend. Key SMAs are still fanning outwards while the momentum indicators remain in a bullish state. From here, expect a retest of the RM0.10 (R1) highs. Once taken out, the next resistance to watch is located further up at RM0.12 (R2). As for the downside, we see support levels present at the RM0.075-RM0.08 (S1) confluence although a break below would cause the share price to capitulate to RM0.05 (S2).

Source: Kenanga Research - 30 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|