Daily Technical Highlights - (MKH, INARI)

kiasutrader

Publish date: Thu, 04 Jan 2018, 05:45 PM

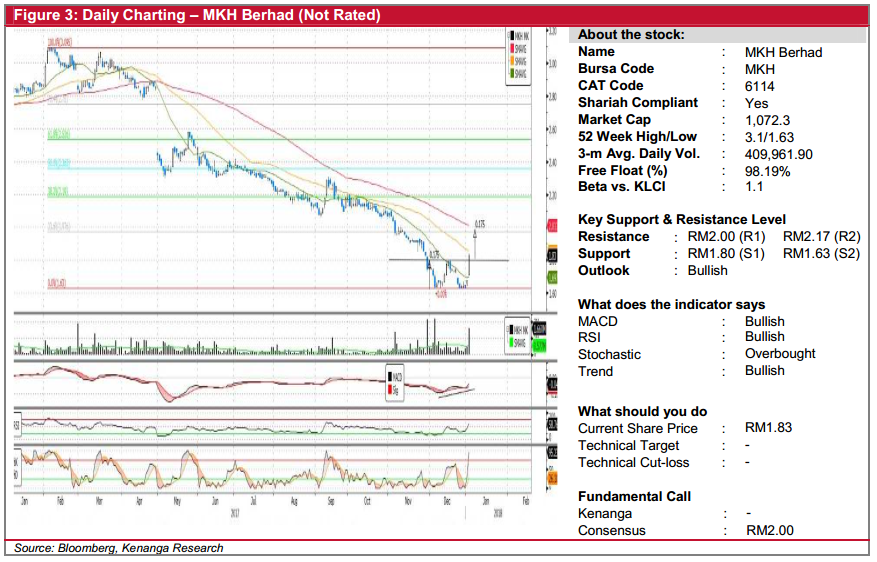

MKH (Not Rated). Yesterday, MKH gained an impressive 15.0 sen (8.9%), to finish at RM1.83. The move was accompanied by strong trading volume, with 1.7m shares traded – triple its 20-days average of 577k. Chart-wise, MKH has been on a downtrend since February 2017, with its share price plunging from RM 3.09 to a low of RM1.63. Notably, yesterday’s bullish move completes a breakout from a "double-bottom" pattern, marking a possible indication of downtrend reversal. Moreover, bullish MACD divergence along with upticks in other key oscillators showed improvement in the technical picture. Hence, based on the reversal pattern measurement objective, we expect MKH to advance towards RM2.00 (R1), and possibly RM2.17 (R2) should R1 is violated. Conversely, near-term dips may be taken as buying opportunities with support levels identified at RM1.80 (S1) and RM1.63 (S2).

INARI (Not Rated). INARI caught our attention yesterday after it rose 15 sen (4.4%) to finish at a record high of RM3.58. This was accompanied by exceptional trading volume of 15.9m exchanging hands - more than double its 20-day average daily trading volume. We believe yesterday's move may signal a continuation of a prior uptrend since the start of April 2016. Furthermore, yesterday's breakout also took out its previous resistance at RM3.48 with the share price leading key SMAs. The MACD indicator showed a positive uptick and is also healthily above the signal line. With that, we expect follow-through buying momentum towards RM4.00 (R1) with a further hurdle at RM4.32 (R2). Conversely, key support levels can be found at RM2.96 (S1) with a lower support level at RM2.64 (S2).

Source: Kenanga Research - 4 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|