Daily technical highlights – (GUH, EPMB)

kiasutrader

Publish date: Tue, 14 Feb 2023, 09:08 AM

GUH Holdings Bhd (Technical Buy)

• GUH’s share price – which has been swinging sideways since early October last year – is approaching the lower range of a rectangle pattern after retracing from a recent high of RM0.45 early this month to close at RM0.41 yesterday.

• An ensuing rebound in the stock price is now anticipated following the appearance of a bullish dragonfly doji candlestick as the MACD indicator signals a strengthening momentum too.

• On the chart, the stock could climb to challenge our immediate resistance target of RM0.45 (R1) initially before attempting to break out from the rectangle box to advance towards our next resistance hurdle of RM0.50 (R2). This represents upside potentials of 10% and 22%, respectively. We have placed our stop loss price level at RM0.37 (or a downside risk of 10%).

• Fundamentally speaking, GUH’s key business segments consist of: (i) electronic (namely the manufacturing of printed circuit boards), (ii) property development, (iii) utilities (i.e. water & wastewater solutions), and (iv) cultivation of oil palm plantation.

• The group made a net loss of RM1.2m in 3QFY22 (compared with 3QFY21’s net loss of RM0.3m), taking 9MFY22’s net lossto RM1.3m (from 9MFY21’s net profit of RM4.5m).

• Nonetheless, its financial position remains steady with net cash holdings of RM29.0m (or 10.3 sen per share which accounts for one-quarter of its existing share price) as of end-September last year. Based on its book value per share of RM1.74 as of end-September 2022, the stock is currently trading at a Price / Book Value multiple of 0.24x (or at its historical mean).

• In terms of recent corporate development, GUH has signed a Memorandum of Understanding in end-January 2023with Jiangsu Xinri International to appoint GUH as the latter’s exclusive representative to market, promote, distribute, assemble, manufacture and sell electric vehicles supplied by Xinri International in Malaysia.

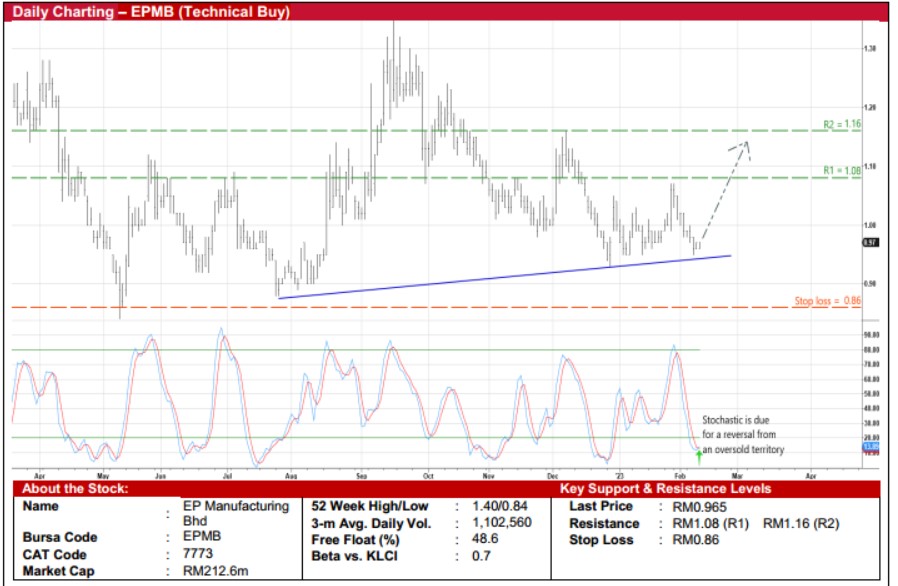

EP Manufacturing Bhd (Technical Buy)

• After slipping from a high of RM1.35 in mid-September last year to as low as RM0.93 late December 2022, plotting lower highs along the way, a technical rebound may be in the offing for EPMB shares.

• Backed by a bullish stochastic signal (following the %K line’s crossover above the %D line in the oversold zone), the share price is set to bounce off from an ascending trendline (that dates back to late July last year).

• With that said, the stock – which is currently hovering near its lowest level since late December 2022 – could shift upwards towards our resistance thresholds of RM1.08 (R1; 12% upside potential) and RM1.16 (R2; 20% upside potential).

• Our stop loss price level is pegged at RM0.86 (translating to a downside risk of 11%).

• Business-wise, EPMB is mainly involved in the manufacturing and supply of automotive parts (such as metal body panels, chassis parts, rear axles, brake systems and fuel tanks) with a diverse customer base that includes Perodua, Proton, Honda, Mazda and Toyota.

• The group saw its net loss narrowing to RM0.6m in 3QFY22 (versus 3QFY21’s net loss of RM7.1m), bringing 9MFY22 netloss to RM1.9m (significantly down from 9MFY21’s net loss of RM10.9m).

• In terms of Price/Book Value rating, the stock is currently trading at a multiple of 0.70x (or marginally below the +1SD level from its historical mean) based on its book value per share of RM1.38 as of end-September 2022.

Source: Kenanga Research - 14 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024