Kenanga Research & Investment

Daily Technical Highlights – (GENETEC, ANNJOO)

kiasutrader

Publish date: Wed, 14 Feb 2018, 09:03 AM

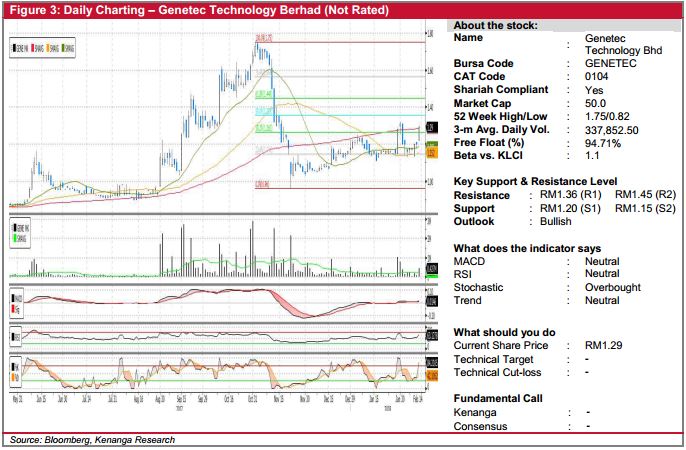

GENETEC (Not Rated)

- GENETEC rose 9.0 sen (7.5%) to close at RM1.29.

- Yesterday’s strong move resulted in a breakout of a two-month consolidation range of RM1.07- RM1.32.

- Momentum indicators are mostly in the positive state with improving trade volumes and uptick in both MACD and RSI. Combined, these potentially signal that the share price is poised for higher highs towards resistance level RM1.36 (R1) and RM1.45 (R2).

- Meanwhile, weaknesses are supported at the RM1.20 (S1) or RM1.15 (S2) further down.

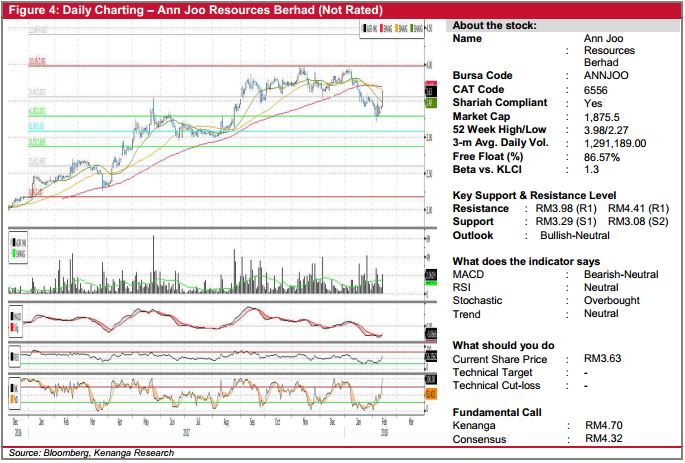

ANNJOO (Not Rated)

- Yesterday, ANNJOO gained an impressive 22 sen (6.4%) to close at intraday high of RM3.63.

- Yesterday’s move marked a first breakthrough from a two-month period of consolidation.

- Uptick in MACD to crossover its Signal-line, coupled with the share price closing above its 20-day SMA for the first time in two months could signal a bullish turn in its technical picture.

- From here, watch out for an immediate overhead resistance at RM3.98 (R1), the all-time high, with a higher resistance at RM4.41 (R2).

- Downside supports can be found at RM3.29 (S1) and RM3.08 (S2).

Source: Kenanga Research - 14 Feb 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments