Kenanga Research & Investment

Daily Technical Highlights - (HUAYANG, HUAAN)

kiasutrader

Publish date: Tue, 16 Jan 2018, 09:28 AM

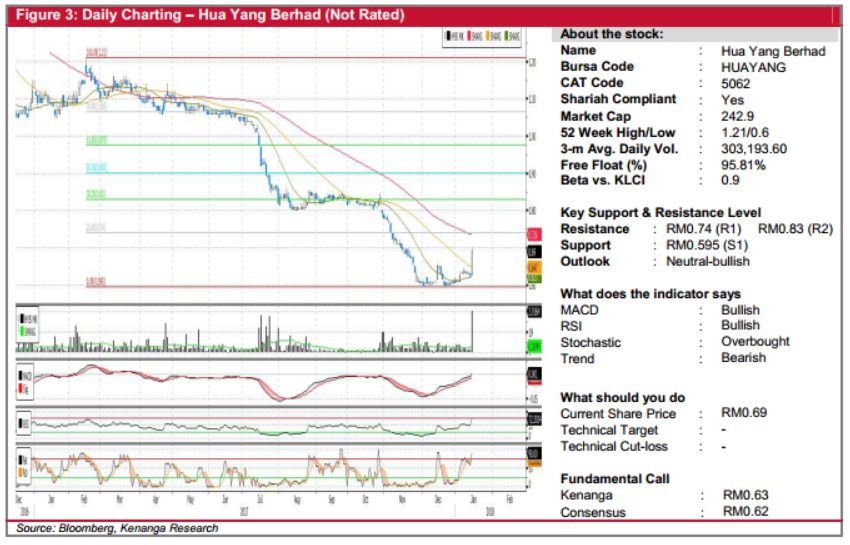

HUAYANG (Not Rated)

- HUAYANG jumped an impressive 6.5 sen (10.4% to RM0.69) yesterday, accompanied by exceptional trading volumes.

- Share is now potentially showing signs of bottoming-out after hitting a “double-bottom” in December last year.

- Over the past 1-2 months, MACD has been creeping upwards despite sideways movement of the share price – thus signalling an underlying build-up in momentum.

- Expect follow-through buying from here, with resistances at RM0.74 (R1) and RM0.83 (R2). Conversely, firm downside support can be identified at low of RM0.595 (S1).

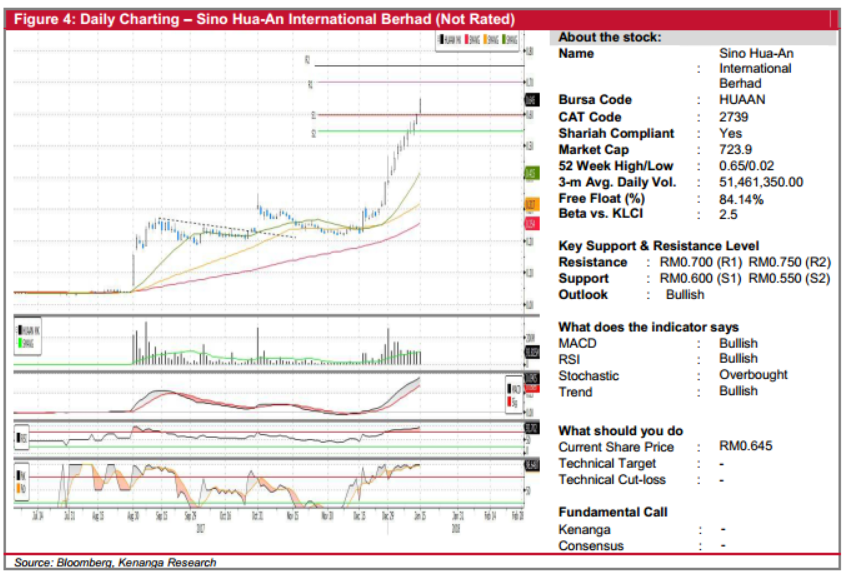

HUAAN (Not Rated)

- HUAAN climbed up 4.5 sen (7.5%) yesterday to reach a 10-year high at RM0.645.

- Technical outlook is bullish as shown by the string of white candlesticks formed over the past 2 weeks, which were supported by elevated trading volumes.

- Momentum indicators are positive and are in a bullish convergence.

- We expect the positive momentum to bring the share price up to RM0.700 (R1) and RM0.750 (R2). Any breaks below the RM0.600 (S1) and RM0.550 (S2) support levels are seen as a good entry point for buying

Source: Kenanga Research - 16 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments