Kenanga Research & Investment

Actionable Technical Highlights – (AXIATA)

kiasutrader

Publish date: Fri, 13 Oct 2023, 09:29 AM

AXIATA GROUP BERHAD (Technical Buy)

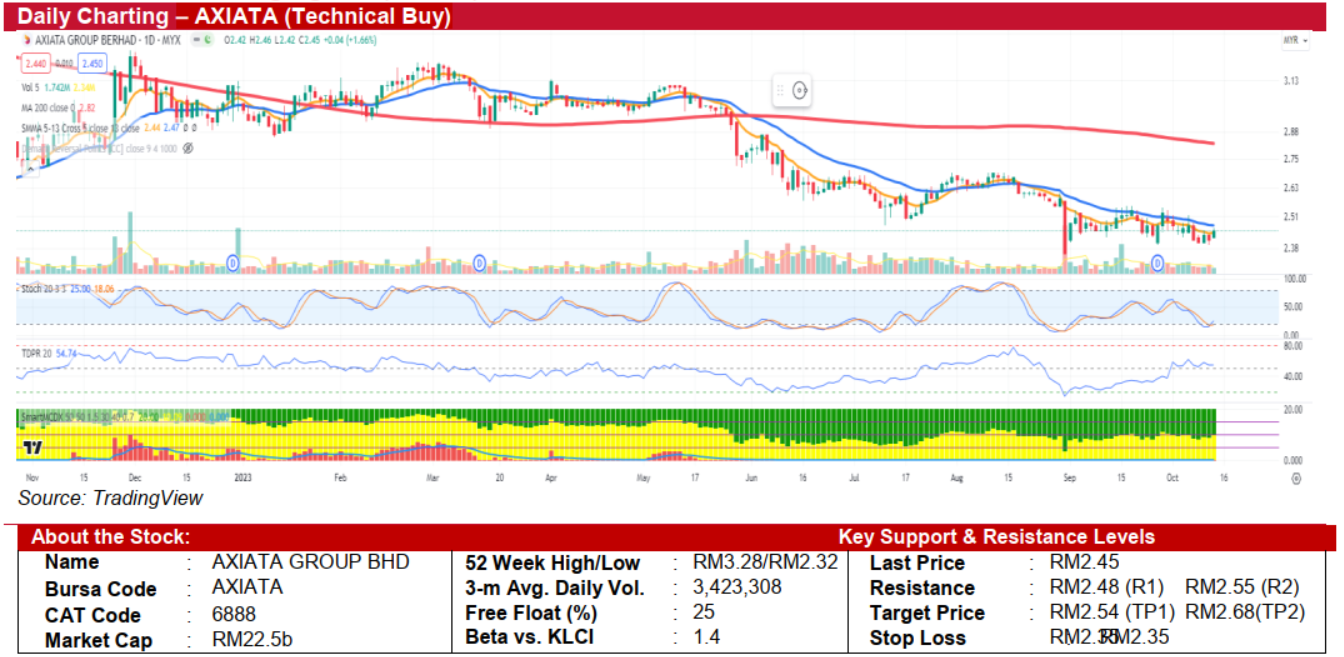

- AXIATA has been on a declining trajectory since breaching its 200-day SMA at RM2.95 on May 26. While the stock's long-term downtrend remains unaltered, a short-term trading opportunity may present itself if the stock successfully surpasses its 13-day SMA, currently near RM2.48. A definitive break above this level could initiate a short-term upward trend. Additionally, AXIATA has consistently rebounded from the RM2.36-RM2.40 range over the past month, indicating the formation of a robust support level within this range.

- Technically speaking, the stochastic oscillator is showing preliminary signs of exiting its oversold zone. The fast-moving %K line has started to trend upward, crossing above the %D line, which suggests that a potential trend reversal may be on the cards.

- A decisive advance above the immediate resistance level of RM2.48 could pave the way for the stock to challenge subsequent resistance levels at RM2.55 and RM2.69. On the contrary, a dip below the recent low of RM2.36 would suggest a new downtrend, with the following support level pinpointed at RM2.13.

- Given the limited technical downside risk, we recommend investors consider initiating a position at RM2.45, with a target for partial profit-taking at RM2.54, followed by RM2.68. This approach yields an estimated upside potential of approximately 7%. We also suggest setting a stop-loss at RM2.35, corresponding to a downside risk of 4.1%.

Source: Kenanga Research - 13 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments