Kenanga Research & Investment

Daily Technical Highlights – (FGV, TM)

kiasutrader

Publish date: Thu, 17 Jan 2019, 09:48 AM

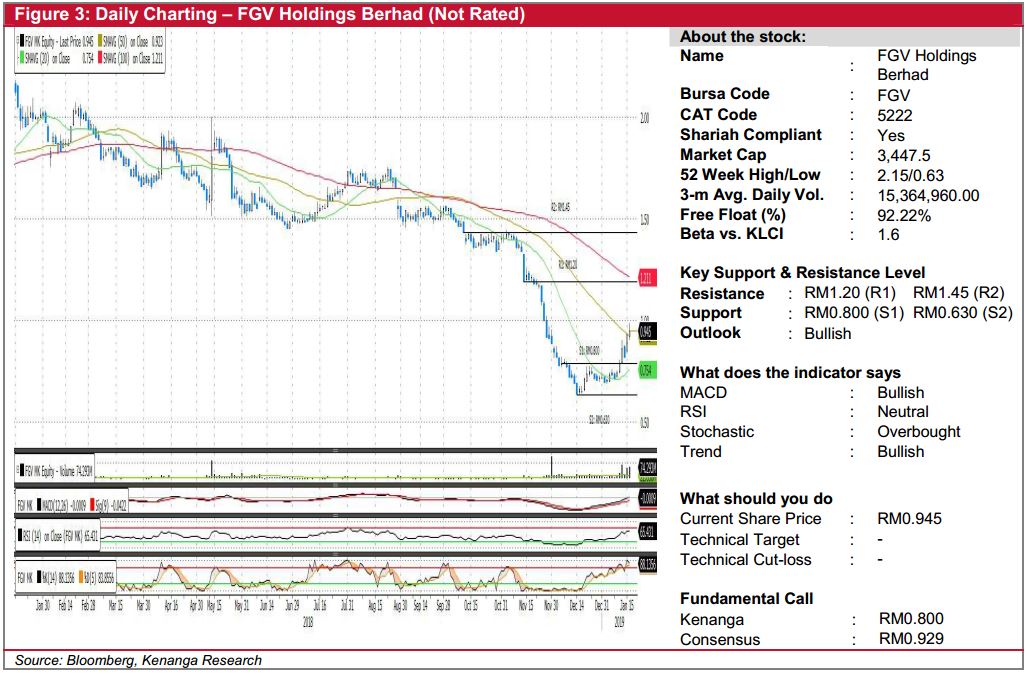

FGV (Not Rated)

- FGV climbed 1.5 sen (+1.61%) to close at RM0.945 on higher trading volume.

- Chart-wise, the share had been rallying over the past few trading days as we believe investors reacted positively towards the news on its management being committed to turnaround the company.

- Overall technical outlook is positive as momentum indicators are bullish while the share had also just broken above both the 20-day and 50-day SMAs.

- From here, expect the share to rally further to its next resistances at RM1.20 (R1) and RM1.45 (R2).

- Any unexpected negative news flow will see supports at RM0.800 (S1) and RM0.630 (S2)

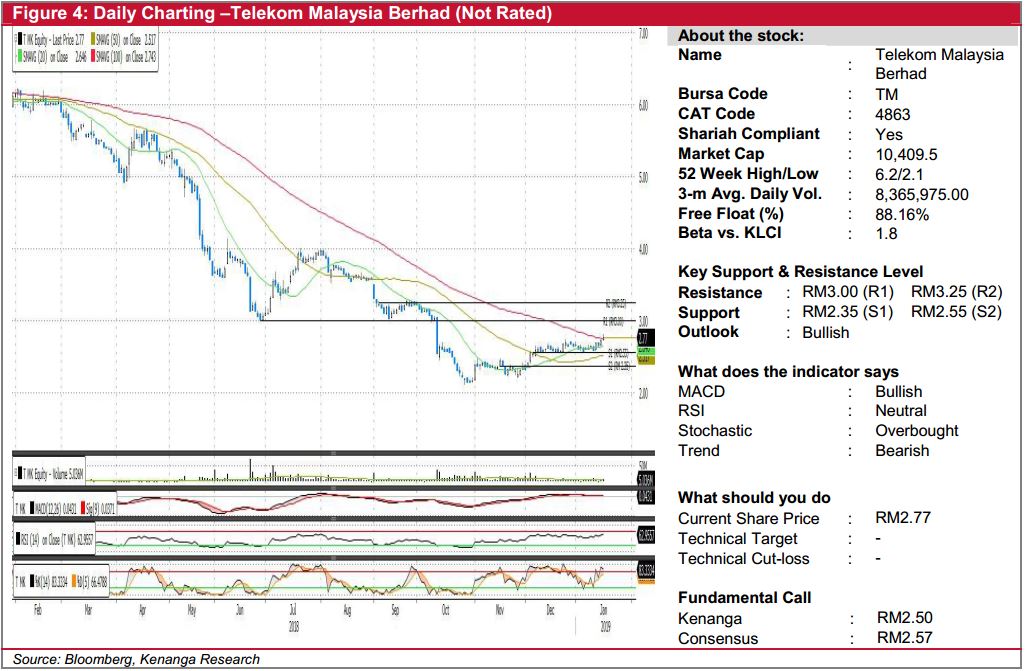

TM (Not Rated)

- TM rose 5 sen (+1.84%) to close at RM2.77.

- The share has been on a downtrend since end-Feb. However, buying interest has returned in late-October with the formation of a long bullish engulfing candle stick that started the rally.

- With that, we believe upward momentum should persist as the share is seen to respect the 20-day SMA while key technical indicators are still bullish.

- Thus, we expect TM to advance above its 100-day SMA to find overhead resistance at RM3.00 (R1) and RM3.25 (R2).

- Conversely, immediate support can be found at RM2.55 (S1) and RM2.35 (S2).

Source: Kenanga Research - 17 Jan 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Jan 06, 2025

Bond Market Weekly Outlook - Domestic yields poised for an uptick ahead of US jobs data

Created by kiasutrader | Jan 03, 2025

Discussions

Be the first to like this. Showing 2 of 2 comments

WoonDeWai

interesting. this is a good read

2019-01-17 09:58