Kenanga Research & Investment

Actionable Technical Highlights - THPLANT

kiasutrader

Publish date: Tue, 02 Jul 2024, 09:39 AM

THPLANT BERHAD (Technical Buy)

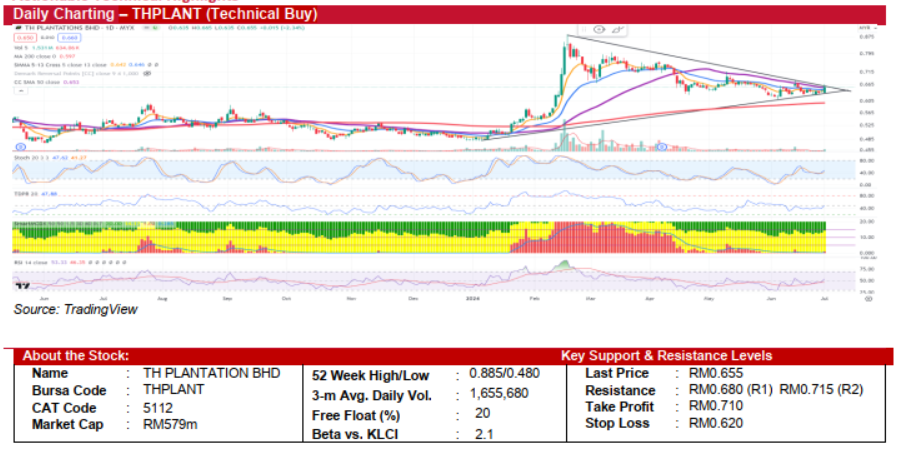

- TH Plantations BHD (THPLANT) closed at RM0.655 yesterday, gaining 2.34%. The stock is forming a promising triangle chart pattern, hinting at a potential breakout if it continues to rise above the 50-day SMA at RM0.655. The recent bullish engulfing candlestick pattern further reinforces the positive outlook.

- Yesterday's increased trading volume, along with the price rise, signals strong bullish momentum. The Stochastic Oscillator is trending upwards, indicating renewed buying interest. Additionally, the Relative Strength Index (RSI) at 46.35 is moving up, supporting the potential for continued upward movement.

- Key levels to watch include immediate resistance at RM0.680. A break above this could push the stock towards the next resistance at RM0.715. On the downside, key support levels are at RM0.645, near the 13-day SMA, and RM0.625, providing a strong base against any declines.

- Given these bullish indicators and the potential for a breakout, we recommend considering an entry around RM0.655. Setting a take-profit target at RM0.710 offers an attractive upside potential of about 8.4%. For risk management, placing a stop-loss at RM0.620 limits potential downside to approximately 5.3%. This strategy presents a favorable risk-to-reward ratio, making it an appealing opportunity for investors looking to capitalize on THPLANT’s upward momentum.

Source: Kenanga Research - 2 Jul 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Market Weekly Outlook - MGS/GII yields poised for an uptick ahead of US job data

Created by kiasutrader | Jan 31, 2025

Oil & Gas - Dissecting Petronas and Trump's Impact on the Sector (OVERWEIGHT)

Created by kiasutrader | Jan 31, 2025

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Jan 27, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments