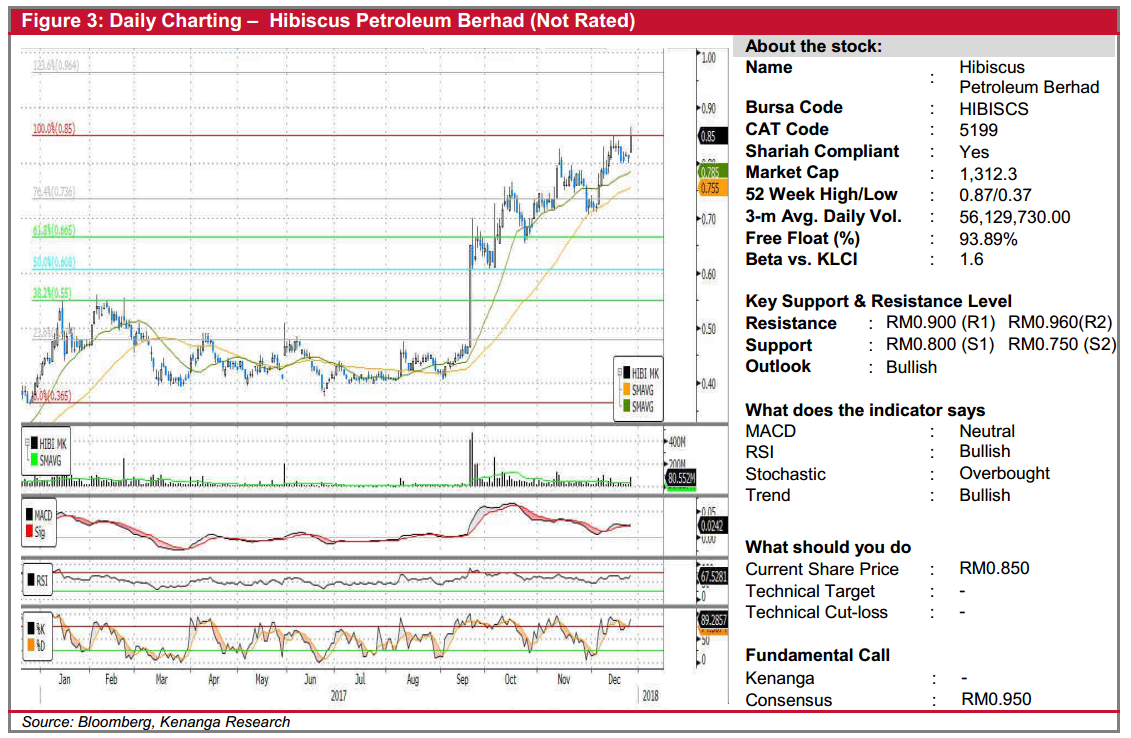

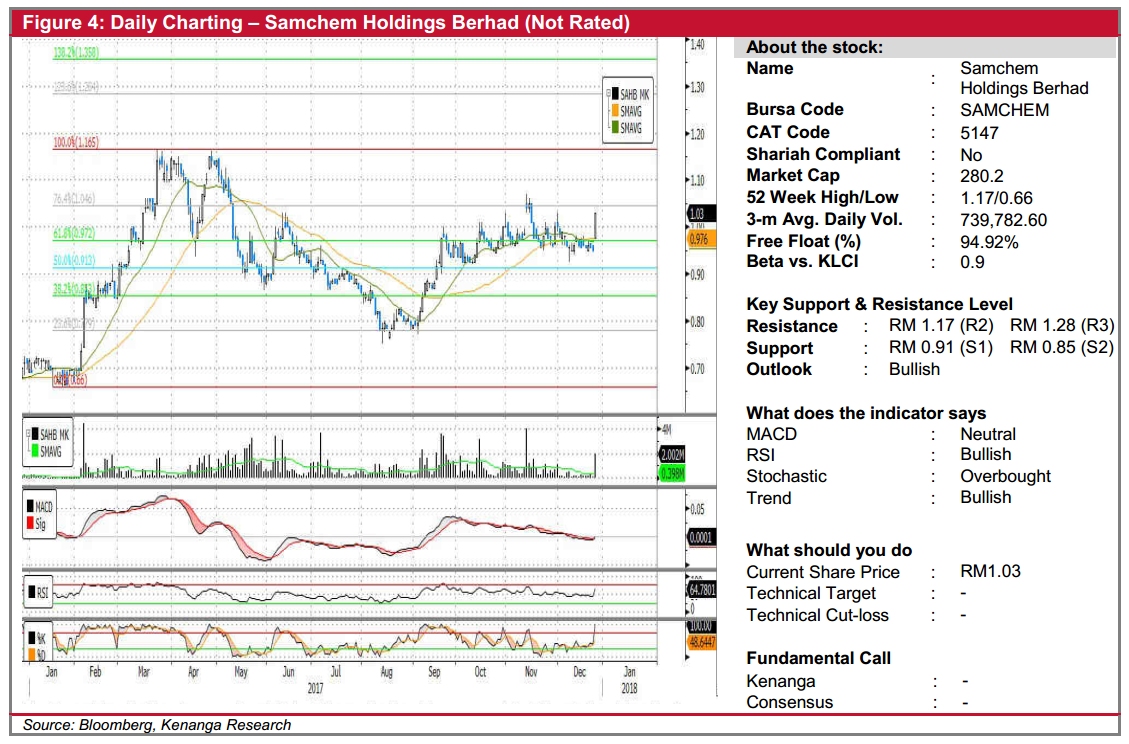

Daily Technical Highlights - (HIBISCS, SAMCHEM)

kiasutrader

Publish date: Wed, 27 Dec 2017, 09:55 AM

HIBISCS (Not Rated). HIBISCS saw its trading volume doubled the daily average to 80.6m shares yesterday, with its share price gaining 4.0 sen (4.9%) to RM0.850 for the day. Chart-wise, the share price has been trading in an upward channel for the past 4 months. Yesterday’s movement resulted in an uptick on the key indicators with MACD crossing above both the Signal and Zero lines mark. These signalled that the upward trend still has momentum. Currently, share price is in the midst of testing its all-time high level of RM0.850. We expected it to punch through the level before a further move towards key psychological level of RM0.900 (R1) en route to a higher resistance at RM0.960 (R2). A strong support level can be found at key psychological level of RM0.800 (S1) with any weaknesses towards this level perceived as opportunities to collect on weakness. However, a decisive break below RM0.750 (S2) would be highly negative.

SAMCHEM (Not Rated). SAMCHEM saw its share price climbed 8.0 sen (8.4%) to close at RM1.03 formed a white “Marubozu” candlestick. The move also backed by strong trading volume with 2.0m shares exchanging hands – five times of its 20 day-average of 0.4m shares. Chartwise, over the past three months, SAMCHEM has been consolidating sideways since mid- September. More importantly, with all key momentum indicators in the positive state, we expect SAMCHEM to punch through its recent high of RM1.05 (R1) to resume its uptrend seen earlier in Feb-Mar, before trending higher towards higher resistance level of RM1.17 (R2) and RM1.28 (R3) further up. Meanwhile, immediate support levels can be found at RM0.91 (S1) and RM0.85 (S2).

Source: Kenanga Research - 27 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|