Kenanga Research & Investment

Daily Technical Highlights – (OSK, GADANG)

kiasutrader

Publish date: Fri, 17 May 2019, 09:32 AM

OSK (Not Rated)

- OSK dropped 0.5 sen (-0.54%) yesterday to close at RM0.920.

- Lately, the share has gapped down and broken below the key SMAs coupled with higher than average trading volume after it fails to penetrate the psychology resistance at RM1.000 and form a double top reversal pattern.

- Furthermore, the key indicator also shown a bearish signal prompting us to believe that the share will continue its downward movement.

- We expect the share to test it support level at RM0.905 (S1), violation of the support level will further test the next support at RM0.884 (S2).

- Conversely, should the share rebound, resistance levels can be found at RM0.955 (R1) and RM0.975 (R2).

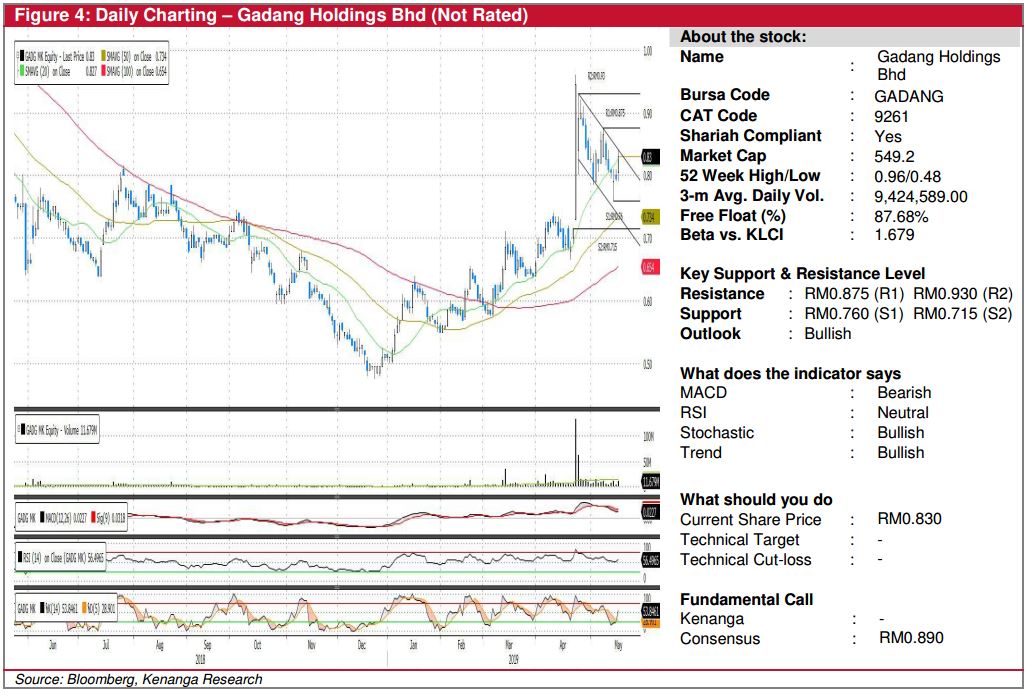

GADANG (Not Rated)

- GADANG gained 3.5 sen (+4.40%) yesterday to end at RM0.830.

- Chart-wise, overall uptrend still remains intact after the share break above the key SMAs back in March 2019. Strong buying pressure evidenced by a bullish marubozu candle coupled with exceptional high trading volume further support the bullish sentiment.

- Formation of a flag pattern recently could possibly indicate that the share is taking a breather before continue its upward movement.

- Should the share break above from the flag pattern, we expect it to test the immediate resistance at RM0.875 (R1) and the second resistance level at RM0.930 (R2).

- On the other hand, support can be found at RM0.760 (S1) and RM0.715 (S2).

Source: Kenanga Research - 17 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|