Kenanga Research & Investment

Daily Technical Highlights – (FRONTKN, KAREX)

kiasutrader

Publish date: Tue, 18 Jun 2019, 09:00 AM

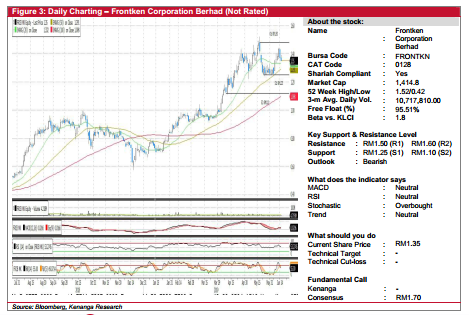

FRONTKN(Not Rated)

- Yesterday, FRONTKN slipped 2.0 sen (-1.46%) to end at RM1.35.

- Chart-wise, we note that the share is retracing after the stochastic indicator was in the overbought zone.

- Moreover, trading volume was not strong, possibly indicating that the previous uptrend is not sustainable.

- From here, the share is more likely to retrace back to its supports at RM1.25 (S1) and even RM1.10 (S2).

- Conversely, resistances can be identified at RM1.50 (R1) and RM1.60 (R2).

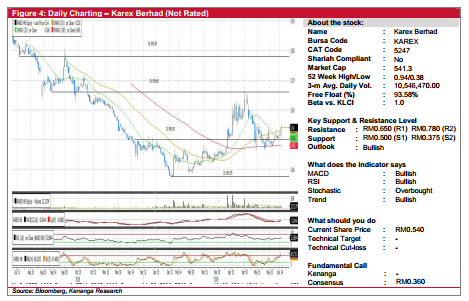

KAREX (Not Rated)

- KAREX gained 2.5 sen (+4.85%) to end at RM0.540 last night.

- Over the past few trading days, the share broke above the 20 and 50-day SMAs.

- Moreover, other momentum indicators are in bullish convergence, possibly indicating more upside.

- We think that the share may rally and test its immediate resistance at RM0.650 (R1). A break above R1 would see R2 at RM0.780.

- On the other hand, supports are found at RM0.500 (S1) and RM0.375 (S2).

Source: Kenanga Research - 18 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments