Kenanga Research & Investment

Daily Technical Highlights – (DAYANG, CYPARK)

kiasutrader

Publish date: Wed, 15 May 2019, 08:53 AM

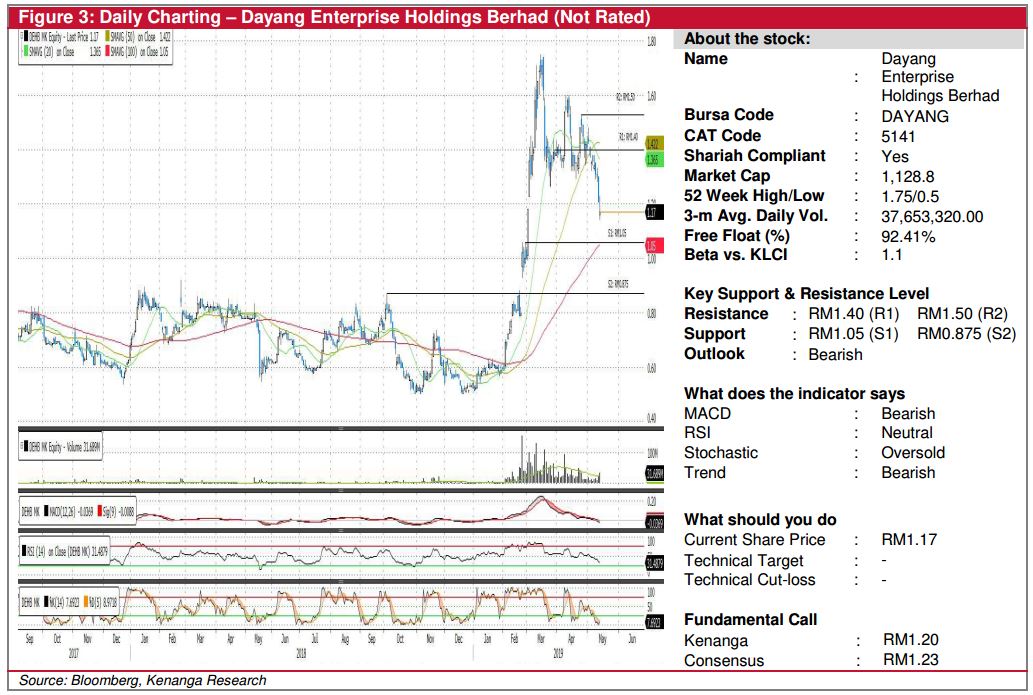

DAYANG (Not Rated)

- Yesterday, DAYANG declined 4.0 sen (-3.31%) to close at RM1.17.

- After the bullish run that happened from January to early March 2019, the share is now on a downtrend.

- Key technical indicators are looking bearish. Coupled with the overall weaker market sentiment, we think that the share is likely to further decline.

- Expect the share to test its immediate support at RM1.05 (S1), which is also where the 100-day SMA is. A break below S1 will then see next support at RM0.875 (S2).

- Conversely, resistances can be found at RM1.40 (R1) and RM1.50 (R2).

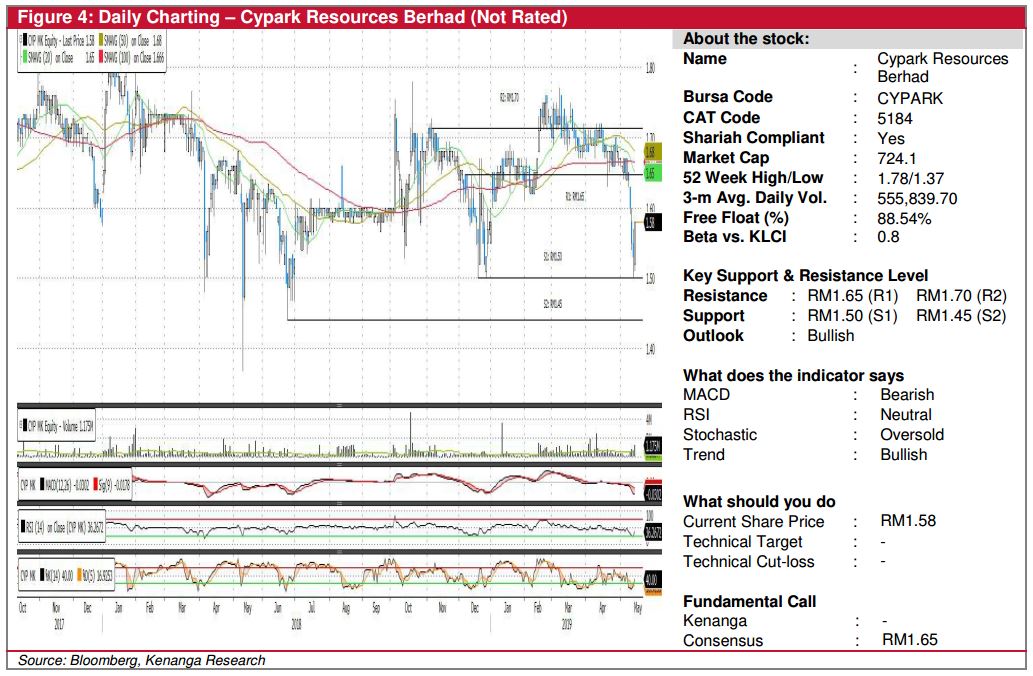

CYPARK (Not Rated)

- CYPARK gained 5.0 sen (+3.27%) yesterday to end at RM1.58.

- From a charting perspective, yesterday’s candlestick resembles a Bullish Engulfing pattern, possibly indicating a bullish reversal may come soon.

- Moreover, the stochastic indicator had just rebounded from the oversold zone.

- From here, the share may head back up to its resistances at RM1.65 (R1) and even RM1.70 (R2).

- On the other hand, RM1.50 (S1) is a good support level for interested investors to put some position in while a break below RM1.45 (S2) is deemed highly negative.

Source: Kenanga Research - 15 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments