Daily Technical Highlights - (HAIO, CWG)

kiasutrader

Publish date: Tue, 05 Dec 2017, 09:14 AM

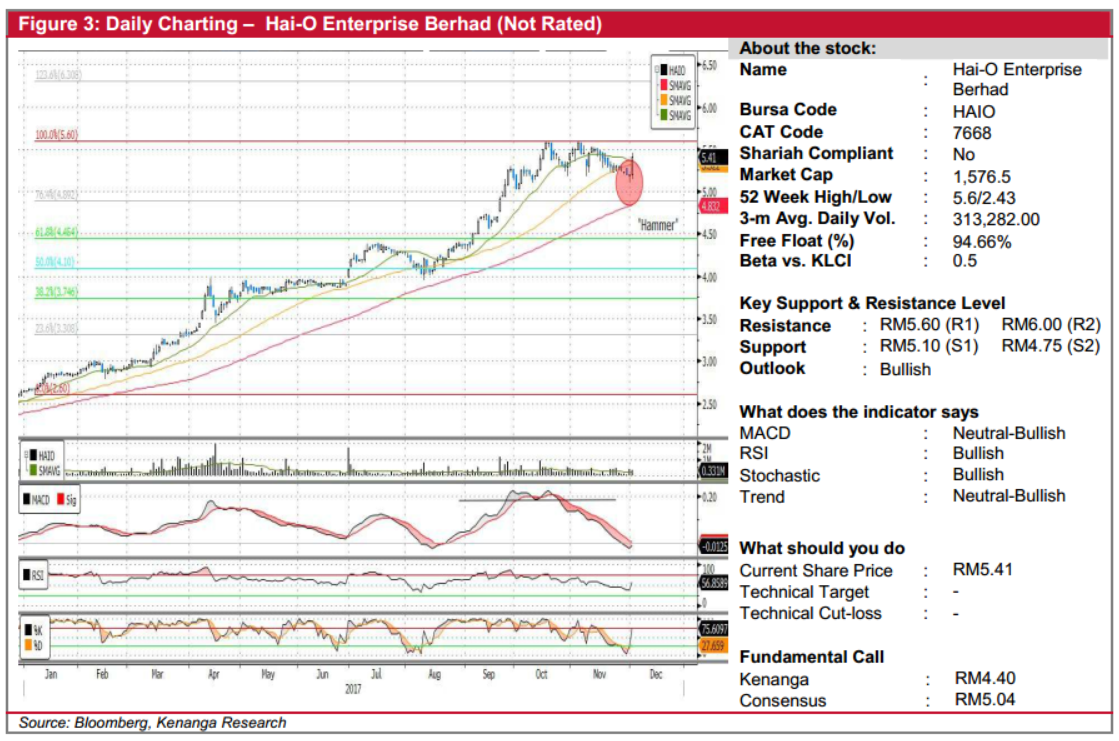

HAIO (Not Rated). HAIO gained 21.0 sen (4.0%) yesterday to close at RM5.41. This was accompanied by high trading volume, with 331.4k shares exchanging hands, compared to its average of 286.6k shares. Yesterday’s move confirmed the ‘Hammer’ pattern from the day before in addition to a breakout from its previous one-month downward consolidation. These two signs are possibly signalling a resumption of a prior uptrend after taking a brief pause for the past two months. Despite remaining in the negative territory, the MACD saw an uptick after yesterday’s movement as the price gained momentum while other key indicators are in positive zones. From here, we expect the share price to retest its all-time high of RM5.60 (R1), with a decisive breakout from this level to confirm a ‘Triple Bottom’ pattern and set the price to trend higher towards RM6.00 (R2) level. As for the downside, support levels are at RM5.10 (S1) and RM4.75 (S2).

CWG (Not Rated). CWG gained 3.0 sen or 5.7% to close at RM0.560 yesterday on increased trading volume of 319.4k shares which tripled its 20-day volume average of 124.0k shares. Notably, yesterday’s gain was a breakout from its 3-month sideways consolidation, potentially signalling a reversal. In supporting this view, the MACD is upwards trending during the consolidation period, showing a pick-up in momentum before turning positive from yesterday’s move. As such, we believe that the balance of evidence favours the upside in the near-term. Immediate resistance level to look out for is RM0.600 (R1). Further up, resistance is placed at the key psychological level of RM0.650 (R2). Conversely, the support levels are RM0.530 (S1) and a range of RM0.500 (S2).

Source: Kenanga Research - 5 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|