Kenanga Research & Investment

Daily Technical Highlights – (VS, GKENT)

kiasutrader

Publish date: Fri, 26 Jan 2018, 03:05 PM

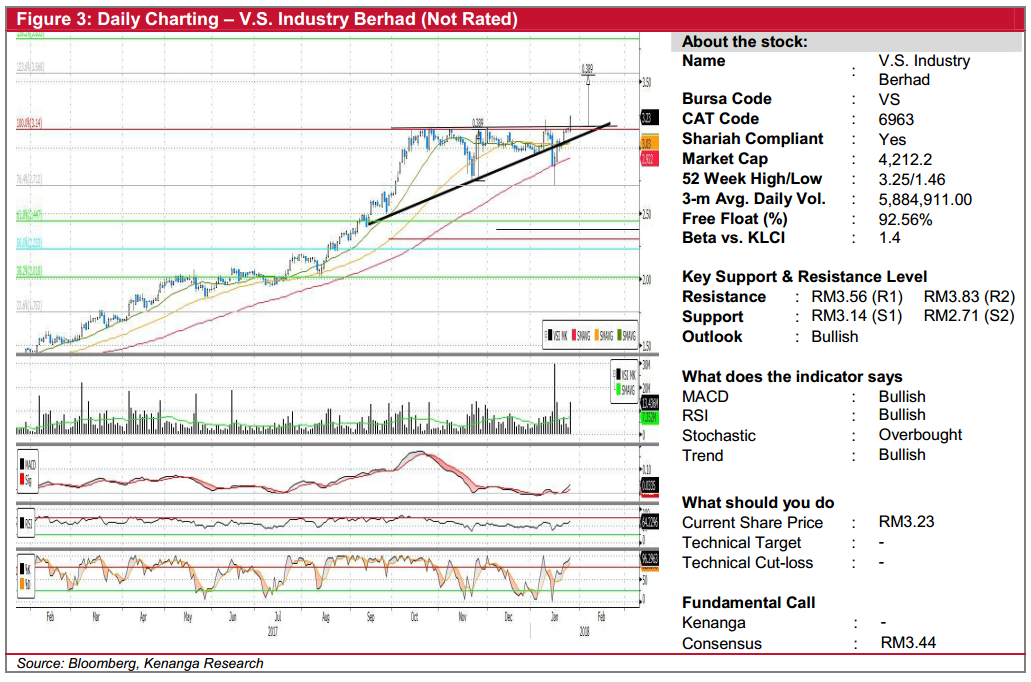

VS (Not Rated)

- VS jumped 8.0 sen (2.54%) yesterday to reach RM3.23, accompanied by stronger than average trading volume of 13.4m.

- Consequently, the share price has broken out of an ‘ascending triangle’ potentially signalling the start of a bullish trend.

- Momentum indicators are turning bullish and key SMAs are currently in a “golden-crossover” state.

- Following yesterday’s announcement on the proposed bonus issue, we expect follow-through buying to drive VS towards RM3.56 (R1), with further resistance at RM3.83 (R2). Any near-term dip towards the resistance-turned-support level of RM3.14 (S1) offers a good entry point with further support at RM2.71 (R2).

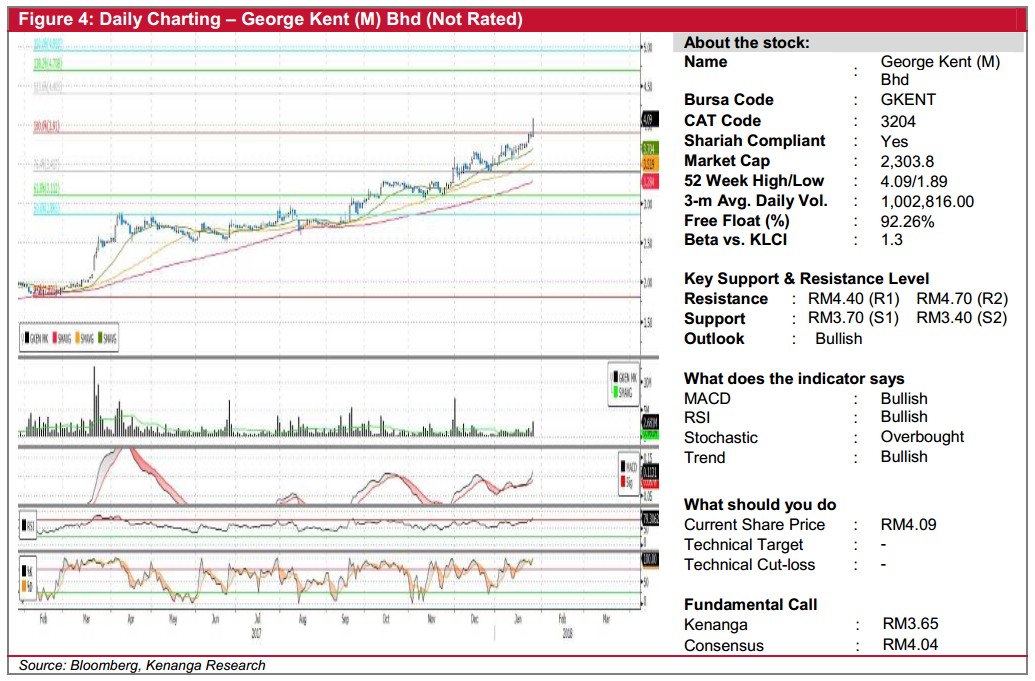

GKENT (Not Rated)

- GKENT surged 23.0 sen (6.0%) yesterday, finishing at the day’s high of RM4.09, accompanied by strong trading volume of 2.7m – tripled its average volume.

- “Marubozu” candlestick indicates that bulls dominated entire trading day.

- Overall outlook remains bullish with share price firmly above key SMAs whilst momentum indicators showed upticks.

- Expect follow-through buying towards RM4.40 (R1) and RM4.70 (R2) further up.

- Conversely, downside supports can be identified at RM3.70 (S1) and RM3.40 (S2).

Source: Kenanga Research - 26 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments