Kenanga Research & Investment

Daily Technical Highlights – (DENKO, PCCS)

kiasutrader

Publish date: Fri, 19 Jan 2018, 04:47 PM

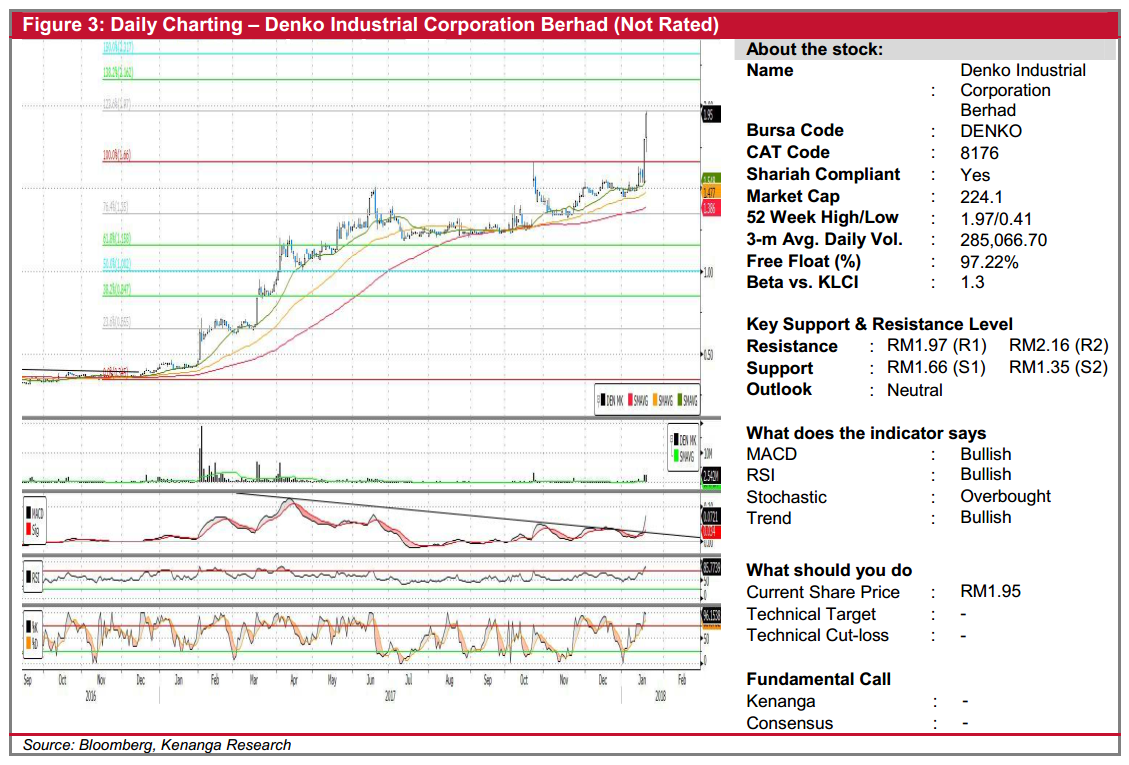

DENKO (Not Rated)

- DENKO jumped 15.0 sen (8.33%) yesterday to reach RM1.95.

- Yesterday’s move marks second straight days of gains and also accompanied by strong trading volume.

- Momentum indicators such as the MACD already turned positive and we believe that the share is poised to punch out from a year-long consolidation phase.

- Watch for a breakout above the RM1.97 (R1) resistance level, which would signal further gains towards R2 at RM2.16.

- Downside support levels, however, can be found at RM1.66 (S1) and RM1.35 (S2).

PCCS (Not Rated)

- PCCS jumped 2.5 sen to RM0.355 (7.6%) yesterday, accompanied by high trading volumes.

- Technical outlook is positively biased with display of “dragonfly doji” on 16-Jan followed by bullish price advancement yesterday.

- MACD is in positive state as the indicator is leading its Signal Line.

- From here, share is in the midst of retesting 50.0% Fibonacci derived resistance at RM0.355 (R1).

- A decisive break above R1 will likely see further advancement towards RM0.395 (R2).

- Downside supports can be found at RM0.315 (S1) and RM0.265 (S2).

Source: Kenanga Research - 19 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments