Daily technical highlights – (KNM, ECONBHD)

kiasutrader

Publish date: Fri, 03 May 2019, 09:43 AM

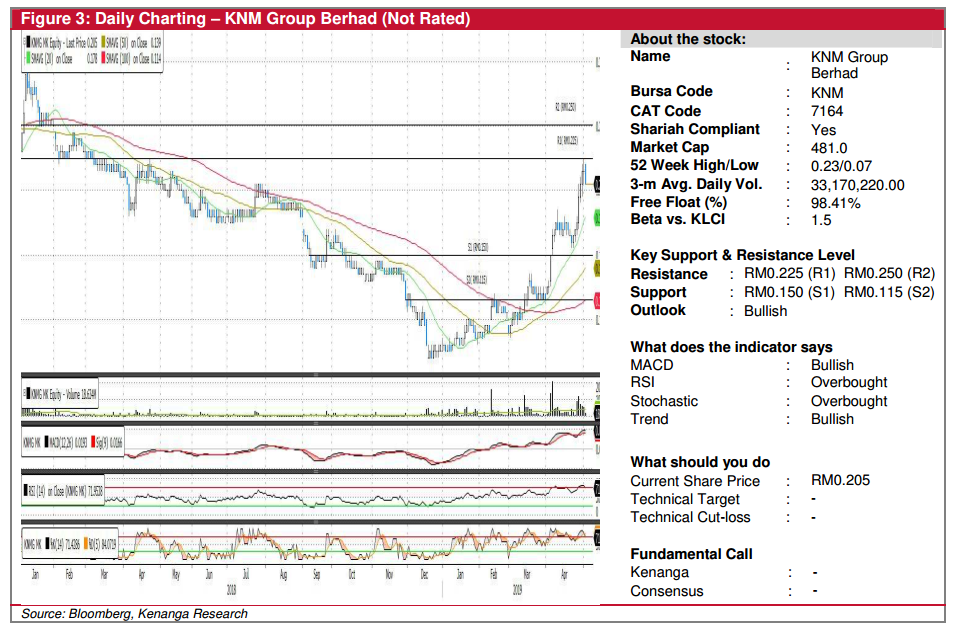

KNM (Not Rated)

• Yesterday, KNM dropped 1.0 sen (-4.65%) to close at RM0.205.

• Despite yesterday’s loss, the share’s uptrend still remains intact which was accompanied by stronger-than-average trading

volumes.

• Technical picture, on the other hand, appears positive with its momentum indicators in a bullish convergence with the

uptrend.

• Recent moves saw the share retesting a key resistance level at RM0.225 (R1). Hence, a decisive breakout from R1 will likely

signal further gains towards R2 at RM0.250.

• Conversely, downside supports can be identified at RM0.150 (S1) and RM0.115 (S2).

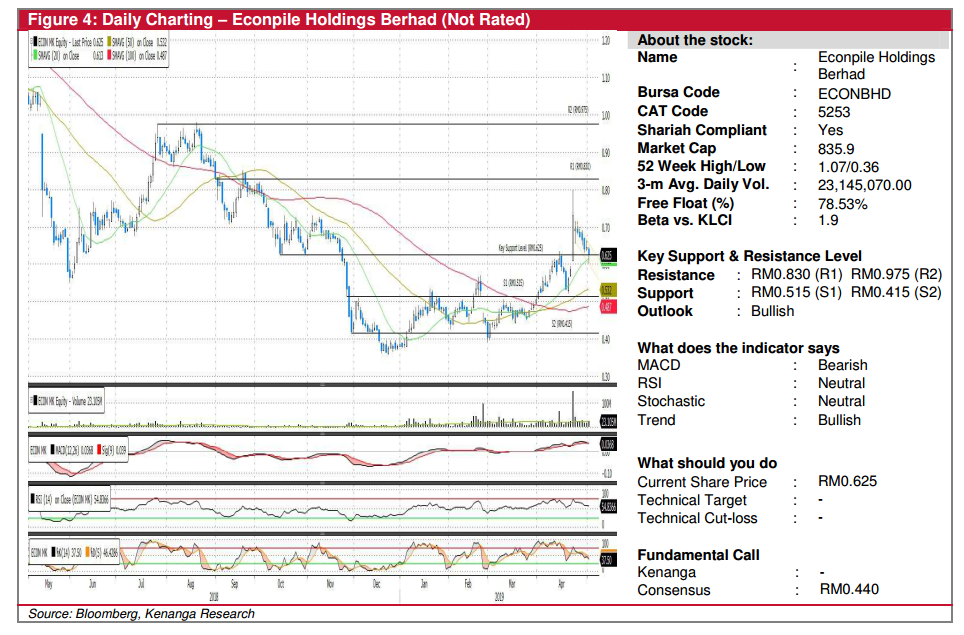

ECONBHD (Not Rated)

• ECONBHD lost 2.0 sen (-3.10%) yesterday to end at the key support level at RM0.625.

• Chart-wise, the share’s recent sell down saw a formation of a “flag pattern” which could possibly indicate that the share is

merely taking a breather before continuing with its uptrend.

• Therefore, a rebound from a significant support level at RM0.625 may see a continuation of the uptrend towards RM0.830

(R1) and RM0.975 (R2).

• On the other hand, a decisive break below the aforementioned support level may see the share trending lower towards

RM0.515 (S1) and RM0.415 (S2)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|