Follow Kim's Stockwatch

SKPRES - Will Be The Exploding Gem Soon!

Kim Stockwatch

Publish date: Sun, 20 Aug 2017, 02:22 AM

DATE : 21/08/2017

STOCK : SKPRES (7155)

PRICE : RM1.45

OUR TP'S : RM1.60

WARRANT : SKPRES-CE (0.23)

Market Cap: 1812 M.

Number of Shares: 1250 M.

#Kim's Stockwatch - https://www.telegram.me/kimstock

-. Kim has called again on friday 18/8 in the morning session at RM1.45 and gave his 2nd Tp's RM1.60. Trying to clear 1.48 and close unchanged at RM1.45. Expectation will be continue more volumes in next 1-2 weeks time. We forsees the good move still on progress. Staytune for the next.

-. SKPRES : Among the major Electronic Manufacturing Services (EMS) players in Malaysia, SKP has been trading as a laggard with two-year forward price-earnings ratio (PER) (consensus) of only 10.4 times as opposed to other EMS players trading at two-year forward PER (consensus) of 12 times to 13 times with PCBA capability.

-. SKPRES : Sourcing the PCB parts from the other suppliers. To further improve its profitability as well as its capability as a complete integrated “one-stop” electronic manufacturing services (EMS) service provider.

-. SKPRES : On April 2017 announced its long-term strategic plans to expand into PCBA and other EMS-related services.

-. SKPRES : Planning a final single-tier dividend of 4.15 sen per share for its financial year ended March 31, 2017 (FY17).This is up 18.6% from the 3.5 sen apiece it paid out for FY16.

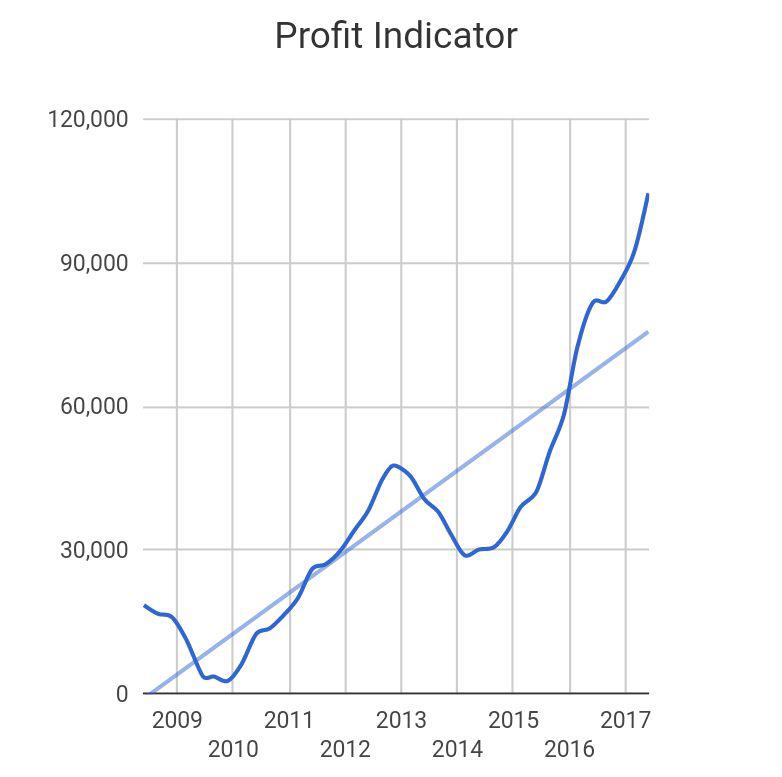

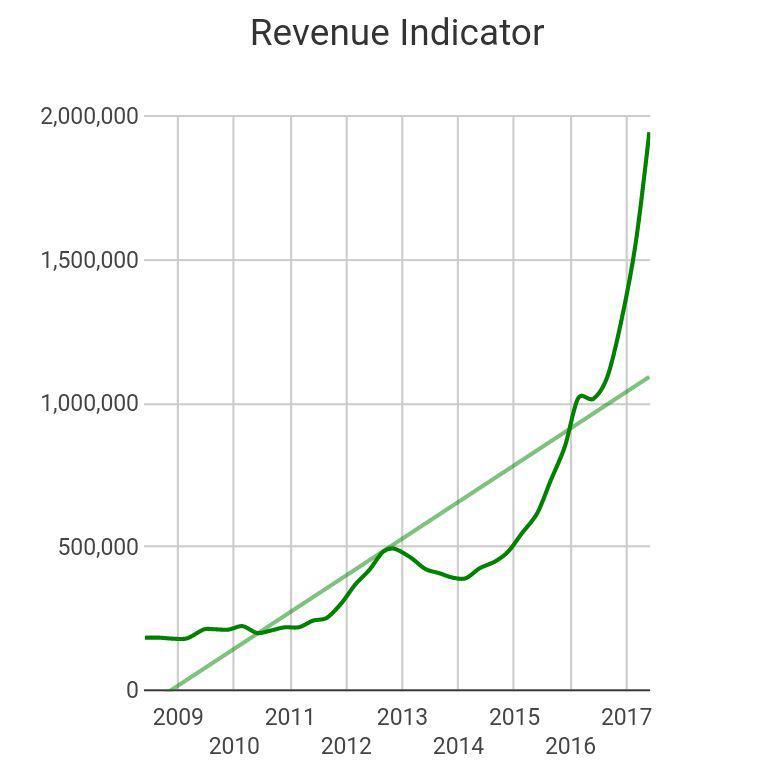

-. SKPRES : Electrical and electronics plastics manufacturer, posted a 28% jump in its net profit for FY17, at RM104.51 million from RM81.55 million a year ago, as revenue grew 91% to RM1.94 billion from RM1.02 billion. The improved results boost its earnings per share to 8.93 sen in FY17 from 7.47 sen in FY16.

-. Expecting good QTR result will be out soon.

Regards,

Ms Kana

For Kim’s Stockwatch

Do join us on a good gain at these sites

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Facebook : https://www.facebook.com/kim.thor.58

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Follow Kim's Stockwatch

MLGLOBAL - "Must Look Global" Dont miss this potential gems!

Created by Kim Stockwatch | Aug 21, 2017