Daily technical highlights – (INNATURE, RGB)

kiasutrader

Publish date: Mon, 04 Sep 2023, 09:39 AM

Innature Bhd (Technical Buy)

• Listed back in February 2020, the share price of INNATURE reached its peak of RM0.885 in October 2021 before trendedlower subsequently. It closed at RM0.45 last Friday.

• Chart-wise, we believe the share price is on the verge of overcoming a negative sloping trendline as: (i) both the Stochasticand RSI indicators are in the midst of climbing out from the oversold zone, and (ii) the share price is anticipated to moveback above the lower Bollinger Band.

• Hence, the stock is poised to challenge our resistance thresholds of RM0.50 (R1; 11% upside potential) and RM0.54 (R2;20% upside potential).

• Conversely, our stop-loss price has been identified at RM0.40 (representing an 11% downside risk).

• INNATURE is a leading regional retailer of cosmetics and personal care products serving customers across Malaysia,Vietnam and Cambodia which offers exposure to the robust retail sales.

• Earnings-wise, the group reported a net profit of RM1.8m in 2QFY23 compared with a net profit of RM5.6m in 2QFY22. Thistook 1HFY23 net profit to RM4.8m (versus net profit of RM10.1m previously).

• Based on consensus forecasts, INNATURE’s net earnings are projected to come in at RM15.0m in FY December 2023 andRM21.3m in FY December 2024, which translate to forward PERs of 21.2x this year and 14.9x next year, respectively.

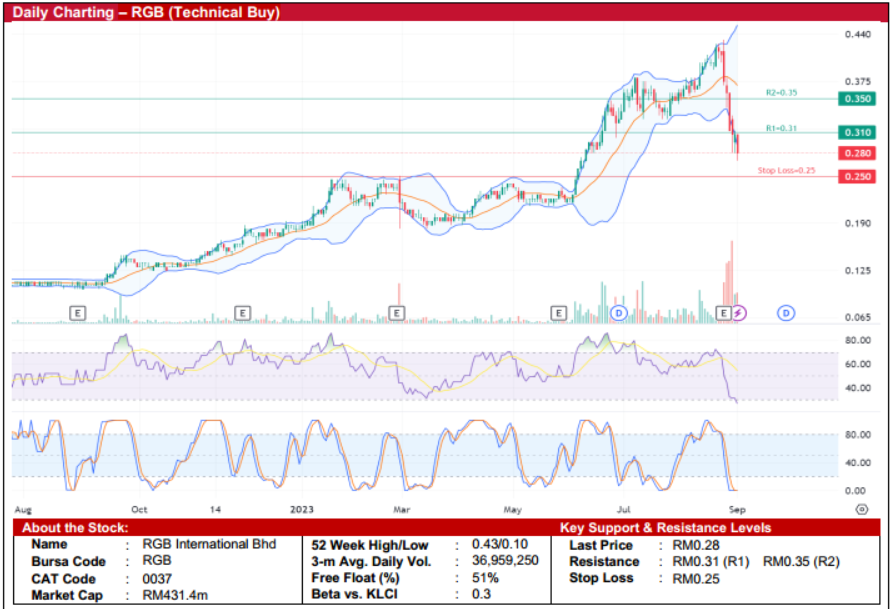

RGB International Bhd (Technical Buy)

• The share price of RGB has been trending upwards since September 2022 from a low of RM0.10 to hit a 52-week high ofRM0.43 last month before reversing till now. It closed at RM0.28 last Friday.

• On the chart, the share price is expected to stage a rebound backed by: (i) both the Stochastic and RSI indicators set to climbout from the oversold zone, and (ii) the share price currently hovering at the lower end of the Bollinger Band.

• An upward shift could then propel the stock towards our resistance targets of RM0.31 (R1; 11% upside potential) andRM0.35 (R2; 25% upside potential).

• Our stop loss level is pegged at RM0.25 (representing an 11% downside risk).

• Fundamentally-speaking, RGB is a leading supplier of electronic gaming machines and casino equipment as well as a keymachine concession provider with geographical presence in Malaysia, Singapore, and Indo-China.

• Earnings-wise, the group reported a net profit of RM26.5m in 2QFY23 compared with a net loss of RM2.7m in 2QFY22. Thistook FY23 bottomline to RM37m (versus net loss of RM6m previously).

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 1.5x based on its book value per share ofRM0.19 as of end-June 2023.

Source: Kenanga Research - 4 Sept 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|