JKGLAND VALUE INCREASE

Kim Stockwatch

Publish date: Mon, 02 May 2016, 01:49 AM

JKGLAND (6769) Formerly known as Keladi Maju Berhad Group (KM Group) is principally involved in property development and property investment in Kedah Darul Aman.

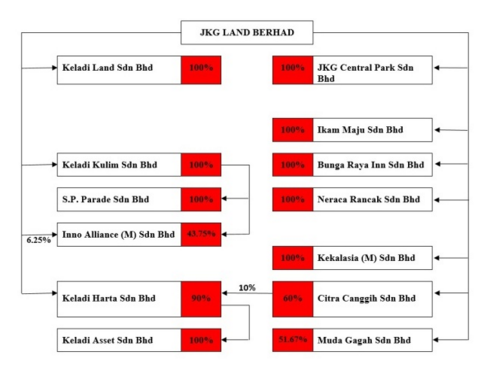

The company is into cultivation of palm oil segment and sale of oil palm fruits. The Company also have mixed development project which includes Taman Desa Cinta Sayang, consisting of around 455 units of single storey terrace houses, 152 units of shops and one plot of petrol station land. Its subsidiaries include Keladi Kulim Sdn. Bhd., Keladi Land Sdn. Bhd., Neraca Rancak Sdn. Bhd. and Kekalasia (M) Sdn. Bhd, engaged in property development and investment holding; Ikam Maju Sdn. Bhd., JKG Central Park Sdn. Bhd. and S.P. Parade Sdn. Bhd., engaged in property development; Keladi Asset Sdn. Bhd., engaged in property investment, and Keladi Harta Sdn. Bhd

The development carried out by the KM Group comprises mainly low and medium cost residential projects, commercial offices and, to some extent, light industrial factory buildings for small and medium scale industries. It has always been the Group's policy to move in tandem with the Government's aspiration to satisfy the housing needs of the lower income group of the population. The Group has todate developed more than 14,600 units of various type of properties, out of which approximately 12,000 units or, 83% were low cost houses.

LAND VALUE INCREASING IN KULIM

Currently the Group's development projects are concentrated in Kulim, one of the fastest developing districts in the state of Kedah.

Adding to the value of development project is that they are located nearby Kulim Hitec as a Multimedia Super Corridor. The Park is strategically located about 27 kilometers from the North-Butterworth Container Terminal (NBCT). The constructed Kulim highway has provided convenient travelling from Kulim to the North South Highway and also to the Penang Island. Thus promoting land value increase to Kulim.

And the proposal on constructing a new airport has raised the value of land around Kulim. Housing price has increase drastically from the proposal of the new airport.

CURRENT PROJECTS IN HAND

For the current FY17, JKG Land’s projects in progress include the housing development in Taman Lagenda and Taman Desa Cinta Sayang.

Phase 2 of Taman Lagenda, comprising 450 residential houses, is expected to be completed with a Certificate of Completion and Compliance for launch this year. For Taman Desa Cinta Sayang, phase 1S and phase 1A are targeted to be completed and handed over to purchasers by the first half of the year.

Below is the cooperate structure of Jkgland:-

DYNAMIC TEAM LEADERS

The management team of the KM Group is headed by Ir Chuah Chin Ah JP who is the Managing Director, and Thor Poh Seng the Executive Director. Both of them have accumulated extensive experience in the industry. They also enjoy the support and guidance of Tan Sri Dato’ Tan Hua Choon, the Chairman of KM,

If we look closely at Tan Sri Dato’ Tan Hua Choon background.

At the age of 74 Tan Hua Choon is connected to 24 board members in 5 different organizations across 9 different industries. The following is what we have:-

Mr. Hua Choon Tan, also known as Robert, P.S.M. D.P.M.S., served as the Managing Director of Goh Ban Huat Berhad from October 16, 2009 to June 1, 2013. Mr. Tan served as Managing Director of Jasa Kita Bhd from January 4, 1993 to March 16, 2002. He has vast experiences in various fields and industries. He has been involved in a wide range of businesses over 40 years, which include manufacturing, marketing, banking, shipping, property development and trading. During the last 11 years, he has built-up investments in numerous public listed companies. Mr. Tan has been the Executive Chairman of Jasa Kita Bhd since March 29, 2002. He has been Non Independent & Non Executive Chairman of Goh Ban Huat Bhd since June 1, 2013 and previously served as its Executive Chairman since April 15, 2010 to June 1, 2013. He has been the Chairman of the Board at FCW Holdings Bhd since February 16, 2000 and Marco Holdings Berhad since December 20, 2001. He has been the Chairman of Keladi Maju Bhd since March 15, 1997. He served as the Chairman of the Board of Jasa Kita Bhd from January 4, 1993 to March 29, 2002, Malaysia Aica Bhd from April 19, 1996 to June 2013 and PDZ Holdings Berhad from November 23, 2000 to March 26, 2007. Mr. Tan had been Non-Independent Non Executive Director of GPA Holdings Bhd from May 31, 2000 to June 1, 2013. He serves as an Executive Director of Jasa Kita Bhd. He has been a Non-Independent Non-Executive Director at FCW Holdings Bhd since January 26, 1999. He has been a Non-Independent Non-Executive Director of Goh Ban Huat Bhd since June 1, 2013 and served as its Executive Director since October 16, 2009 until June 1, 2013. He served as the Chairman of PDZ Holdings Bhd since May 8, 2008 to June 1, 2013. Mr. Tan served as the Chairman of the Board of GPA Holdings Bhd from May 31, 2000 to June 1, 2013. He served as a Non-Executive Director of PDZ Holdings Bhd from May 8, 2008 to June 1, 2013. Mr. Tan served as a Non-Independent Non-Executive Director at Sunsuria Bhd (formerly, Malaysia Aica Bhd) from September 23, 1995 to June 2013. Mr. Tan served as Member of Supervisory Board at Banco Popolare Ceská republika, a.s. from January 1999 to May 2007. He served as a Non Independent & Non Executive Director of Goh Ban Huat Bhd from July 8, 2008 to October 16, 2009. Mr. Tan previously served as a Non-Independent Non-Executive Director of PDZ Holdings Berhad from November 23, 2000 to March 26, 2007.

Up-to-date info about JKGLAND

159.25M market capital

43.45m Revenue (TTM)

18.99m Net income (TTM)

58 employees

Number of shares 758.31M

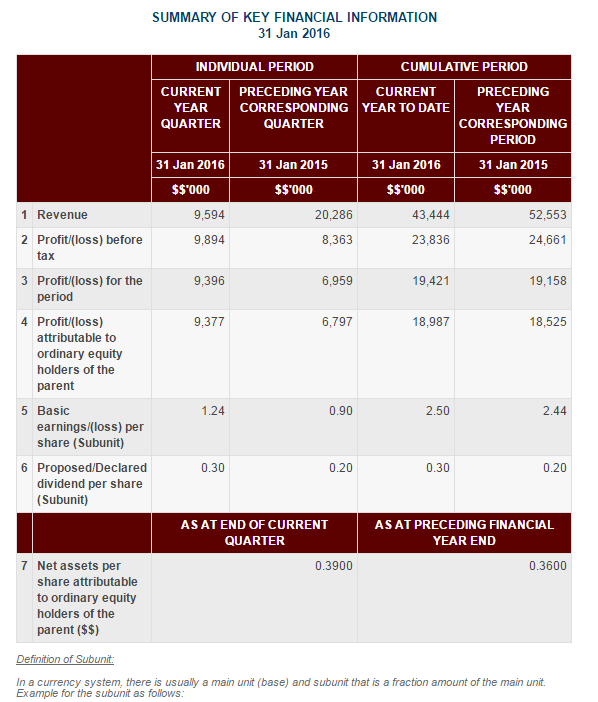

SUSTAINING PROFIT AND PROPOSE DIVIDEND

Last year June 2015 KELADI MAJU declares 0.2 sen dividend and proposed to change its name to JKGLAND. For this year JKGLAND with its profit in positive will be proposing 0.3 sen dividend. Above information is brought from the last QR report retrievable from Bursa website

CONCLUSION

Price of JKGLAND will go up because:-

1) Land value increasing in Kulim

2) Current projects in hand

3) Dynamic leaders

4) Sustaining profit and proposed dividend

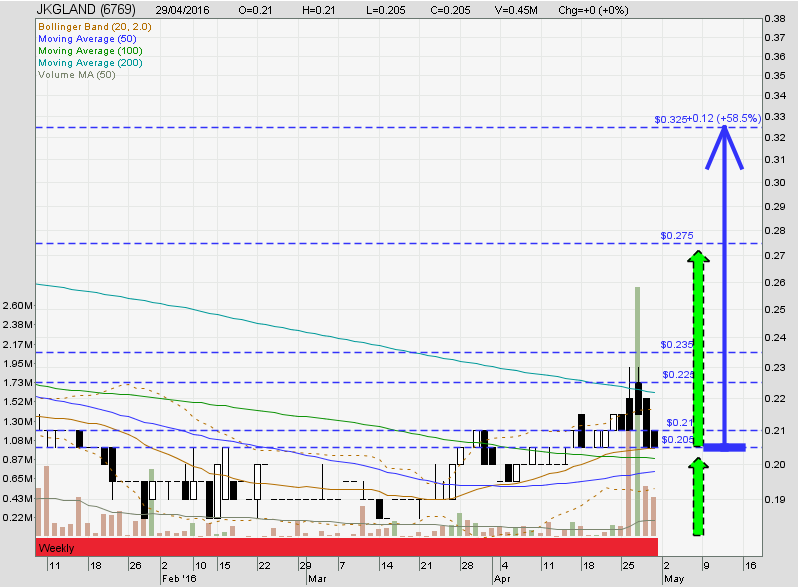

Prices will soar to 0.275 and subsequently go to 0.325 with the total of increase of 12sen or 58.5%

Kim’s Stockwatch TP: 0.30

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Follow Kim's Stockwatch

Created by Kim Stockwatch | Aug 21, 2017