Pick of the Day: VS-CN

NagaWarrants

Publish date: Wed, 14 Jun 2017, 11:10 AM

VS net profit increased 2.6x to RM50.5mil ending April 30 2017 (3QFY17) from RM19.3mil a year ago. This was mainly contributed by higher sales orders from clients in Malaysia, Indonesia & China.

<click here for the full article>

Pick of the Day:

VS-CN : buy-on-weakness

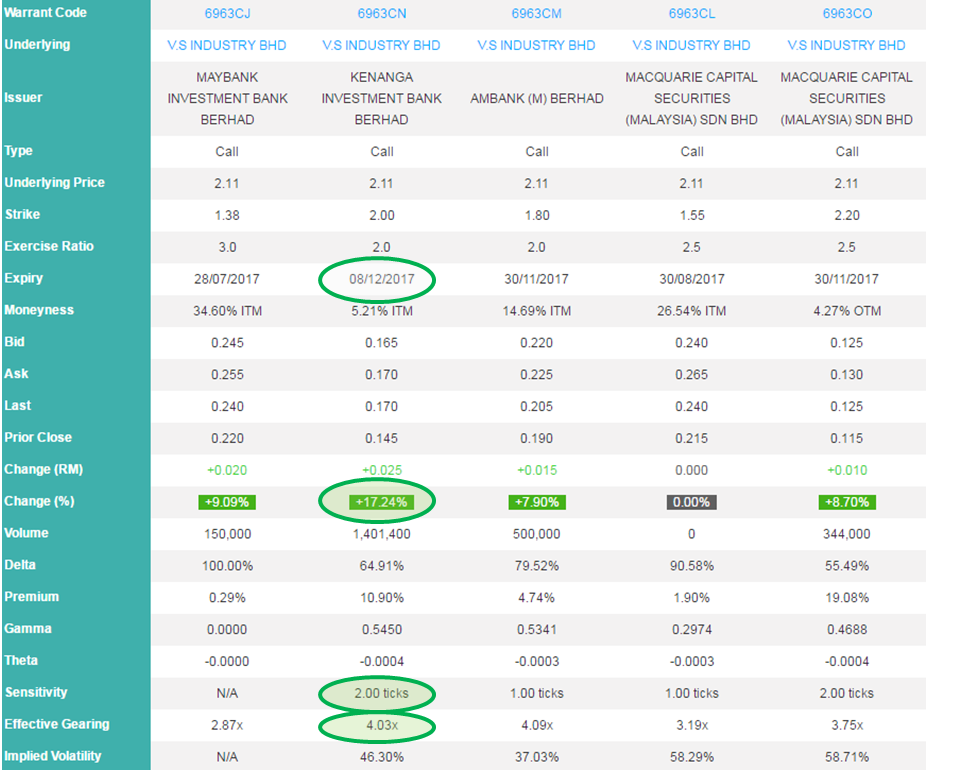

- Effective Gearing 4.03x

- Sensitivity at 2 ticks

- Expires on 8/12/2017 (longest to expiry)

So, what does this even mean?

Effective Gearing means that when the VS moves up by 1%, VS-CN will move up by 4.03%.

Sensitivity means that VS must move up by 2 ticks (RM0.02) to cause a 1 tick movement in VS-CN.

* High Sensitivity means low ticks!

Join our *NEW* Official Telegram Channel! Its free.

Telegram: https://www.telegram.me/KenangaWarrants (Real time LIVE updates)

i3investor.com Official Blog: https://klse.i3investor.com/blogs/kenangawarrants/

More info & tools at www.NagaWarrants.com/home

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|