Daily Technical Highlights - (LTKM, PMBTECH)

kiasutrader

Publish date: Tue, 23 May 2023, 10:46 AM

LTKM Bhd (Technical Buy)

• After rising from a trough of RM0.85 in January 2021 to plot a sequence of higher lows along the way, LTKM’s share price is poised to extend its uptrend pattern ahead.

• With the shares treading near the ascending trendline, a resumption of the upward trajectory may be forthcoming following the golden cross by the 50-day SMA above the 100-day SMA as the stochastic indicator is in the midst of climbing out from the oversold position.

• Riding on the positive momentum, the stock could advance towards our resistance thresholds of RM1.62 (R1; 13% upside potential) and RM1.70 (R2; 19% upside potential).

• We have pegged our stop loss price level at RM1.28 (or a downside risk of 10% from its last traded price of RM1.43).

• In terms of corporate developments, LTKM has announced multiple proposals to: (i) dispose of its existing poultry business for RM222.0m cash, (ii) undertake a proposed special dividend cum capital repayment of RM0.90 per share, (iii) consolidate 2 LTKM shares to 1 new consolidated LTKM share, (iv) acquire a new business (of providing electronic manufacturing services) for RM336.0m (to be satisfied by RM100.0m in cash and the issuance of 181.5m new LTKM Shares at an issue price of RM1.30 each) which comes with a profit guarantee amounting to a combined net profit of not less than RM50.0m over FY December 2023 and 2024, and (v) undertake a restricted issue of 63.3m new LTKM shares.

• Meanwhile, LTKM registered net earnings of RM2.2m (-7% YoY) in 3QFY23, bringing its 9MFY23’s bottomline to RM11.3m(a turnaround from net loss of RM6.9m previously).

• Valuation-wise, the stock is currently trading at Price/Book Value multiple of 0.91x based on its book value per share of RM1.58 as of end-December 2022.

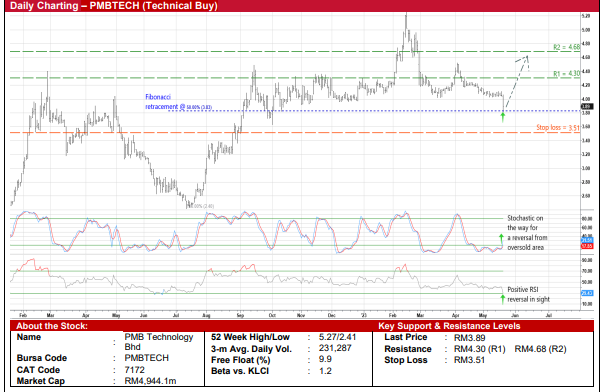

PMB Technology Bhd (Technical Buy)

• Following a pullback from its high of RM5.27 in mid-March this year, PMBTECH’s share price – which ended at RM3.89yesterday or back to where it was in mid-October 2022 – will probably find support at the 50% Fibonacci retracement level.

• Backed by strengthening technical signals arising from the reversal from the oversold territory by both the stochastic and RSI indicators, an upward shift in the shares is anticipated.

• On the way up, the stock is expected to challenge our resistance targets of RM4.30 (R1) and RM4.68 (R2), offering upside potentials of 11% and 20%, respectively.

• Our stop loss price level is set at RM3.51 (translating to a downside risk of 10%).

• Business-wise, PMBTECH (a 21.5%-owned associate of listed Press Metal Aluminium Holdings) is involved in two segments: (i) the manufacturing and/or distribution of metallic silicon products, access equipment and other aluminium related products and distribution of related building materials, and (ii) the design, fabricate and installation of aluminium curtain wall, cladding, skylight, façade works and the fabrication and installation of aluminium system formworks.

• Via its metallic silicon products which are used in the production of polycrystalline silicon (polysilicon) as a base material for solar cells (and semiconductor chips), PMBTECH is an indirect proxy to the fast-growing renewable solar energy industry.

• The group made net profit of RM10.1m (-91% YoY) in 4QFY22, which took full-year’s bottomline to RM118.2m (-23% YoY) in FY December 2022.

• Based on its book value per share of RM0.78 as of end-December 2022, the stock is presently trading at Price/Book Value multiple of 5.0x.

Source: Kenanga Research - 23 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Jan 27, 2025

Created by kiasutrader | Jan 27, 2025

Created by kiasutrader | Jan 24, 2025