Daily Technical Highlights - (FRONTKN, INARI)

kiasutrader

Publish date: Tue, 19 Dec 2017, 10:19 AM

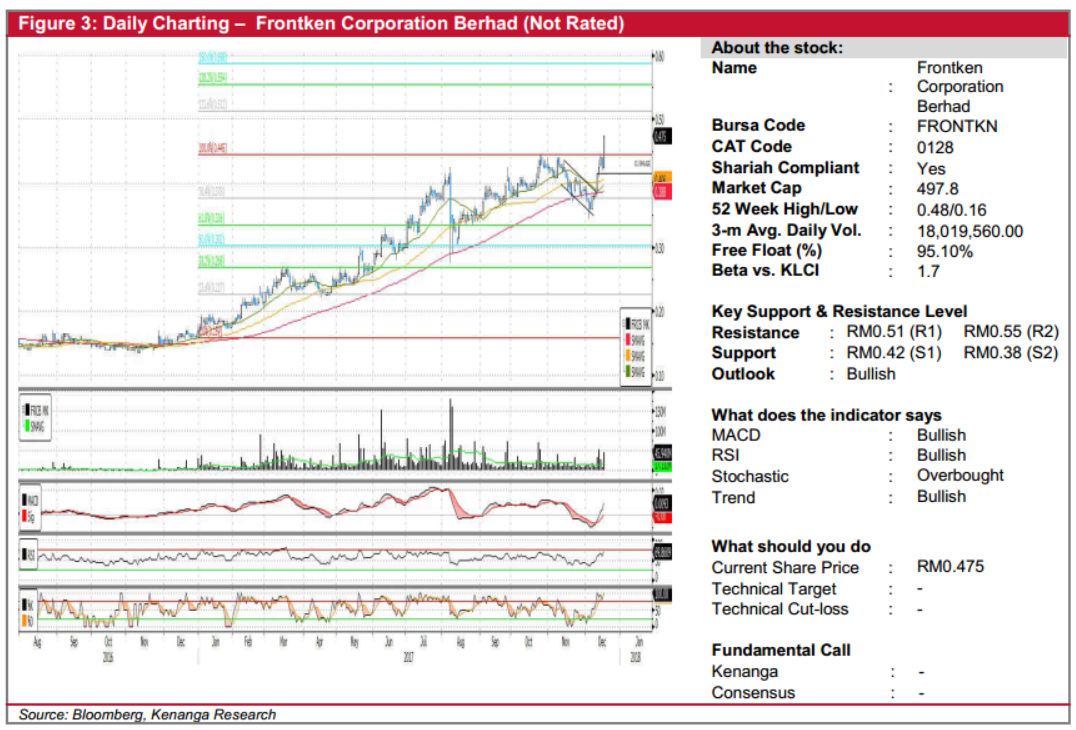

FRONTKN (Not Rated). Yesterday, FRONTKN rose 5 sen (11.8%) to close at all-time high of RM0.475. This was accompanied by exceptional trading volume with 45.9m shares transacted, representing almost triple of its average. More importantly, after numerous retests over the past month, yesterday’s move finally marks as decisive breakout from its RM0.45 resistance. This was further supported by promising signs from key indicators, with the MACD staging a bullish crossover against its zero and Signal-line, coupled with the share price punching through key SMAs from beneath. With the prior key resistance taken out, we believe the share could see a clear path upwards from here towards resistances at RM0.51 (R1) and RM0.55 (R2). Conversely, support levels can be at RM0.42 (S1) and RM0.38 (S2).

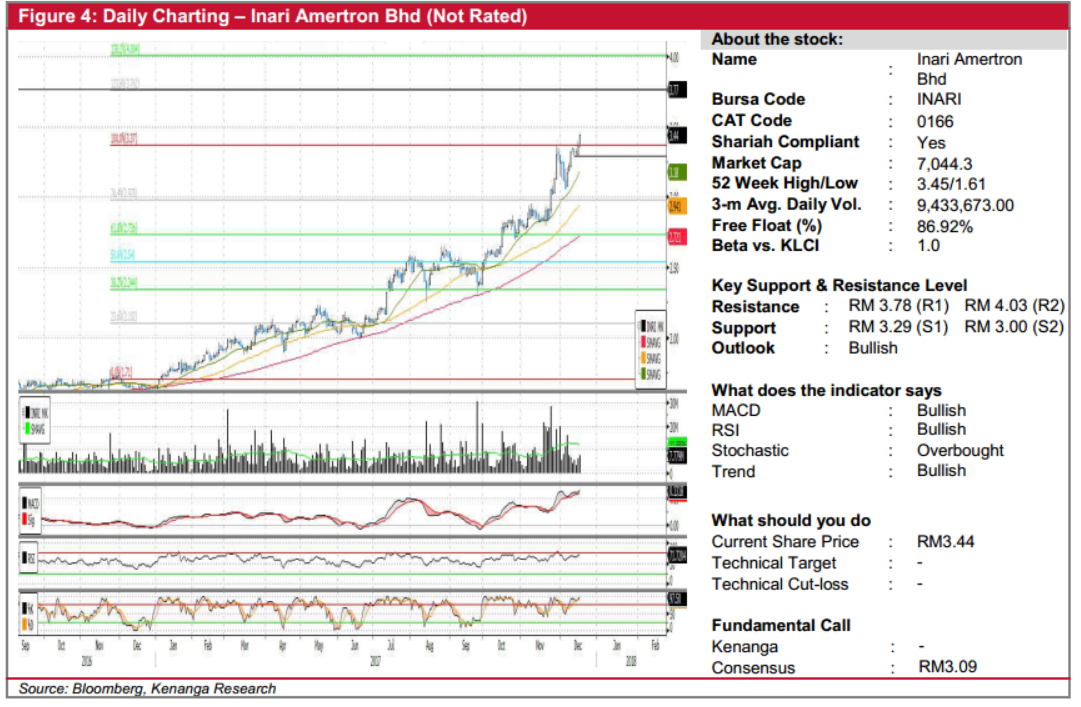

INARI (Not Rated). INARI gained 8.0 sen (2.4%) yesterday to close at at RM3.44 on the back of decent trading volume of 7.8m shares exchanging hands. Chart-wise, INARI has been on healthy uptrend having doubled from a low of RM1.71 in January. More importantly, yesterday’s move took out the key resistance level of RM3.44 which it had previously retested twice over last weeks to signal a continuation of its prior uptrend. Likewise, given the share price above all key SMAs and still positive technical indicators like MACD above signal line and RSI close to the overbought zone, confirm the resumption of this bullish trend. From here, we expect INARI’s share price to trend higher towards resistance level of RM3.78 (R1) or further up, at the resistance level of RM4.03 (R2). Meanwhile, immediate support can be found at RM3.29 (S1), with a lower key psychological support level at RM3.00 (S2).

Source: Kenanga Research - 19 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

FRONTKN2024-11-26

FRONTKN2024-11-26

INARI2024-11-26

INARI2024-11-26

INARI2024-11-26

INARI2024-11-25

FRONTKN2024-11-25

FRONTKN2024-11-25

INARI2024-11-22

FRONTKN2024-11-21

FRONTKN2024-11-21

INARI2024-11-20

FRONTKN2024-11-20

INARI2024-11-19

FRONTKN2024-11-19

INARI2024-11-18

FRONTKN