Daily Technical Highlights - (AJI, SEG)

kiasutrader

Publish date: Fri, 08 Dec 2017, 09:26 AM

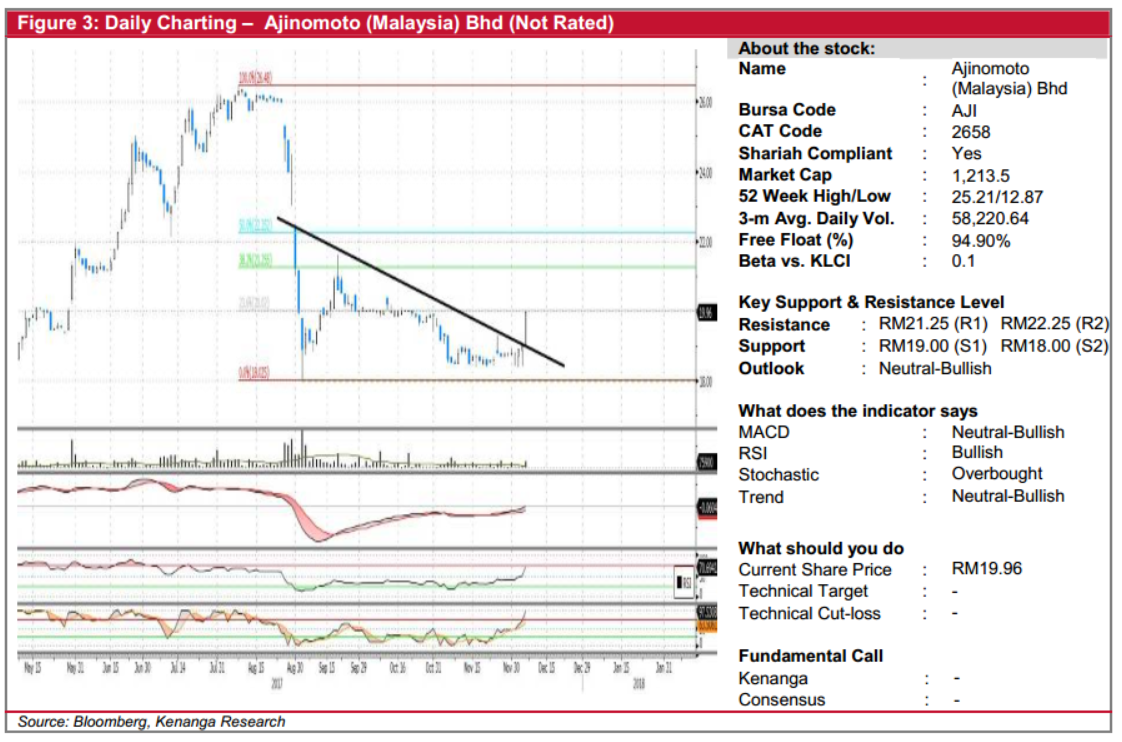

AJI (Not Rated). AJI’s share price rallied 96.0 sen (5.1%) yesterday to finish at RM19.96 after newswires highlighted the CEO’s comments that AJI targets over 50% sales growth in two years. This was accompanied by renewed buying interest as 75.9k shares exchanged hands - 2.6x the daily average volume of 28.8k. Chart-wise, AJI has triggered a breakout from its three months consolidation. Moreover, presence of a bullish divergence between price action and MACD indicator along with upticks from key oscillators suggest that AJI has bottomed out, giving rise to price reversal potential. AJI’s share price is now in the midst of testing its RM20.00 resistance. From here, we expect follow-through buying to continue and foresee a climb to the next resistance levels at RM21.25 (R1), and subsequently towards RM22.25 (R2). Conversely, downside support levels are identified at RM19.00 (S1) and RM18.00 (S2).

SEG (Not Rated). SEG’s share price rose 1.5 sen (2.3%) yesterday to RM0.665 after 237.0m shares were traded. Notably, the share price has broken out of 7-month downwards consolidation phase, potentially signalling a reversal of the downtrend. With the key indicators improving after yesterday’s move, we expect further gains ahead with a swift retest of the RM0.680 (R1) high. Beyond these levels, the next resistance to look out for is RM0.700 (R2), where the Fibonacci retracement level coincides with the key psychological level. Conversely, downside support levels are RM0.650 (S1) and RM0.640 (S2).

Source: Kenanga Research - 8 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|