Daily Technical Highlights – (HLBANK, LPI)

kiasutrader

Publish date: Tue, 07 Jan 2020, 10:41 AM

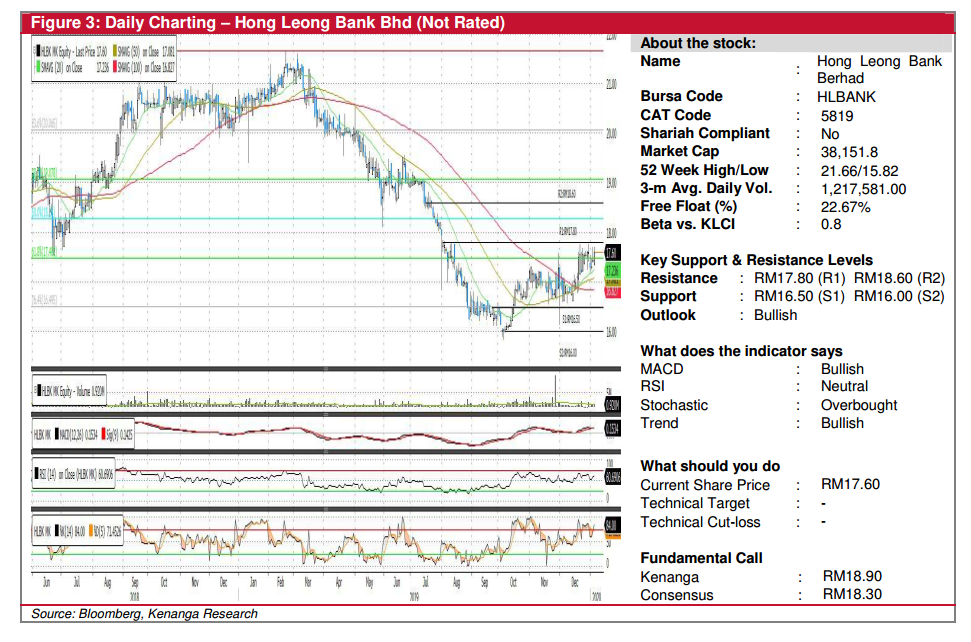

HLBANK (Not Rated)

• HLBANK gained 16.0 sen (+0.90%) to end at RM17.60 yesterday.

• Chart-wise, we note that the stock has been displaying a healthy uptrend after bottoming out in Oct ’19, where it is currently finding comfort in its 20-day SMA while trading above all of its key SMAs.

• With the RSI indicator distancing away from its overbought levels, we believe the stock could move higher.

• From here, expect the stock to test its immediate resistance level at RM17.80 (R1) and then at RM18.60 (R2).

• On the other hand, downside supports can be identified at RM16.50 (S1) and RM16.00 (S2).

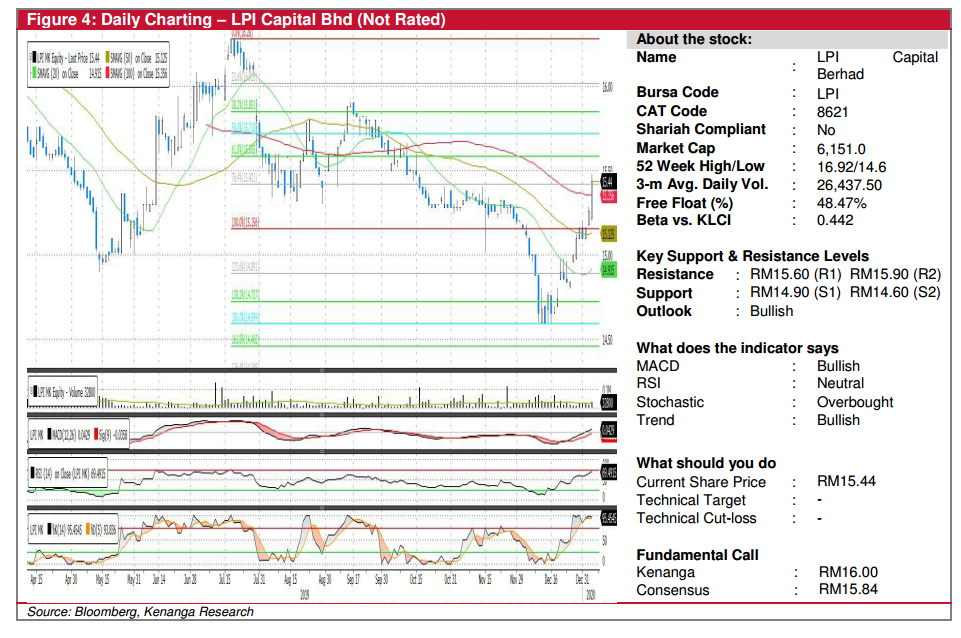

LPI (Not Rated)

• LPI rose 18.0 sen (+1.20%) to close at RM15.44 yesterday.

• Chart-wise, the stock is rebounding from its previous sell down, which saw it punching above all key SMAs.

• Coupled with the recent formation of three consecutive bullish candlesticks and a bullish MACD crossover, we believe there may still be room for upside.

• Should the positive momentum persist, the stock is expected to see resistances at RM15.60 (R1) and RM15.90 (R2).

• Conversely, support levels can be identified at RM14.90 (S1) and RM14.60 (S2).

Source: Kenanga Research - 7 Jan 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-29

HLBANK2024-11-29

HLBANK2024-11-29

HLBANK2024-11-29

HLBANK2024-11-29

HLBANK2024-11-29

HLBANK2024-11-29

HLBANK2024-11-29

HLBANK2024-11-28

HLBANK2024-11-28

HLBANK2024-11-28

HLBANK2024-11-28

HLBANK2024-11-27

HLBANK2024-11-27

HLBANK2024-11-26

HLBANK2024-11-26

HLBANK2024-11-26

HLBANK2024-11-25

LPI2024-11-22

HLBANK2024-11-21

HLBANK2024-11-20

HLBANKMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 29, 2024

Created by kiasutrader | Nov 29, 2024