Daily technical highlights – (MTAG, FITTERS)

kiasutrader

Publish date: Wed, 03 Mar 2021, 09:18 AM

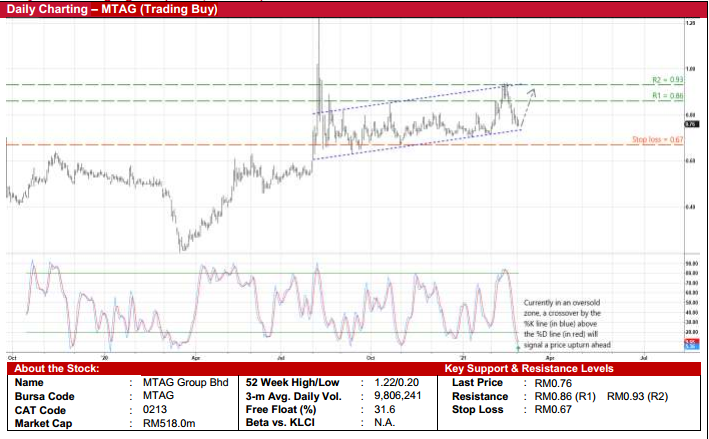

MTAG Group Bhd (Trading Buy)

• MTAG offers exposure to the fast-growing electronics manufacturing services (EMS) industry in Malaysia. As one of the leading labels and stickers printing and materials converting specialists in the country, the Group serves a diversified clientele from various industries, including VS Industry and ATA IMS (who have collectively contributed more than three-quarters of its revenue in the past).

• Growing in tandem with its key customers, the Group reported a steady net profit of RM10.4m in the second quarter ended December 2020 (broadly similar to 2QFY20 and 1QFY21), taking its 1HFY21 earnings to RM21.2m (+25% YoY) as its overall performance was boosted by higher sales.

• Going forward, consensus is forecasting MTAG to: (i) make net profit of RM39m in FY June 2021 and RM44m in FY June 2022, which implies forward PERs of 13.3x and 11.8x, respectively; and (ii) declare DPS of 3.5 sen in FY21, translating to an implied dividend yield of 4.6%.

• The Group is financially strong with a debt-free balance sheet that is backed by cash holdings of RM121.4m (17.8 sen per share or nearly one-quarter of its existing share price) as of end-December last year.

• Technically speaking, the prevailing share price pullback from a recent high of RM0.94 in mid-February to near the bottom of an ascending price channel presents a timely buying opportunity in MTAG.

• And a resumption of its upward trajectory is expected to occur when the %K line cuts above the %D line as both values of the stochastic indicator are currently hovering below the oversold level.

• Riding on the positive momentum, the stock could then rise towards our resistance thresholds of RM0.86 (R1) and RM0.93 (R2). This represents upside potentials of 13% and 22%, respectively.

• We have placed our stop loss level at RM0.67 (or 12% downside risk).

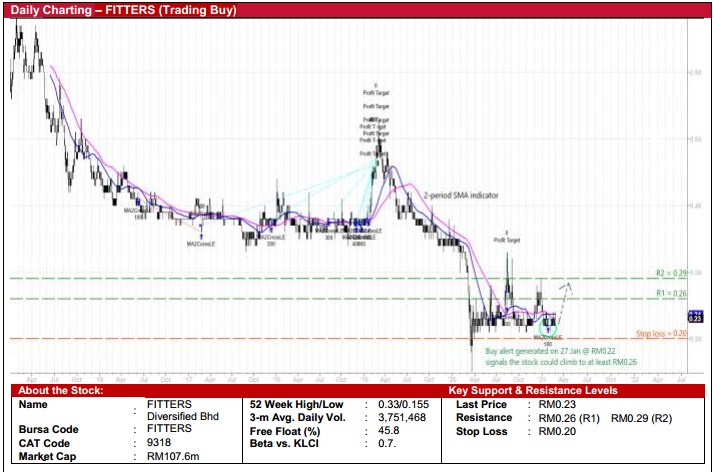

FITTERS Diversified Bhd (Trading Buy)

• FITTERS is a diversified group that is engaged in the following core businesses: (i) fire protection services; (ii) property development & construction; (iii) renewable & waste-to-energy and green palm oil mill; and (iv) manufacturing & distribution of PVC-O pipes (which are used in the water, irrigation and waste water systems).

• The Group (via its PVC-O pipes business) is a potential beneficiary of Air Selangor (the state water concessionaire)’s recently announced programme to replace some 716km of old damaged pipes at a cost of RM671.7m to address the non-revenue water problem in Selangor.

• Whilst the Group is currently loss-making (with a reported net loss of RM13.2m in FY December 2020), the weak fundamentals are probably already reflected in its share price (which has tumbled 30% from a high of RM0.33 in mid-August last year). Quite interestingly, against a weak market backdrop, the stock was up 5% to close at RM0.23 yesterday amid a surge in trading volume.

• Our positive technical stance on FITTERS is driven by our trading system, which is built on a 2-period moving average (MA) indicator to trigger buy signals when the fast MA crosses above the slow MA. Using an exit rule of either a 20% profit or 10% stop loss (whichever comes first) from the trigger levels, its back-tested results showed that 8 of the 9 signals generated by the trading system since 2015 were profitable trades (i.e. it has correctly predicted the ensuing share price gains of 20% or more), representing an accuracy rate of 89%.

• Based on the historical guide, the latest buy alert that appeared on 27 January this year is indicating that FITTERS’ share price could climb to at least RM0.26 going forward. On the chart, we have placed our resistance thresholds at RM0.26 (R1; 13% upside potential) and RM0.29 (R2; 26% upside potential).

• Our stop loss level is set at RM0.20 (representing a 13% downside risk).

Source: Kenanga Research - 3 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Aug 26, 2024

.png)