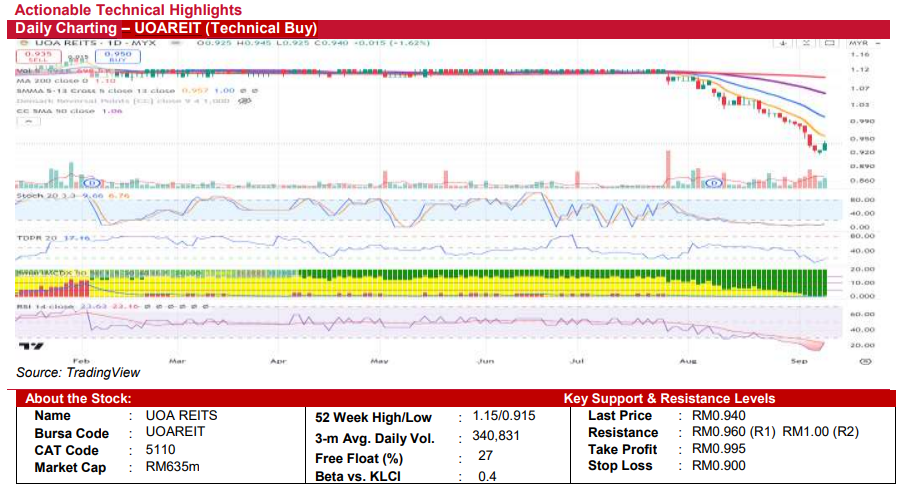

Daily Charting – UOAREIT (Technical Buy)

kiasutrader

Publish date: Tue, 10 Sep 2024, 10:25 AM

UOAREIT BERHAD (Technical Buy)

• UOA REITs (UOAREIT) closed at RM0.940, up by 1.62%. The stock’s performance has been underpinned by a consolidating price range which hints at an impending directional movement. The recent trading sessions have shown attempts to stabilize above the support levels, with the candlestick patterns suggesting a possible easing of the prior bearish pressure.

• On the technical analysis front, the Stochastic Oscillator is rising from low levels, suggesting a potential increase in momentum. Additionally, the RSI is just below 30, pointing to an oversold condition that may attract buyers looking for a bargain, anticipating a rebound. The stock’s weekly chart also displayed a similar oversold setup.

• Key levels to watch include the immediate resistance at RM0.960 (5-day SMA). A break above this level could see the stock challenge further resistance at RM1.00 (13-day SMA) and RM1.06 (50-day SMA). Support is currently established around RM0.915, with further downside risks potentially extending to lower historical support zones at RM0.88-RM0.90 range, levels not seen since 2008.

• Given the oversold conditions and the stabilizing price actions, considering an entry around RM0.940 might be opportune. A take-profit exit can be reasonably set at RM0.995, with an extended target up to RM1.06 if momentum persists. To manage risks, a stop-loss slightly below the support at RM0.90 would limit exposure, presenting a balanced risk-to-reward scenario for those looking to capitalize on potential short-term gains from UOAREIT’s market movements

Source: Kenanga Research - 10 Sept 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Jan 27, 2025

Created by kiasutrader | Jan 27, 2025

Created by kiasutrader | Jan 24, 2025

Created by kiasutrader | Jan 24, 2025